Q2/2025

What Happened in Q2 2025

Commentary • What Happened

Date posted

Jul 14, 2025

Market & Economic Update

As we look back on the second quarter of 2025, it’s clear that the global economy and financial markets continue to navigate a complex and shifting landscape. While some of the disruptions from earlier in the year, particularly around trade and tariff tensions, began to ease, other familiar challenges remained firmly in place. Inflation is still running hotter than central banks would like (especially in the U.S.), while interest rates are in a holding pattern, and the U.S. labor market continues to show surprising strength. For investors, this environment has been a reminder of the importance of staying focused on long-term goals while understanding there may be some volatility along the way.

Markets Rebound, Led by Tech

After a shaky start to the year, markets found their footing in Q2. The S&P 500 not only recovered its Q1 losses but is nearing all-time highs once again. Much of this rebound was driven by strong performance from large-cap technology companies, often referred to as the “Magnificent Seven.” Most of these names posted impressive gains, supported by solid earnings and continued enthusiasm around artificial intelligence. Outside of the U.S., international markets also performed well. The Canadian equity market was up over 9%, while European equities benefited from attractive valuations and improving domestic demand. Select emerging markets saw support from fiscal stimulus and commodity strength. This kind of regional variation reinforces the value of global diversification which helps minimize the reliance on one specific country or sector.

Inflation Pressures and Labour Market Signals

Inflation has dropped significantly from the highs we saw a couple of years ago. However, it’s still not quite where central banks would like it to be. In the U.S., the Fed’s go-to inflation gauge, being the core PCE index, has only improved slightly and is still sitting above their 2% target. That stickiness is due to lingering effects from earlier tariffs and strong demand in certain parts of the economy, which are keeping prices elevated.

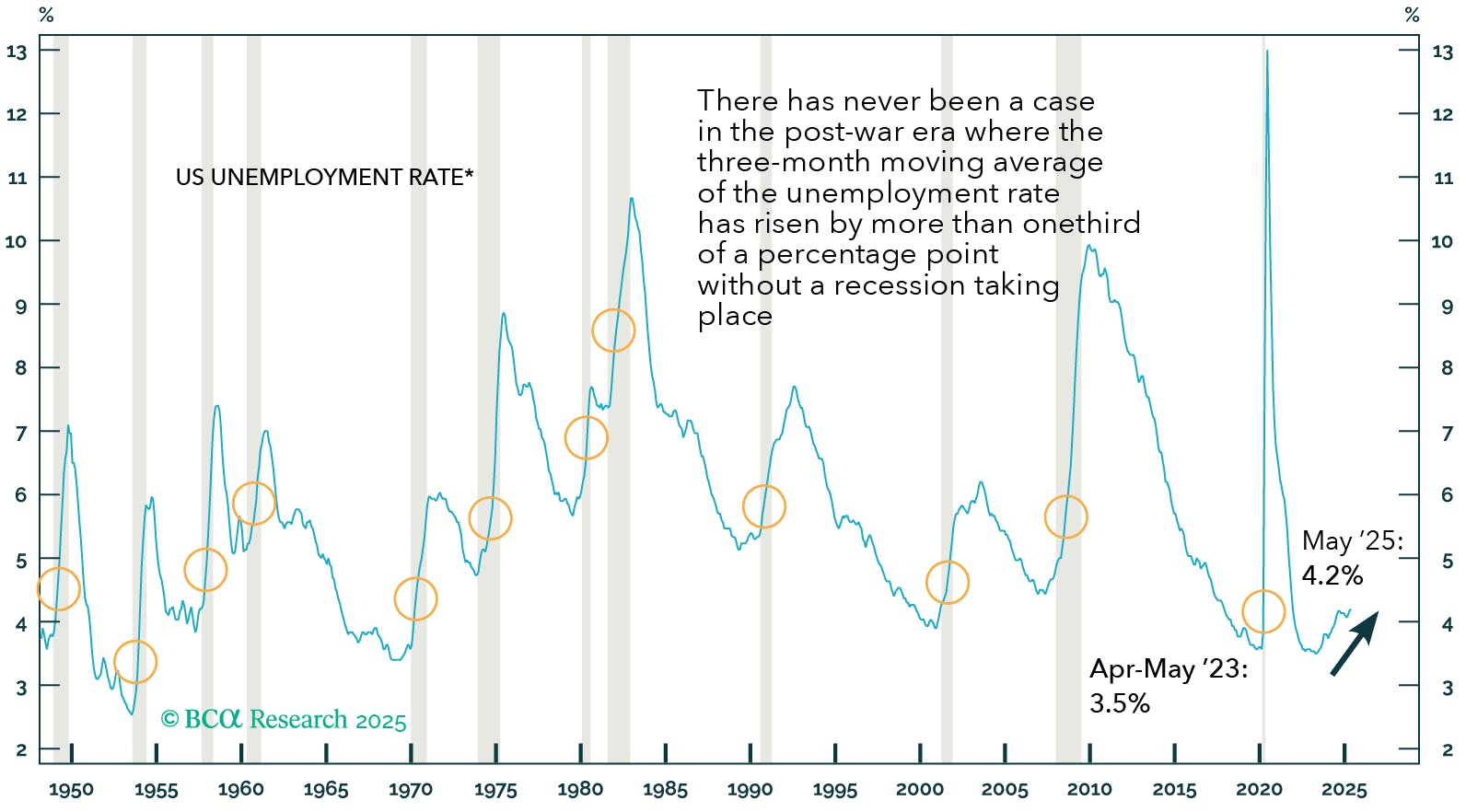

Unemployment is still relatively low but has been creeping up. May marked the fourth straight month of increases, pushing the rate to a new cycle high of 4.24%, with the three-month average now well above the 3.5% low we saw in early 2023. That’s worth watching, as historically, when this average rises by a third of a percentage point, a recession has often followed not long after, as shown by the chart below.

Chart 1: Will it be different this time?(1)

Source: BCA Research 2025

*Shown as a 3-month moving average.

Note: Shaded areas denote nber-designated recessions; circles in the chart denote the times when the 3-month moving average of the unemployment rate increased by more than 1/3 of a percentage point from prior lows.

Given this information, both the U.S. Federal Reserve and the Bank of Canada decided to hold interest rates steady this past quarter, after cutting them earlier in the year. Their message? They’re in no hurry. Especially with inflation above target and the job market showing resilience. For investors, that likely means more of the same for now, as central banks monitor whether those earlier rate cuts are starting to work their way through the system.

Client Experience

Despite the broader market volatility, Kinsted client portfolios held up well in Q2. While each client’s portfolio is unique and tailored to their specific goals, the average experience this quarter was positive. Each of our pool funds posted a gain except for one. This resilience was notable, as almost all our pools funds posted gains. The sole exception was the Strategic Growth pool, which is primarily invested in U.S.-denominated assets, which concluded the quarter with negative returns. This was largely due to the Canadian dollar’s significant appreciation (4.4%) against the U.S. dollar, diminishing the value of those assets when converted back to Canadian dollars. Beyond currency effects, private equity returns within this pool were also somewhat constrained by a lack of exits and subdued merger and acquisition (M&A) activity, both influenced by ongoing tariff uncertainty.

In contrast, our global equity holdings delivered a positive return, though they underperformed their benchmark. This was mainly because the pool was underweight in large-cap technology stocks, which led the broader market rally. While this positioning may have created a performance drag this quarter, we believe it continues to serve clients well over time by avoiding overexposure to potentially overvalued segments of the market and maintaining a broadly diversified approach.

Meanwhile, our strategic income-focused investments continued to deliver on their design: providing steady income and minimizing portfolio volatility. They outperformed traditional bond indices, despite some muted returns from short-term volatility in publicly traded components. This remains a reliable contributor to overall portfolio resilience and performance, especially given the ongoing challenges fixed income faces from inflation and interest rate uncertainty.

Finally, our other private investments, encompassing infrastructure, real estate, and agriculture, delivered stable performance across the board. These holdings continue to play a key role in diversifying portfolios and providing long-term growth potential. Infrastructure investments, in particular, remain a strong source of inflation-resilient returns, while private equity and real estate continue to offer attractive longer-term return potential.

Looking Ahead

As we look ahead to the second half of the year, we’re keeping a close eye on several key trends. Global growth appears to be slowing and recession risks in the U.S. remain elevated. Labor markets are beginning to show early signs of softening, and trade tensions, are still a drag on corporate profits and global supply chains.

We expect continued market volatility and a higher chance of economic contraction in the near term. Central banks are walking a tightrope trying to support growth without letting inflation flare up again. Their decisions in the coming months will be critical for both bond and equity markets.

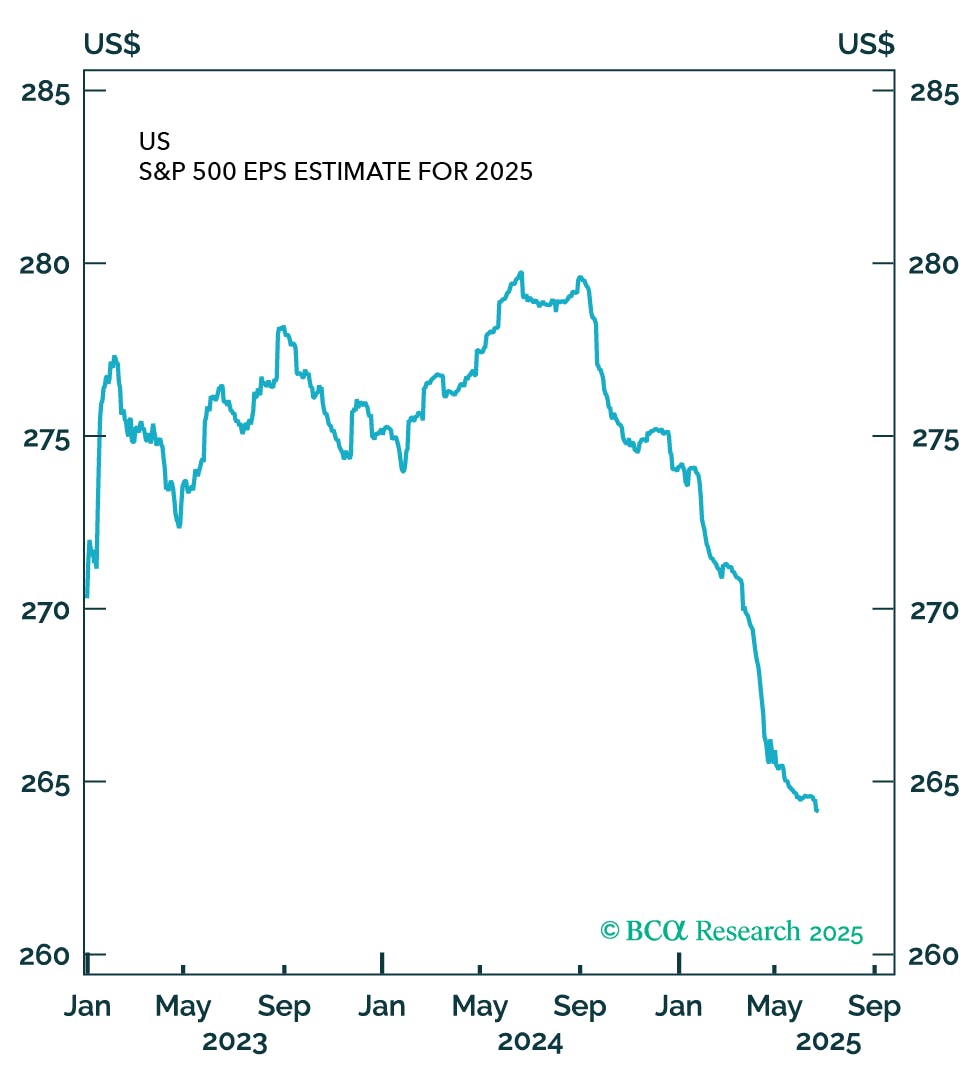

Chart 2: earnings estimates for 2025 have fallen(2)

Source: FactSet, via BCA Research. Data as of June 2025. (BCA Research charts now display earnings data from FactSet instead of Refinitiv/IBES.)

In the near term, we remain cautious on public equities, particularly in the U.S., where valuations appear overly optimistic relative to the mounting risks, as reflected in the recent decline in S&P 500 earnings estimates shown in the chart above. While we don’t make active currency bets, we’re keeping our eyes on exchange rates. The U.S. dollar could strengthen (benefitting our non-hedged U.S. holdings) if risk aversion does pick up.

That said, we remain optimistic about the long-term role of real assets and private markets. Infrastructure, especially in areas like utilities, transportation, and digital networks continues to offer attractive, inflation-resilient returns. Farmland and agriculture also remain key parts of our strategy, given their stability and growing importance in global supply chains.

Final Thoughts

Periods of uncertainty are never easy, but they’re part of the investing journey. What matters most is how we prepare for them. At Kinsted, we’re focused on building portfolios that can adapt and thrive over time. That means staying disciplined, being selective, and always keeping your long-term goals in mind.

We’re grateful for your continued trust and partnership. As always, we’re here to help you navigate whatever comes next.

Regards,

Kinsted Wealth