Elevate your portfolio with Kinsted Wealth

Kinsted Wealth provides you with access to an expanded range of private market investment opportunities typically available only to larger institutions, enabling you to enhance your portfolio with unique strategies and growth potential.

What It Means To You

Tailored strategies. Trusted expertise.

Our clients partner with, and entrust Kinsted to look after the day-to-day safeguarding and growth of their wealth. With consideration for capital preservation and responsible growth, we allocate your investments based on what makes the most sense for your circumstances. Our clients are delegators, appreciate professional expertise, transparency, and accountability.

Kinsted has the unique ability to create a portfolio of public and private investments that will help you achieve your goals. Our platform is best suited to high net worth clients and institutions.

Our Beliefs

We believe there is a better way to manage money.

We’ve seen far too many issues within our industry, whether it’s the conflicting fees that clients are charged, hidden spreads, or substandard products they are sold – a few of the many areas we are trying to improve upon. We also want to democratize the investment landscape, and provide access to investments that you may not be able to gain access to on your own.

The Kinsted Way

Stocks and bonds are not enough.

The investment universe is much broader than just stocks and bonds, investors simply need access. Alongside some of the world’s largest and most skilled money managers, our clients own assets such as: agriculture, infrastructure, real estate, private debt, and private equity. The challenge for individual investors has always been accessing these types of assets.

How we do it

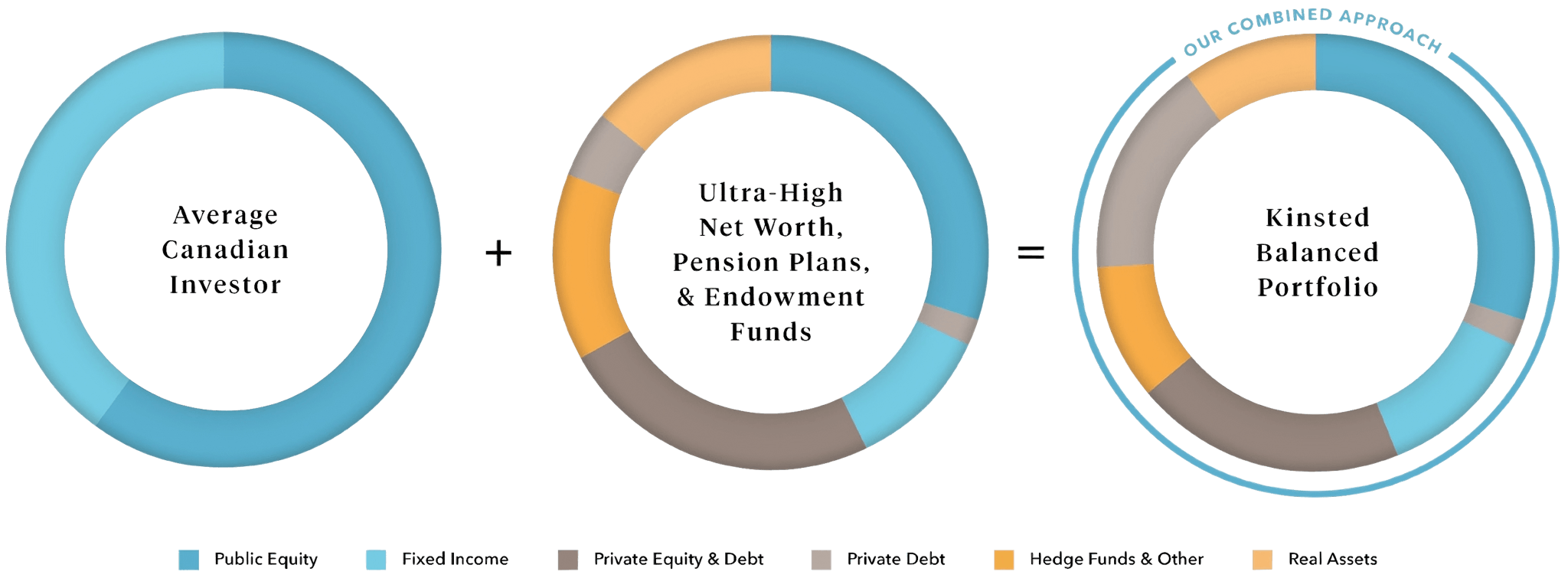

Follow the smart money

Kinsted Wealth follows the smart money. “Smart money” refers to large money managers such as pension funds, sovereign wealth funds, and endowments. In most cases, these institutions’ long-term objectives permit them to allocate a significant amount of their portfolios to alternative asset classes, allowing them to capture the size and illiquidity premiums to achieve enhanced returns with lower volatility, while still being exposed to public and fixed income markets.

At Kinsted Wealth, our platform was developed the same way, allowing our clients and advisors access to institutional alternative asset classes such as agriculture, timberland, private equity, private infrastructure, and private debt, to name a few. These, along side traditional public and fixed income markets construct our portfolio management strategy.

Increased Diversification

Diversifying for long-term stability

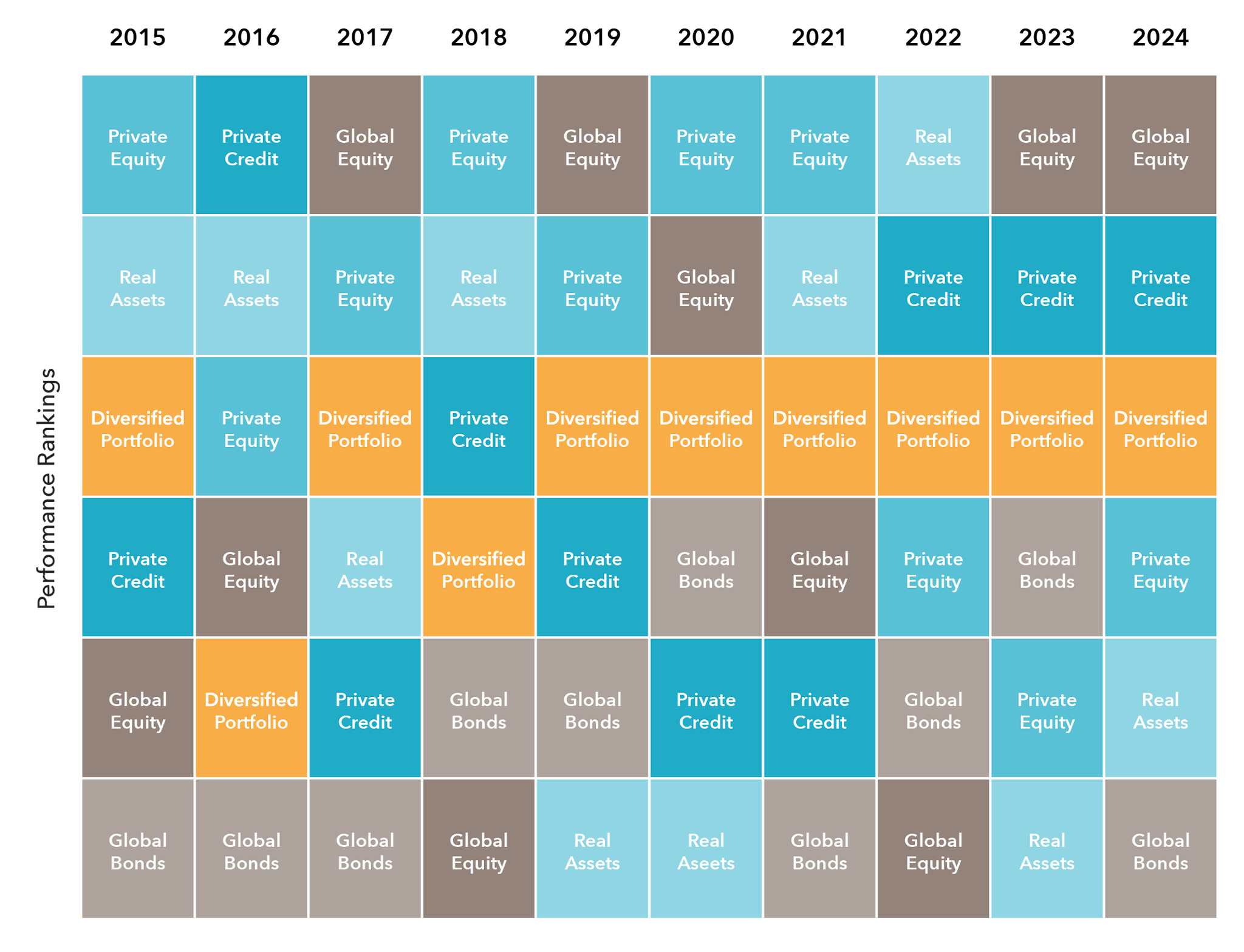

It would be ideal to pick the top performing asset classes each year. In reality, it has proven to be an improbable task for investors to pick the winners (and avoid the losers) year after year. The answer is to diversify your portfolio, the only “free lunch” in investing.

Instead of putting all your eggs in one basket, a diversified portfolio spreads your investments across a variety of different baskets, looking to avoid the impact of that “bad egg”. By embracing diversification, investors are able to build a resilient portfolio of assets that can perform well through all manner of market conditions. The private markets allow investors to spread risk beyond traditional stocks and bonds, lowering portfolio volatility and enhancing long-term returns.

Annual Return Rank of Select Asset Classes 1

Ideal Client

At Kinsted, we work with those investors who think differently about their wealth.

Our clients are high-net-worth individuals and families who are ready to move beyond traditional portfolios. They understand that the wealthiest institutions in the world, pension plans, endowments, and sovereign wealth funds, don’t rely solely on stocks and bonds. Instead, they’ve quietly built their success on private markets, often allocating more of their portfolios to private credit & equity, infrastructure, agriculture, and other alternative asset classes.

Yet most Canadian investors have virtually no exposure to these asset classes.

Kinsted believes in giving our clients the opportunity to invest like billionaires, with access to the same institutional-grade opportunities, without the steep barriers, long lockups, or multi-million-dollar minimums typically associated with this space.

We work exclusively with clients investing $1,000,000 or more, ensuring portfolios are customized, deeply diversified, and aligned with long-term objectives.

Our ideal clients are seeking:

· Greater stability and peace of mind in the face of market volatility and geopolitical uncertainty.

· True diversification beyond the public markets, investments that are built to endure.

· Personalized guidance and a firm that is aligned with their goals, not one trying to sell them product.

· Access to elite asset managers from around the globe who specialize in areas most investors can’t reach.

· A long-term partner who values transparency, independence, and service.

We help you build a portfolio designed to protect and grow your wealth, one that’s grounded in thoughtful risk management, tailored to your goals, and built for what’s ahead.

If you're ready to think beyond the banks and embrace a different way of investing, Kinsted may be the right partner for you.

Book a Call

Discover how Kinsted Wealth Management can help you achieve your financial goals. Our expert advisors are ready to provide personalized guidance tailored to your needs. You've already taken the first step—let us help you move even closer to financial security. Schedule your consultation today.

Available Calendars

Citations

1

Source: Annual returns for the 10 year period ending 2024/12/31. Global Stocks: MSCI ACWI; Global Bonds: Bloomberg Global Aggregate Bond Index. Hamilton Lane Cobalt LP Aggregate Benchmarks used for Private Markets. Private Equity: Private Equity Composite; Private Credit: Credit; Real Assets: Real Asset Composite. Diversified Portfolio: equal weighted composite of each asset class, rebalanced annually.