Q4/2025

What Happened in Q4 2025

Commentary • What Happened

Date posted

Jan 14, 2026

Global stock markets had another strong year, with major indices up about 15%, marking the third year in a row of solid gains. However, for clients with diversified portfolios, combining public stocks with private investments in infrastructure, real estate, and private equity, the headline number doesn’t tell the whole story.

Much of the strength in public markets came from a small group of large U.S. technology companies, driven by the rapid adoption of Artificial Intelligence (AI). Concurrently, private investments experienced slower deal activity as higher interest rates made it harder for buyers and sellers to agree on prices. When transactions slow, valuations in private markets tend to remain locked at levels below what managers believe these businesses are truly worth. This delay often results in lower short-term returns for the asset class, particularly private equity, despite the underlying companies continuing to perform well. As deal activity improves, these valuations typically recover.

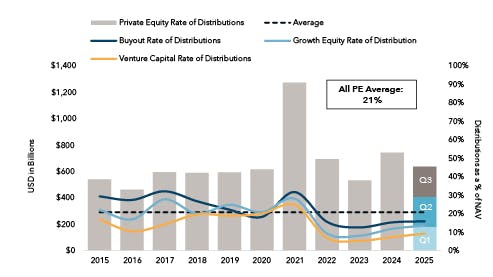

Chart 1: Private Equity Rate of Distribution (2015-2025)

Private equity distributions unlock value through exits. As shown above, distribution activity remains below historical averages, which we believe explains much of the recent lag in reported private equity returns. U.S. markets posted gains in the high teens, with technology-heavy indices doing even better as AI moved from early-stage development into real-world applications. Nvidia’s surge toward a $5 trillion valuation became a symbol of AI’s influence, and even energy infrastructure businesses benefited from the massive power needs of AI. However, this strong performance was concentrated in a relatively narrow group of expensive stocks, trading at valuations reminiscent of the late 1990s. In contrast, markets in Europe and Asia lagged, weighed down by concerns about China’s economy and global trade tensions.

For Canadian investors, trade tensions were particularly relevant. In April, the U.S. announced a new wave of tariffs, including potential 25% duties on Canadian goods, which created uncertainty for domestic markets. While U.S. stocks bounced back quickly, Canadian assets faced more sustained pressures. The completion of the Trans Mountain pipeline expansion provided a boost for energy holdings. However, broader uncertainty remained around Canada’s trade relationship with the U.S.

To support the economy, the Bank of Canada cut interest rates aggressively. A full percentage point was seen during 2025 and 2.75 points from their peak, while the U.S. Federal Reserve moved more cautiously. By year-end, inflation was near 2% and the unemployment rate stood at 6.8%, suggesting most of the cuts were behind us.

Private credit benefitted from higher rates, with floating-rate loans delivering attractive yields in the 9–11% range. Credit quality remained stable, showing that challenges in private equity were specific to deal-making rather than broader stress. Private infrastructure delivered steady results, supported by long-term trends such as the energy transition and growing demand for reliable power, particularly as AI drives energy needs higher. Real estate faced more challenges, particularly in office properties, as it adjusted to the hybrid work model, but signs of stabilization began to emerge.

For long-term investors, private markets remain a crucial source of diversification and access to opportunities not available in public markets, particularly as deal activity improves and interest rates normalize.

Client Experience

Across our six investment pools, returns ranged from the low 3% to the low 20%. These outcomes underscore the effectiveness of our core approach, which provides access to institutional-quality investments comparable to those used by major pension plans and endowments, along with thoughtful diversification across public and private markets, and a focus on maintaining liquidity as needed.

Private markets presented challenges over the past three years as industry-wide transaction activity slowed. This meant valuations often adjusted more gradually, even as the underlying businesses continued to perform well. Toward the end of 2025, conditions began to improve. Several of our portfolio companies completed successful exits or received updated valuations, which positively contributed to our performance in the fourth quarter. These developments signal healthier activity in private markets and reaffirm the quality of the businesses in which we’ve invested. While a few isolated issues in the Strategic Income pool created temporary pressure on returns, these were limited to specific holdings within the pool.

One of the year’s most notable innovations was the introduction of a portable alpha strategy within the Global Equity pool in early Q4. In its first full quarter, the strategy delivered a return of 4.8% in USD, compared to 3.1% for its benchmark. This approach separates broad market exposure from the additional returns generated by skilled hedge fund managers, and the early results reflect that design.

Throughout the year, the contrast between strong public market performance and slower-moving private valuations required patience. Public equities climbed steadily, while private markets lagged simply because fewer transactions occurred. This delay was challenging at times, particularly when private company fundamentals remained solid, but valuations took longer to catch up. As deal activity increased late in the year, more timely price discovery helped narrow part of that gap. Maintaining discipline and avoiding the sale of high-quality private businesses at discounted prices was critical to navigating these dynamics.

Looking Ahead

One theme keeps coming up in nearly every conversation heading into 2026: Artificial Intelligence. Unlike past technological shifts that took years to unfold, AI went from concept to widespread adoption in a matter of months, and the pace hasn’t slowed. What’s interesting is how far its influence now reaches beyond just technology companies. It’s reshaping power infrastructure, real estate, middle-market businesses, and even credit markets. The numbers tell the story: from 2000 to 2024, U.S. electricity demand grew just 0.8% per year. Now, it’s expected to grow at a rate of 2.2% annually through 2050, driven largely by the expansion of data centers .1

The debate around AI cuts both ways. The optimistic case sees this investment translating into real revenue growth and productivity gains. The pessimistic view worries that workforce disruption could occur faster than the economic benefits materialize, putting pressure on consumer spending when expectations are already sky-high. That tension is sitting at the heart of today’s market.

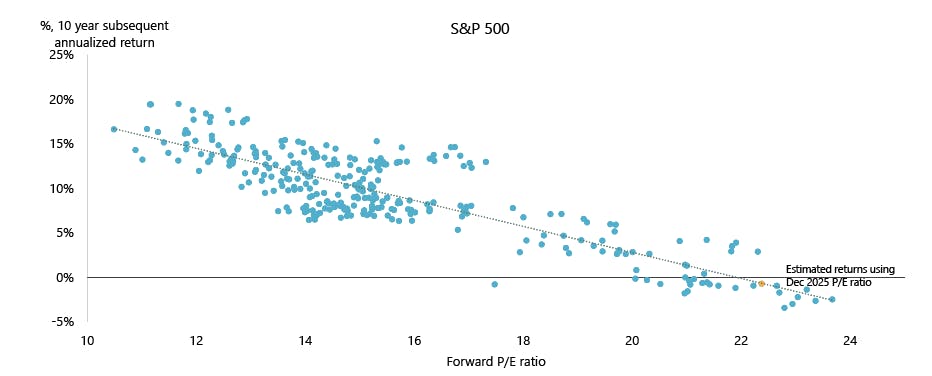

Market expectations reflect just how concentrated the situation has become. Wall Street’s year-end target for the S&P 500 is around 7,550, roughly 10% above its current level, based on earnings growth of 12–15%.2 The interesting part is that the seven mega-cap tech companies are expected to deliver nearly half of that earnings growth. At 25 times trailing earnings, compared with a long-term average of 15.3x, we’re looking at valuations last seen during the dot-com era. The equal-weighted S&P 500 lagged behind the cap-weighted index by over 6%, which highlights the narrowness of this rally. International markets, by contrast, are trading at more reasonable valuations with far less concentration.

Against that backdrop, private markets are presenting some interesting opportunities. Infrastructure stands out as particularly compelling at the moment.

As depicted in the chart below, when stocks are expensive, future returns tend to be disappointing, a relationship that has held consistently over time.

Chart 2: S&P 500 Chart

Digital needs, energy transition requirements, and aging physical systems are all converging simultaneously, driven by enduring forces: digitalization, electrification, and demographic change. Digital infrastructure, encompassing data centers, fiber, semiconductors, and cell towers, has become as essential as traditional networks. Power grids are facing unprecedented strain as electricity demand accelerates, necessitating major upgrades and new capacity. Energy transition assets continue to benefit from sustained investment in clean generation and resilience. Valuations remain below historical peaks, making entry points attractive relative to public equities.

Commercial real estate has turned the corner. After hitting bottom in Q3 2024, the sector posted consecutive quarters of positive returns as capital markets reopened. The major structural issue is a housing shortage: the U.S. is estimated to need 4 million more homes by 2029, and Europe faces similar pressures after years of underbuilding.3 With homeownership costs running nearly twice those of rental costs, demand continues to flow into multifamily, manufactured housing, student housing, senior living, and build-to-rent communities. These are structural drivers, not cyclical. Specialized property types, such as data centers, life science facilities, and self-storage, are becoming a larger part of the investable universe, driven by the same trends transforming infrastructure. Office markets remain bifurcated, with top-quality buildings in good locations performing well, while lower-tier properties struggle. These are all areas that Kinsted has allocated capital to over the past several years.

Private credit is entering the year strong, although returns are moderating as rates decline. First-lien loans are expected to yield around 8.0–8.5%, still well above long-term averages and near the top half of their 12-year range.4 The asset class continues delivering a steady 200–400 basis point premium over liquid credit. European private credit looks particularly interesting, spreads are wider than comparable U.S. deals, and default rates have historically been lower. The market’s fragmentation rewards managers with real local expertise. We committed to several European-focused private credit funds in the second half of the year, recognizing the compelling opportunities presented. Semi-liquid structures are also making private credit more accessible, supporting continued interest even past peak yields.

Looking across public and private markets, 2026 offers meaningful opportunities shaped by technology, infrastructure needs, and shifting valuations. The landscape favors being selective over casting a wide net, emphasizing quality over momentum, and taking a patient approach rather than trying to time things perfectly. As always, thoughtful allocation, careful manager selection, and staying disciplined remain the foundation of Kinsted’s long-term investing philosophy.

Regards,

Kinsted Wealth

1 Investing.com. Where Will the S&P 500 Be in 2026? Here’s the Updated Analyst Consensus. December 2025.

2 Yahoo Finance. Wall Street’s 2026 Forecasts Are Rolling In—and Some See the S&P 500 Hitting 8,000. December 1, 2025.

3 CNN Business. What to Expect from Stocks in 2026. January 1, 2026.

4 TheStreet. Wall Street Analysts Share Their S&P 500 Outlook for 2026. December 2025.