Q3/2017

Q3 2017 Outlook and Beyond

Commentary • Outlook

Date posted

Jan 1, 2017

We remain fully invested and overweight in global equities. The global equity bull market is long in duration, but we see no recessionary catalyst on the horizon that will end this cycle over the next 6-12 months. Our macro themes include:

- US and European households have reduced their debt (“delevered”) so they can get back to more normal consumption, spending and investment.

- Europe is following the US economic path, not Japan’s 30-year deflationary environment, in returning to a self-sustaining broad-based economic expansion. Brexit will be relatively contained.

- Chinese policymakers will refocus their policy agenda after the “elections” are completed this winter. A managed slowdown is expected instead of the feared “hard landing”.

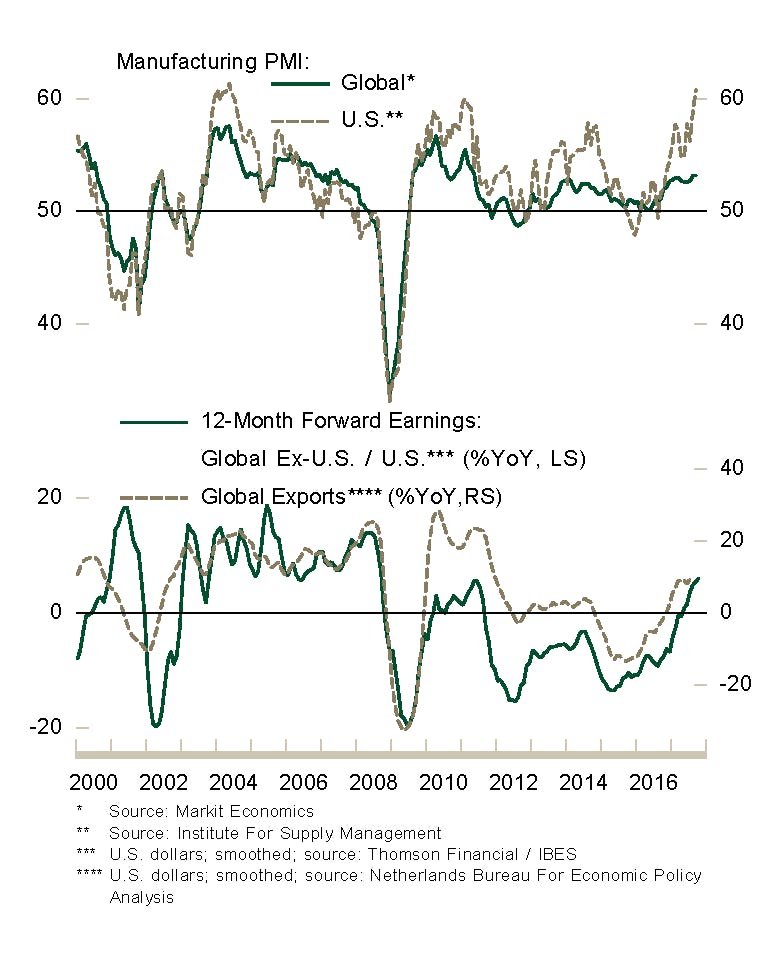

- The global trade cycle will remain firm and continue to foster global earnings.

- Monetary policy around the world is slowly changing to a tightening bias due to stronger economies, but will remain highly accommodative.

There are always risks that need to be monitored:

- Geopolitical tensions around the world and within the US is potentially destabilizing.

- If major central banks raise rates and reduce their balance sheets too quickly and severely, interest rates could snuff out economic growth.

- Major swings in the USD – either rising or falling drastically. The world needs its primary reserve currency to be stable to help economies rebalance and restructure.

- Rising trade protectionist policies.

The US economy will continue to be a core component to support continued growth in other economies. With consumer spending, capital investment and global trade expected to persist, global earnings should continue to grow. This will help investors gain conviction in the global economic and market expansion.

The US Fed intends to stick to its gradual hiking path over the next couple of years as they believe the US economy is strong enough to return to normal yields and not derail the expansion. The Fed’s plans to slowly shrink a major portion of its $4.5 Trillion assets will also not negatively impact the economy. The capital base injected during “QE” largely remained in bank reserves and did not make its way into the economy.

As more economies continue to show strength and become self-sustaining, like Europe, the emergency monetary measures used since the global financial crisis may no longer be required, which is very positive.

For the European region, while Merkel was punished for her immigration policies in the election, the far-right populist policies did not coalesce as seemed feasible at the start of the year. Europe’s economy and markets continue to look promising, even with the political uncertainty that is holding back the European markets due to the Catalonia vote/non-vote, Brexit, and Greece still needing bailouts.

The BOC is now backpedaling from its tightening bias this summer as the CAD strength could be a detriment to Canada’s economic growth. A weaker currency is still necessary to help facilitate a multi-year rebalancing process of improving Canada’s productivity and rebuilding the manufacturing sector. We are confident in our core Canadian equity holdings long-term, but we remain underweight as there are better opportunities outside of Canada.

While the US economy will help drive global economic growth, European and Asian investment opportunities are more appealing from a valuation perspective. Any stimulus from Trump’s pro-growth policies of infrastructure spending, tax cuts and deregulation will provide positive market sentiment, but will only add marginally to economic growth over the next 12 months due to delays in getting policies passed and implemented. Regardless, the global economies and markets will remain in an uptrend.

Regards,

Kinsted Wealth