Q1/2024

Q1 2024 Outlook and Beyond

Commentary

Date posted

Jan 12, 2024

Looking forward

The market is still dealing with uncertainty surrounding inflation, which is not only creating a difficult landscape for traditional fixed income investors but making it just as difficult an environment for public equity investors. Will inflation gradually recede to Central Bank targets, or will we experience another surge in inflation? A gradual decline will be positive for traditional fixed income, but will it be for equities? It really depends on how corporate earnings hold up over the coming year.

The market seems to be forecasting a return to the interest rate regime we experienced coming out of the pandemic. We don’t believe that will occur. Even if inflation returns to the 2% target, interest rates will not see a return to what we saw only two years ago. How will stocks react to an environment where rates will be “higher for longer”? There’s no doubt in our minds that the extremely low cost of capital that was prevalent had a positive impact on corporate profitability and valuations. As a result, valuations are too high based on anticipated relative lower corporate earnings. How the major central banks handle monetary policy over the next year or so will play a pivotal role in how capital markets behave.

Prior to the great financial crisis of 2008, international equities had outperformed US equities for close to a decade. Today, the opposite is true. Given investors’ recency bias, most question why they should have international equities at all. Consumer spending in the US has certainly shown some resilience over the past several years, supported by a very robust labor market. However, the scenario may change if the labor market begins to soften. Given the large impact that the consumer has on US growth, what will occur if consumer spending does in fact begin to soften? While the coming year may not be the one where non-US stocks finally begin to outpace their US equivalents, we do believe that we’re near the cusp of a change in global equity leadership and expect the baton to be taken from US hands.

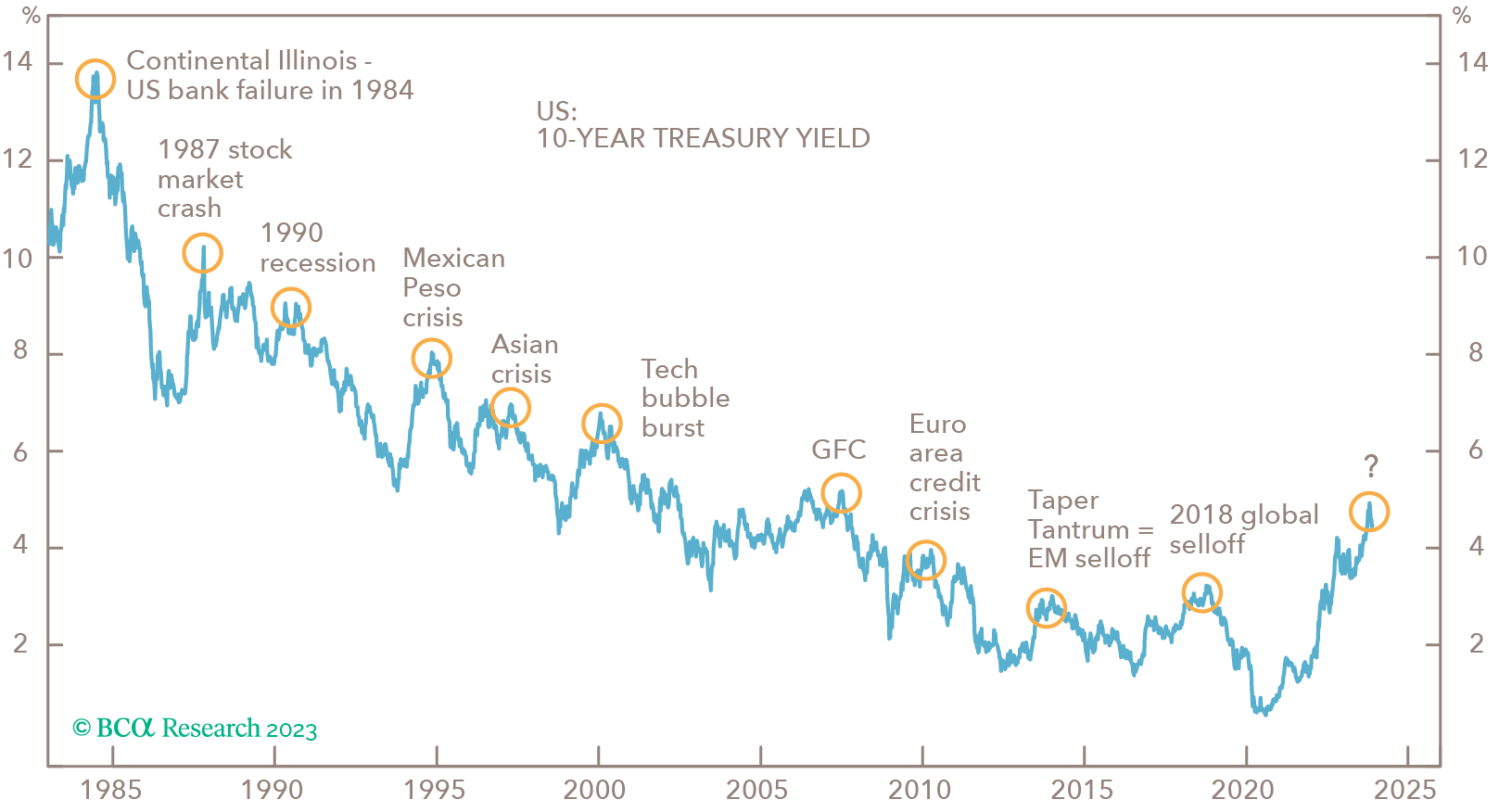

Large moves in bond yields have historically led to market stress as seen in the chart below. Will this most recent surge follow the same pattern, or not?

US mega-cap technology stocks, which led the global equity rebound of 2023, may give way to a stock picker’s market in 2024. We suspect that after more than a decade of easy money, where a “passive” approach to equity investing was the winning strategy, active stock picking will become the leading approach for public equities going forward. We believe this will certainly benefit the investment strategies we currently employ in both our Global and Canadian equity pools.

While the answers to many of these questions will only be known in hindsight, the potential risks certainly warrant a more diversified portfolio approach to portfolio management, and as mentioned in numerous other quarterly reports, the only way to achieve that is through the addition of private assets to one’s portfolio. We expect our private pools to provide a consistent 5-10% range of returns without the short-term market volatility. A truly diversified portfolio approach to portfolio management will likely not outperform a traditional balanced portfolio when public equities deliver exuberant returns over short time periods. That said, it’s in times of market stress that Kinsted’s approach to wealth management Calgary will shine. We believe those days are closer than many expect.

In light of these uncertainties, maintaining a truly diversified portfolio is key to weathering potential storms. At Kinsted, diversification has been a cornerstone of our approach for quite some time, ensuring our clients are well-positioned to maintain stability and reasonable returns through changing market conditions. By incorporating alternative investments and diverse asset classes, we provide stability and growth opportunities, giving individual investors the opportunity to invest like institutional investors. As a wealth management Calgary firm, we are committed to offering innovative investment strategies that cater to varied risk appetites and investment decisions, aiming to achieve a balanced and diversified portfolio that aligns with our clients' long-term financial goals and helps reduce risk.

Regards,

Kinsted Wealth