Elevate your portfolio with Kinsted Wealth

Kinsted Wealth enables you to provide your clients with an expanded range of private market investment opportunities normally only available to larger institutions.

A wealth of difference

Gain exclusive access to one of the most unique & effective investment platforms in the industry while maintaining your client relationships.

Better Investment Access

Increased Capacity

Enhanced Client Experience

Compensation & Succession Planning

Book a Call Today

Discover how Kinsted Wealth can help you achieve your financial goals. Our expert advisors are ready to provide personalized guidance tailored to your needs. Take the first step towards financial security and schedule your consultation now.

Access

Better investment access. Less red tape.

Compete at the same level as larger institutions and industry heavy-hitters. Kinsted Wealth offers advisors and their clients with over $500,000 in investable assets, access to our top-quality investment platform, and a full team of investment specialists. We build tailored investment strategies that combine a mix of asset classes from infrastructure to music royalties, to stocks and private debt.

Kinsted Wealth enables you to provide your clients with an expanded range of private market investment opportunities normally only available to larger institutions. Many private assets have a history of delivering superior rates of return with lower risk compared to traditional assets.

Capacity

More time for you.

Expand your client service offering and free up time to grow your business. Partnering with Kinsted Wealth enables you to maintain your client relationships while offloading the investment management, including tasks like KYC and KYP responsibilities, data collection, and compliance requirements.

Our wealth counsellors determine the appropriate mix of assets needed to achieve your client’s target return with the least amount of risk. We constantly monitor and refine the investment strategy, freeing up more time for you to focus on financial planning and client relationships.

Client Experience

Simple, personable and transparent.

Enhance your client experience and take on higher net worth clients. The Kinsted team adds an extra layer of care to the familiar experience your clients have come to expect from you. Your client’s comfort is our priority, and we’re happy to jump on a call to ensure their questions, concerns, and needs are met.

We work with your clients to establish financial strategies, review statements, and answer questions so they’re always in-the-loop and up-to-date. Kinsted’s client service offering includes administrative management, ongoing review meetings, and regular communication. With Kinsted in your corner, your clients gain access to an experienced team and maintain the personal relationship they’ve built with you.

Testimonial

"I have found Kinsted Wealth to be a very good fit for me and my clients. The wealth counsellors I work with are knowledgeable and genuine. They truly get to know the clients before presenting their information and the service team is always on top of the process. The follow-up calls and reviews by the wealth counsellors give my client a sense of being cared for."

- Winnipeg Advisor

How we do it

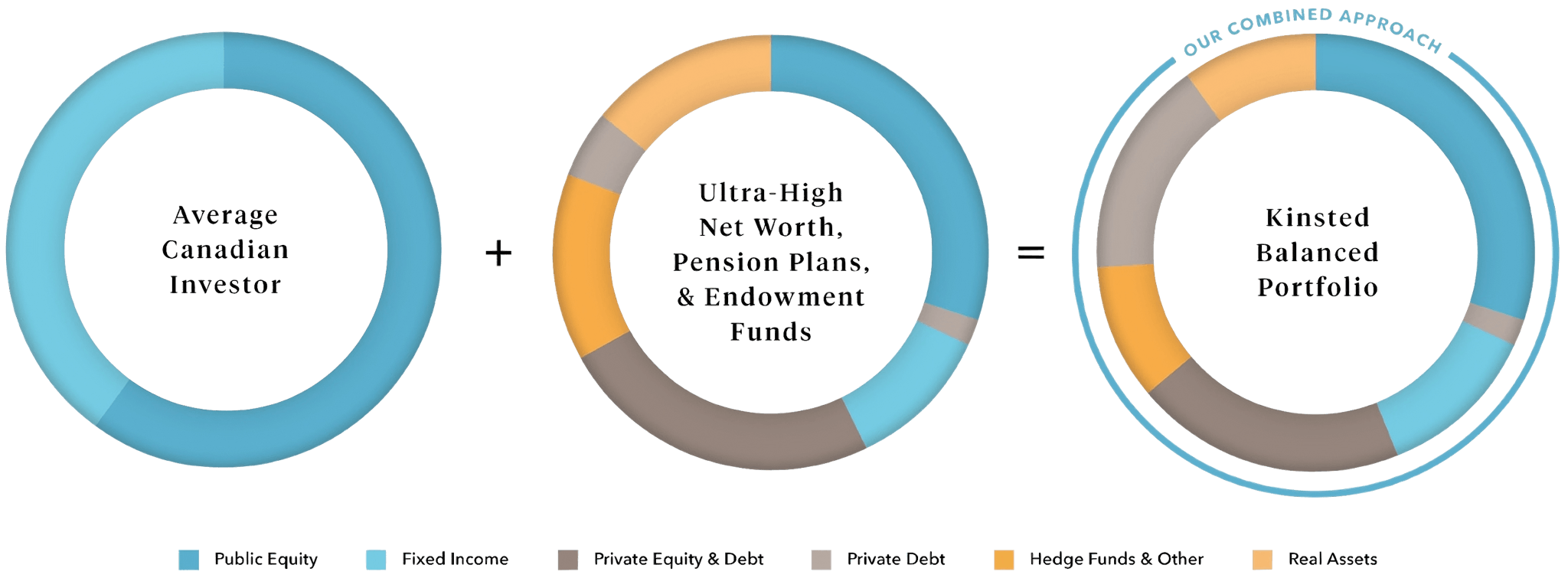

Follow the smart money

Kinsted Wealth follows the smart money. “Smart money” refers to large money managers such as pension funds, sovereign wealth funds, and endowments. In most cases, these institutions’ long-term objectives permit them to allocate a significant amount of their portfolios to alternative asset classes, allowing them to capture the size and illiquidity premiums to achieve enhanced returns with lower volatility.

At Kinsted Wealth, our platform was developed the same way, allowing our clients and advisors access to institutional alternative asset classes such as agriculture, timberland, private equity, private infrastructure, and private debt, to name a few.

Onboarding process

MAKING THE MOVE. CUSTOMIZED FOR YOU.

Phase 1: 1 week

01

Discovery [30 min - 1 hr]

The referral partner will set up an in-person or virtual meeting to introduce the client to their Kinsted wealth counsellor. During this meeting, a discovery session takes place, allowing all parties to learn more about the client’s unique needs. The discovery session ends with an offer to proceed with the next steps.

02

Info gathering [30 min - 1 hr]

Once a client agrees to sign on with Kinsted, information gathering, and data entry begins (in person or virtually). The referral partner can be as involved in this process as they like.

03

Investment policy presentation [30 min]

A Kinsted wealth counsellor presents the tailored investment policy statement as well as an investment management agreement to the client.

Phase II: 2-8 weeks

01

DOCUMENT SIGNING [1-2 DAYS]

All appropriate documentation will be sent for e-signature to the client, referral partner, and wealth counsellor.

02

ASSET TRANSFER [~2-8 WEEKS]

Once signed, the transfer of assets will be initiated, and it will take between 2-8 weeks to move from the relinquishing institution.

During the transfer of assets, Kinsted has multiple touchpoints with the client, including a welcome email introducing our service team, client portal setup, and on-going status updates and follow-ups to answer any questions or concerns.

Phase III: ONGOING

01

REVIEW MEETING [30-1HR]

Once accounts have been transferred, Kinsted recommends having another review meeting with the client within the first three months of assets transferring to walk through the portal and ensure they are comfortable with the strategy while alleviating any client concerns.

For Advisors

Focus on relationships. We’ll handle the rest.

At Kinsted, we partner with financial advisors who want to do more for their clients and their business.

Our platform allows you to outsource investment management without compromising quality. In fact, we believe it strengthens it. With Kinsted as your partner, you gain access to institutional-quality investment solutions that rival the strategies used by pensions and endowments without the administrative burden, complexity, or long-term lockups.

Spend less time managing money. Spend more time managing relationships.

Investment management today comes with a heavy lift: compliance, risk oversight, due diligence, reporting, client inquiries, and more. By outsourcing to Kinsted, you offload that responsibility to a team of investment professionals, backed by robust governance, rigorous processes, and a performance record spanning years.

You're not alone at the table during market turbulence anymore, and that transforms the entire dynamic. Our approach brings another layer of professional insight to your practice, helping you deliver stronger outcomes and more confidence to your clients.

How We Help Advisors Thrive

• Grow your business: Free up capacity to focus on business development, deepen client relationships, and attract higher-net-worth clients.

• Institutional access, simplified: Offer your clients access to exclusive private market opportunities without capital calls, long lockups, or multi-million-dollar minimums.

• Differentiated portfolios: Enhance risk-adjusted returns through strategies designed to lower volatility and create stability across market cycles.

• A seamless onboarding experience: We manage transfers, paperwork, administration, and compliance so you can stay focused on your clients.

• Real partnership: Flexible, collaborative relationships with our advisors which is designed to adapt to your model and fuel long-term success.

You Bring the Trust. We Bring the Tools.

If you're ready to scale your practice, provide deeper value to clients, and stand apart in a competitive landscape, Kinsted is here to help.

Together, we can deliver what clients want most: peace of mind, long-term performance, and confidence in the plan ahead.

Book a Call

Discover how Kinsted Wealth can help you achieve your financial goals. Our expert advisors are ready to provide personalized guidance tailored to your needs. Take the first step towards financial security and schedule your consultation now.

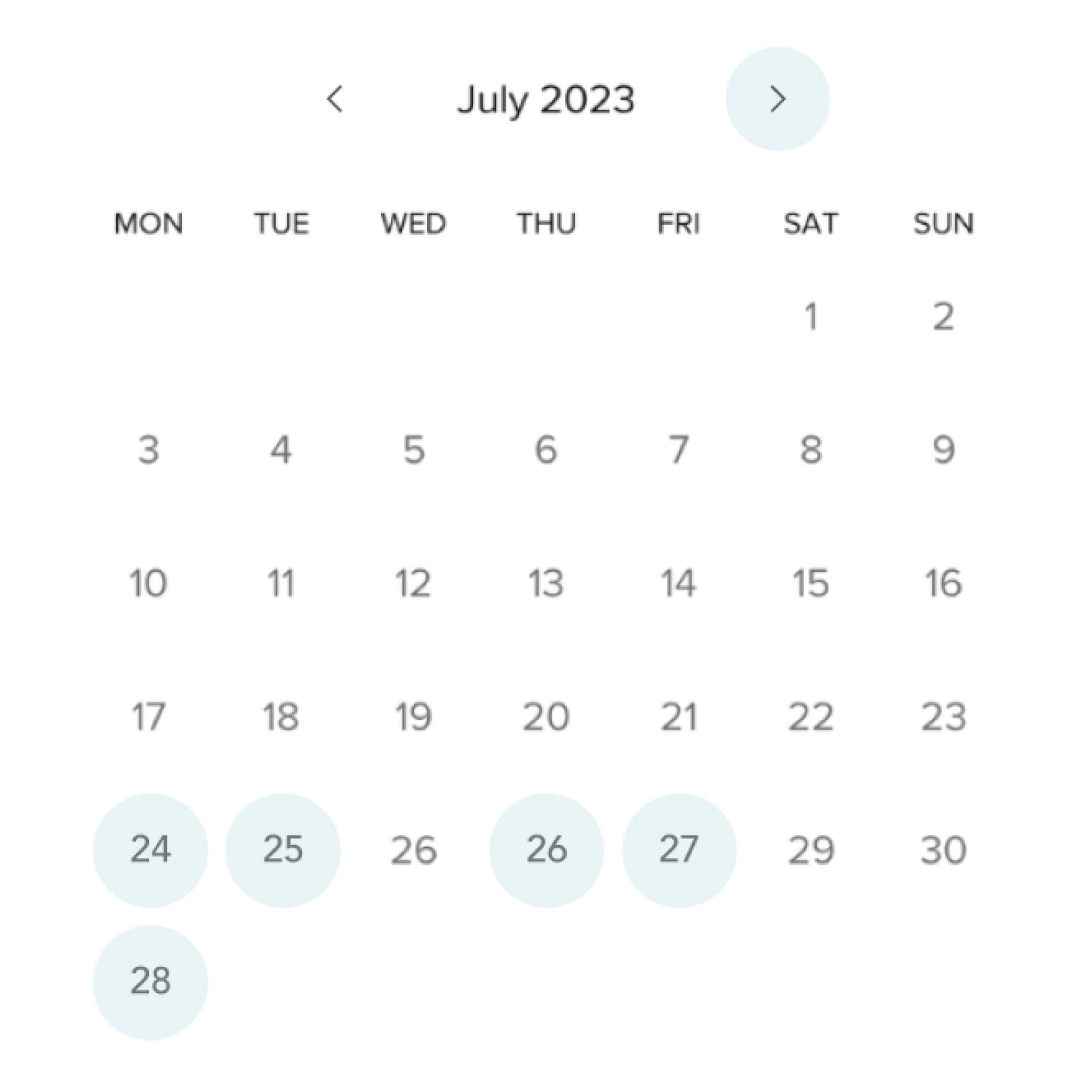

Available Calendars