Elevate your portfolio with Kinsted Wealth

Kinsted Wealth enables you to provide your clients with an expanded range of private market investment opportunities normally only available to larger institutions.

Why Private Markets

For most individual investors, the stock and bond markets have traditionally been the core building blocks of their investment portfolios. These public market assets are liquid, accessible and provide individuals the ability to invest in many companies across the globe.

Private Credit

Loans issued to companies that are not publicly traded on the bond market. Private Credit benefits include higher yields, price stability and customized covenants to protect the investor.

Real Assets

Investment in tangible assets such as privately held Real Estate, Agriculture and Infrastructure. Private Real Assets benefit from inflation protection, lower volatility and value storage in the assets themselves.

Private Equity

Investment in companies that are not publicly traded on the stock market. Private Equity investors benefit from a larger investment universe, a longer time horizon and management alignment with long term growth of the company.

Private Market Benefits

01

Stronger risk adjusted returns

Private market investments have demonstrated the ability to provide consistent, long term outperformance, compared to traditional stocks and bonds.

02

Increased diversification

Including private market exposure can increase the diversification benefits to a portfolio, reducing volatility and overall portfolio risk.

03

Access to other markets and asset classes

Private markets allow access to a wider range of opportunities, including investments that are not available in the stock or bond market.

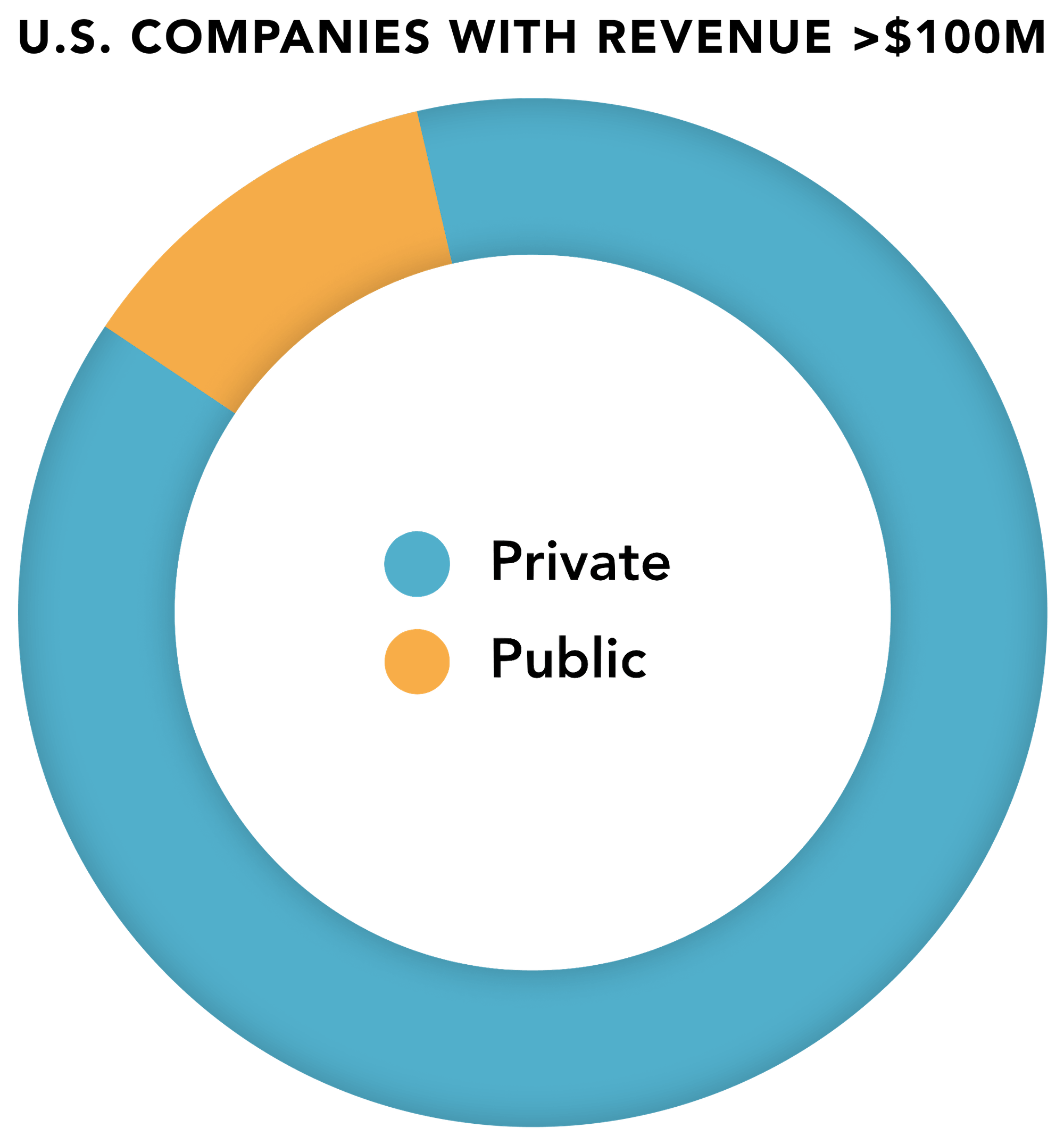

Access to Other Markets and Asset Classes

Broadening your horizon1

Incorporating private markets into your investment portfolio offers access to a diverse and growing array of opportunities beyond traditional stocks and bonds. This exposure not only helps mitigate risk by spreading investments across different sectors and geographies but also allows investors to capitalize on unique growth prospects and emerging trends that may not be readily available in public markets.

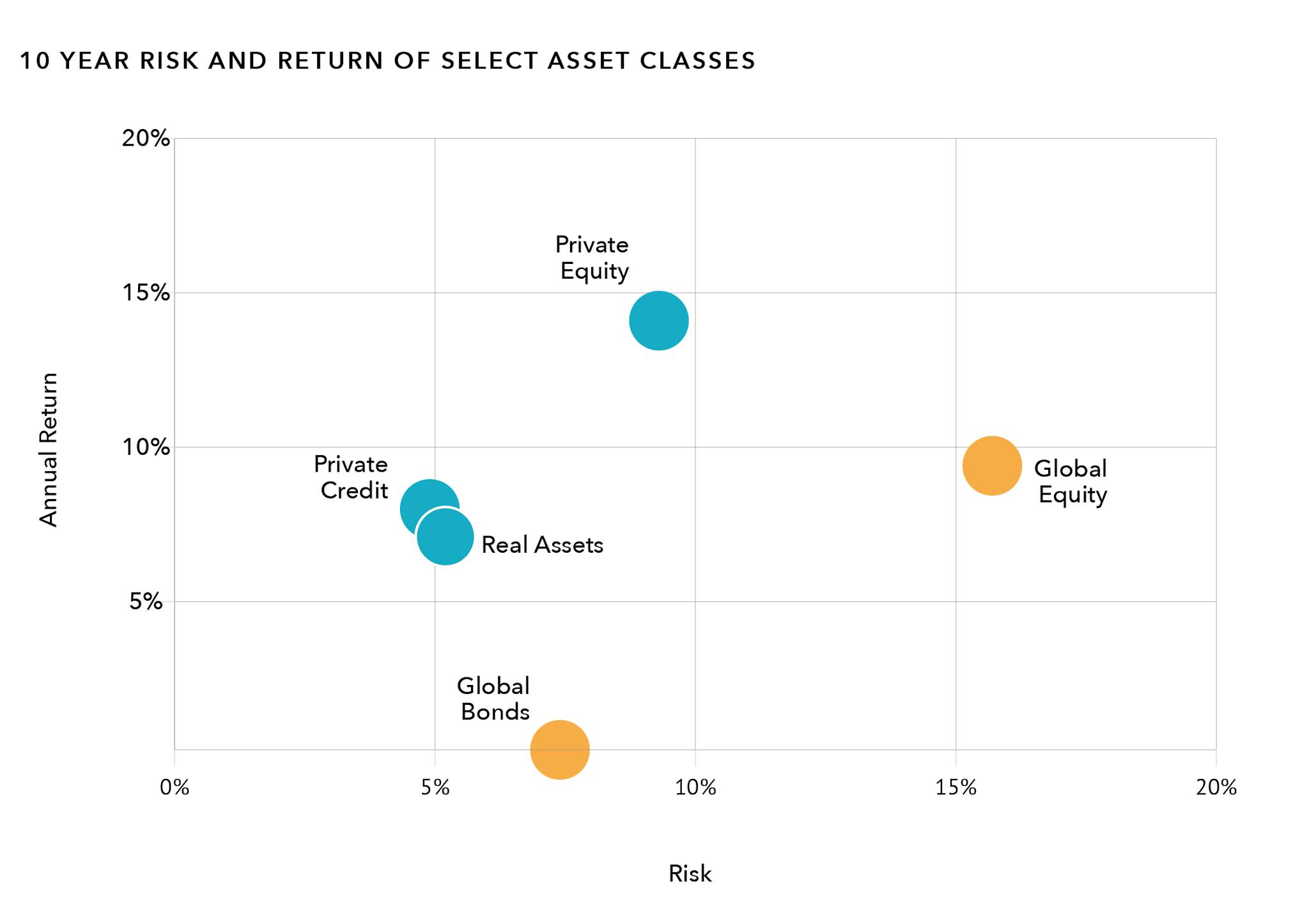

Superior Risk Adjusted Returns

Enhancing returns and reducing risk2

In recent years, there has been a notable trend among large institutions towards allocating a significant portion of their investment assets to private markets. This shift is underpinned by the compelling advantage of private market investments; they consistently deliver superior risk-adjusted returns compared to traditional stocks and bonds.3

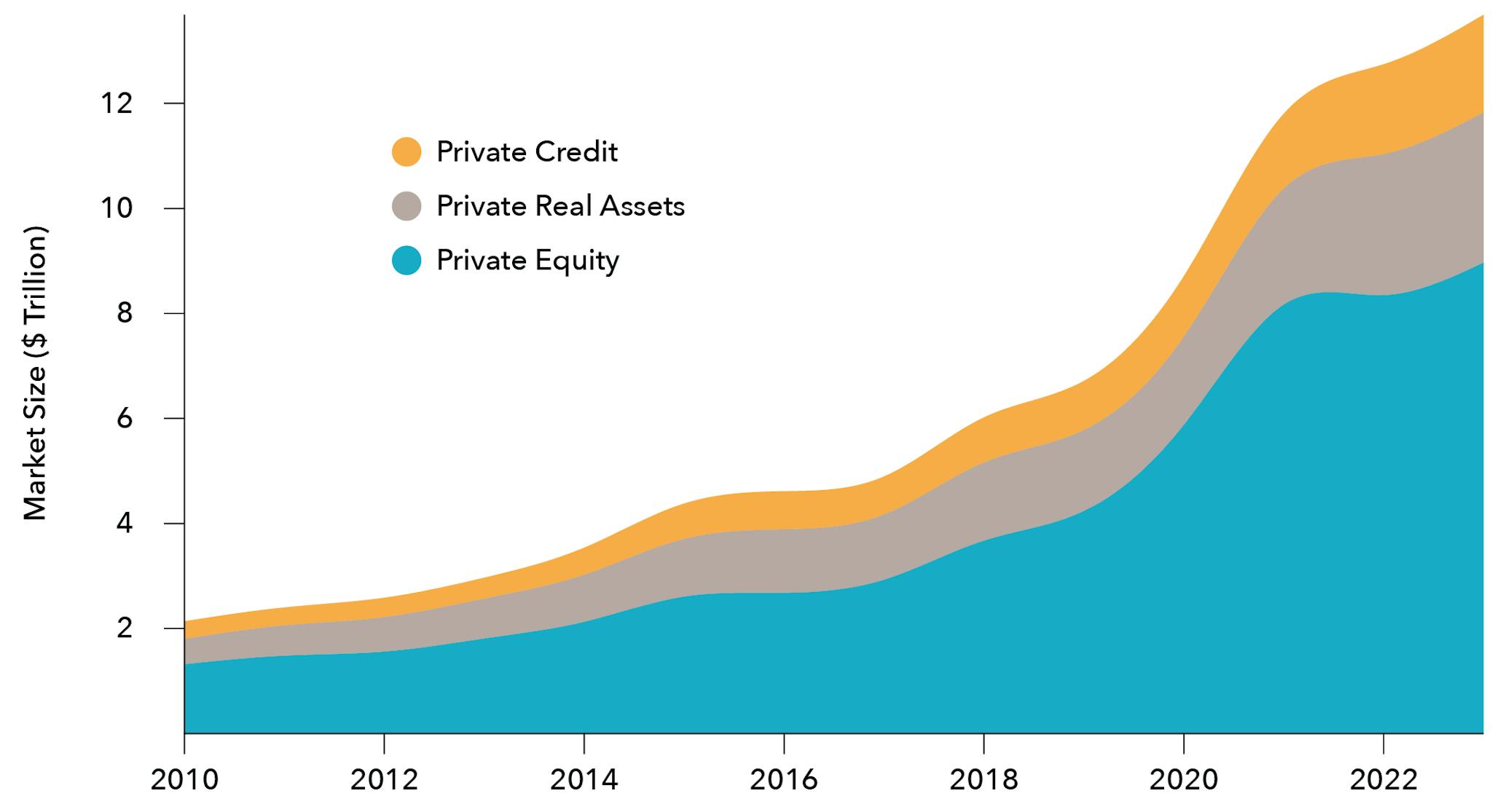

Growth of private markets4

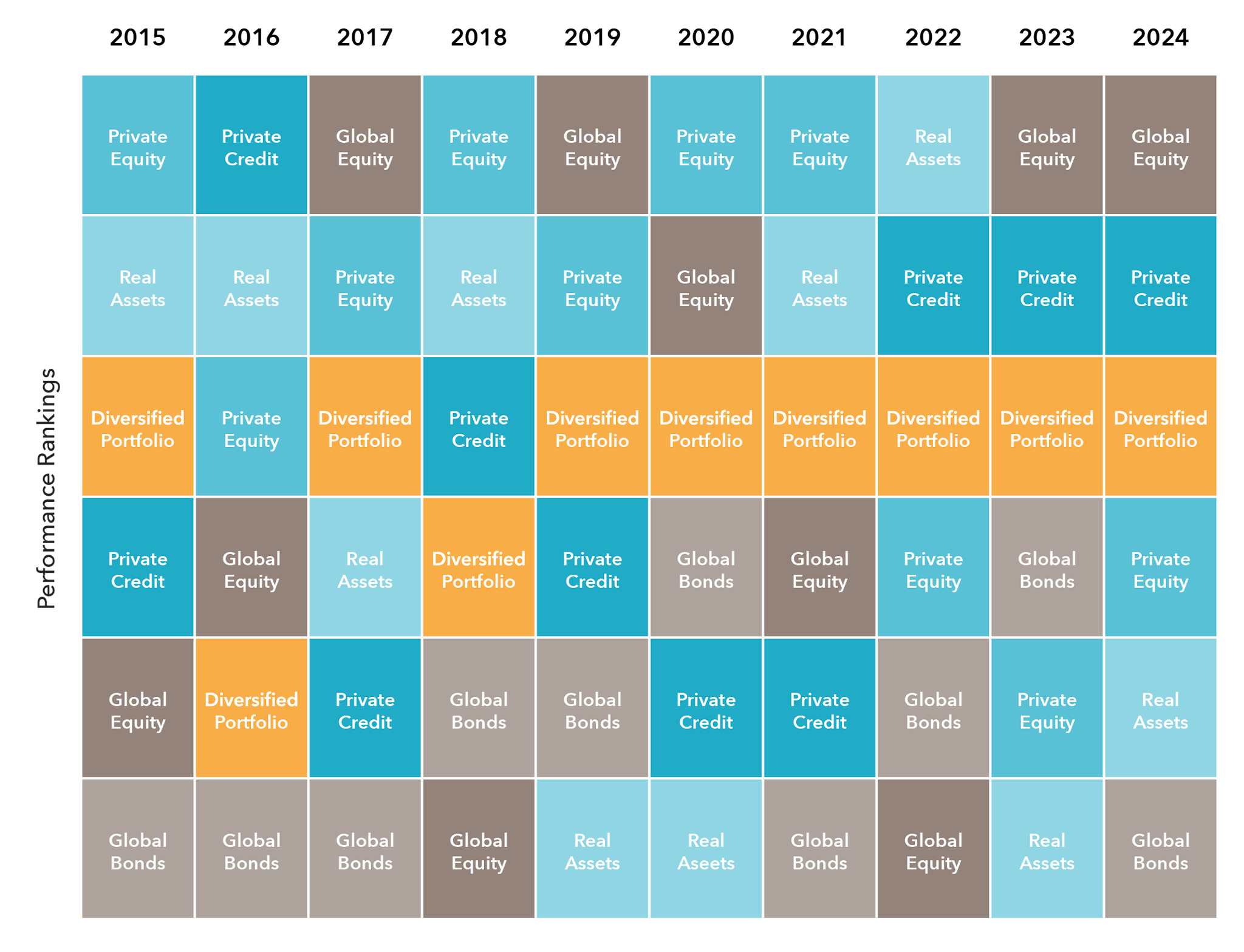

Increased Diversification

DIVERSIFYING FOR LONG-TERM STABILITY

It would be ideal to pick the top performing asset classes each year. In reality, it has proven to be an improbable task for investors to pick the winners (and avoid the losers) year after year. The answer is to diversify your portfolio, the only “free lunch” in investing. Instead of putting all your eggs in one basket, a diversified portfolio spreads your investments across a variety of different baskets, looking to avoid the impact of that “bad egg”. By embracing diversification, investors are able to build a resilient portfolio of assets that can perform well through all manner of market conditions. The private markets allow investors to spread risk beyond traditional stocks and bonds, mitigating exposure to market volatility and enhancing long-term portfolio resiliency.

Annual return of select asset classes5

Where to start

Elevate your wealth

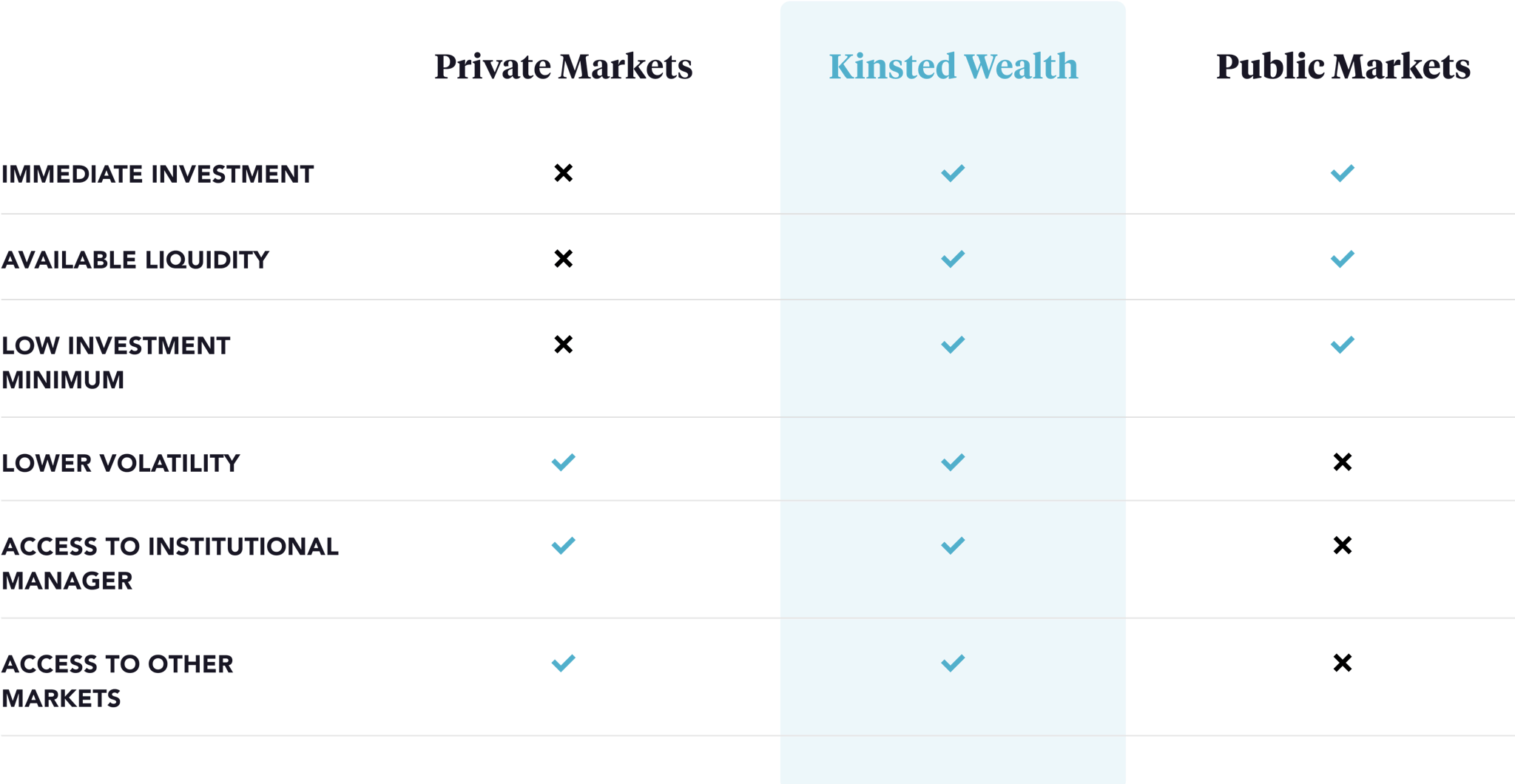

- Until recently, private markets have only been accessible to a select few institutional investors, such as endowments, pension funds, high-net-worth family offices and sovereign wealth funds.

- Kinsted Wealth has built an investment product that provides investors with access to the private markets, with liquidity available. Our product allows your clients to invest with institutional-quality managers that have strong track records, global scale and proven long term value creation.

For Portfolio Managers

CIRO, Single-Family Office, Multi-Family Office, Pensions, Foundations, Endowments

Expand your investment offering without reinventing your platform.

It would be ideal to pick the top performing asset classes each year. In reality, it has proven to be an improbable task for investors to pick the winners (and avoid the losers) year after year. The answer is to diversify your portfolio, the only “free lunch” in investing. Instead of putting all your eggs in one basket, a diversified portfolio spreads your investments across a variety of different baskets, looking to avoid the impact of that “bad egg”. By embracing diversification, investors are able to build a resilient portfolio of assets that can perform well through all manner of market conditions. The private markets allow investors to spread risk beyond traditional stocks and bonds, mitigating exposure to market volatility and enhancing long-term portfolio resiliency.

Kinsted partners with discretionary portfolio managers who are ready to offer their clients more. We help you integrate institutional-quality private investments into your portfolios, without the typical barriers of illiquidity, high minimums, or time-intensive due diligence.

Our ideal partners are independent discretionary managers and investment counselling firms managing over $100 million in AUM, many with $5–10 billion under advice. They are looking to thoughtfully introduce private markets to their client portfolios but do not have the internal infrastructure, access, or scale to build it themselves.

Institutional Access, Without the Build-Out

Kinsted has spent the past five years constructing a robust platform of private pools, built around true institutional strategies, not retail-oriented EMD products. Many of the underlying strategies we access are otherwise unavailable to Canadian wealth managers. Our private pools span income-generating strategies, real assets, and growth capital, with each pool diversified across 10–20 sub-advisors globally.

This platform is a carefully curated, multi-manager approach with clear mandates, disciplined risk management, and years of audited performance.

Why Instituional Investors Choose Kinsted

• Access without Illiquidity: Exposure to the illiquidity and size premium, without tying up capital in long-term lockups. We offer quarterly liquidity up to 5% of the series AUM, with safeguards to protect unitholders.

• Turnkey Due Diligence: Our investment team handles sourcing, evaluating, and monitoring each sub-advisor, saving your team years of research and implementation.

• Custom Portfolio Construction: Use one, two, or all three pools based on your client’s unique goals and risk profile. No one-size-fits-all model portfolios here.

• Tools to Educate and Empower: Our Strategic Partnerships team and investment professionals work with you to help communicate the value of alternatives, manage expectations, and support client conversations.

• Institutional Risk Tools: We’ve invested in portfolio analysis tools to stress-test exposures and drill down into granular risks, by sector, strategy, or geography.

Enhancing the Client Experience

You want to offer your clients more, and we’re here to make it easy. With Kinsted, discretionary managers can provide differentiated portfolios that meet client expectations: resilient, diversified, and positioned for long-term success.

Let us help you bridge the gap between client needs and institutional access, without the operational burden.

Kinsted funds are available to accredited investors; these can include individual accredited investors, a discretionary manager for their clients, or non-discretionary managers representing an accredited investor.

Book a Call

Discover how Kinsted Wealth Management can help you achieve your financial goals. Our expert advisors are ready to provide personalized guidance tailored to your needs. Take the first step towards financial security and schedule your consultation now.

Available Calendars

Citations

1

Source: Capital IQ, Blackrock as of 2022/12/31.

2

Source: Quarterly Returns Series for the 10 year period ending 2024/12/31. Returns and volatility based on the following indices. Global Stocks: MSCI ACWI; Global Bonds: Bloomberg Global Aggregate Bond Index. Hamilton Lane Cobalt LP Aggregate Benchmarks used for Private Markets. Private Equity: Private Equity Composite; Private Credit: Credit; Real Assets: Real Asset Composite.

3

Any investment involves a degree of risk and should only be made if an investor can afford the loss of the entire investment. Investment performance may be volatile. There are no guarantees or assurances regarding the achievement of investment objectives or performance.

4

Private Market Assets Under Management for the period ending 2023/09/30. Hamilton Lane Cobalt LP Aggregate Benchmarks used for Private Markets. Private Equity: Private Equity Composite; Private Credit: Credit; Real Assets: Real Asset Composite.

5

Source: Annual returns for the 10 year period ending 2024/12/31. Global Stocks: MSCI ACWI; Global Bonds: Bloomberg Global Aggregate Bond Index. Hamilton Lane Cobalt LP Aggregate Benchmarks used for Private Markets. Private Equity: Private Equity Composite; Private Credit: Credit; Real Assets: Real Asset Composite. Diversified Portfolio: equal weighted composite of each asset class, rebalanced annually.