The Free Lunch of Investing: How to Achieve True Diversification

Commentary • Education

Date posted

May 30, 2025

Why Diversify

Wealth is typically built by concentrating your investments. For instance, a business owner with a unique advantage understands their business better than anyone else, allowing them to maximize returns. Another example is selecting an individual stock that skyrockets 1,000x, though this is extremely rare, and most investors experience enough losses to offset any major gains.

Few investors consistently outperform the market, and for good reason - you’re competing with some of the smartest minds in the world, who dedicate themselves to research and trading around the clock. This makes it very difficult to beat “Mr. Market”.

To limit losses, diversification is key. Often referred to as the “free lunch of investing”, proper diversification lowers overall risk while sacrificing little, if any, long-term returns.

Proper Diversification Explained

Diversification is the practice of spreading investments across various asset classes, industries, and geographic regions to reduce a portfolio's risk. Different assets usually react differently to the same economic event. By avoiding concentrating on a single investment, you minimize the impact of poor performance in any one area, helping to protect the overall stability of your portfolio.

Proper diversification relies on two key principles:

1. Invest in assets with a low, ideally negative, correlation to one another.

2. Invest in assets with a high certainty of appreciating over a 3-5+ year time horizon.

The correlation coefficient is a statistical measure of the strength of a linear relationship between two variables. Its values can range from -1.0 to 1.0. A correlation coefficient of -1 indicates a perfect negative correlation, where one asset rises as the other declines, effectively eliminating portfolio risk without sacrificing returns. Conversely, a correlation of 1 shows a perfect positive relationship, offering no diversification benefits at all – you are riding the market highs and lows and receiving no free lunch.

Many financial institutions fall short on true diversification, limiting themselves to asset classes that are moderately correlated. They emphasize diversification across various equity markets, such as Canadian, US, International, Emerging Markets, Small Cap, Value, Dividend Paying, etc. However, correlations between these markets typically range from 0.7 - 0.9(1), providing only marginal diversification benefits. Worse, during periods of financial turmoil (e.g., Global Financial Crisis, COVID, or 2022), these correlations tend to converge to 1.0, thereby reducing any diversification benefits when you need it the most. While adding bonds to a diversified equity portfolio may offer some relief (with correlations typically between 0.6 – 0.7(1)), it often comes at the cost of reduced returns.

So, why don’t more firms incorporate appreciating asset classes with low or negative correlations to bonds and stocks to get a larger “free lunch”? That’s a question for your Advisor, as we are just as baffled as you!

Effective Diversification

Kinsted is strategically diversified across multiple asset classes, each expected to generate an average return of 5-10% over a 3-5 year time horizon. Because these asset classes have low correlations to one another, portfolio returns should remain much more stable in the short-term while outperforming over the long-term compared to a traditional stock/bond portfolio.

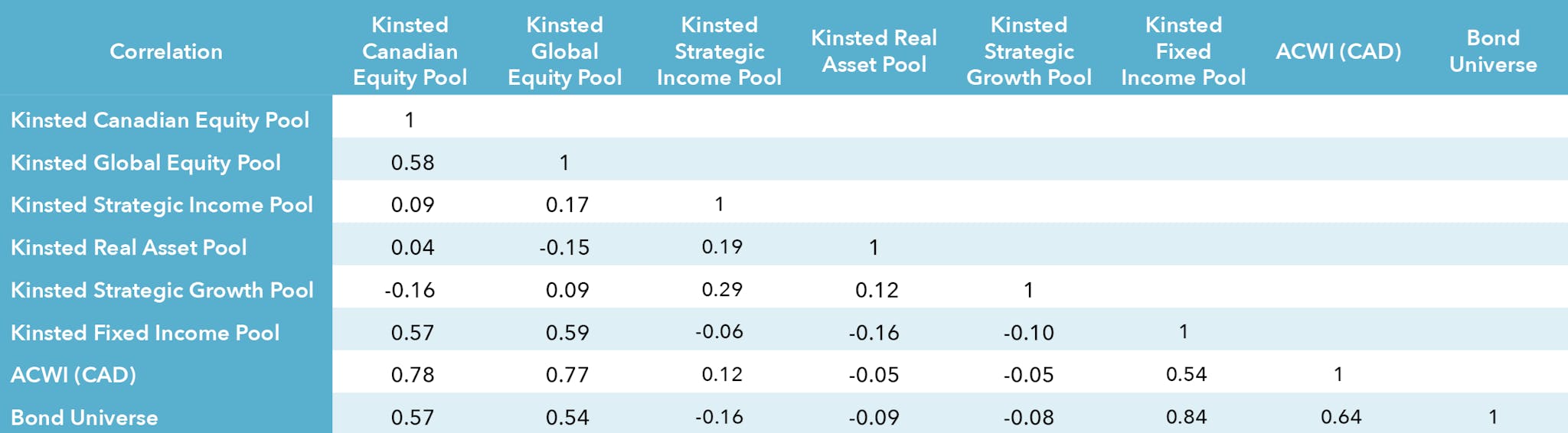

While the concept is simple, execution is not - Kinsted stands out with a broader investment platform than most wealth management firms. We invest in institutional quality private debt, private equity, infrastructure, agriculture, and private real estate – asset classes that are either lowly or negatively correlated with each other and with public stocks and bonds (see Correlation table below). Additionally, we’ve observed that these private asset classes can also provide higher returns than comparable publicly traded assets over the long-term. (ref: Risk Premiums Explained, Kinsted Feb 2025 blog). Now that is a proper “free lunch”!

Correlation Coefficients (the lower the better)

The formula below provides a basic way to measure expected portfolio risk. However, rather than worrying about the research, calculations, and implementation, let Kinsted handle it as it gets complicated - as we strategically allocate across more than two asset classes to optimize diversification.

The formula for calculating portfolio variance with multiple assets is:

σ²(p) = Σ Σ wi wj σ(i) σ(j) ρ(i, j)

Where:

- Σ Σ: double summation

- σ²(p): is the portfolio variance

- wi: is the weight of asset i in the portfolio

- wj: is the weight of asset j in the portfolio

- σ(i): is the standard deviation of asset i

- σ(j): is the standard deviation of asset j

- ρ(i, j): is the correlation coefficient between assets i and j

This formula is an extension of the two-asset portfolio variance formula. It considers the variance of each individual asset, as well as the covariance (or correlation) between all pairs of assets in the portfolio. The sum of all these terms gives you the overall portfolio variance.

Why limit yourself? With Kinsted, you gain access to institutional-quality private assets managed by the same managers that the large endowment and pension funds partner with. The results speak for themselves - significantly lower short-term portfolio risk and the potential for substantially higher long-term returns compared to a traditional managed investment portfolio made up of only stocks and bonds. That is true diversification and a proper “free lunch” - delivered by Kinsted Wealth.

(1)FactSet data from Oct 31, 2019 – Apr 30, 2025. Canadian Bonds are reflective of XBB (iShares Canadian Universe Bond Index ETF). Private Debt is reflective of Kinsted’s Strategic Income Pool. Private real estate, infrastructure and agriculture investments are reflective of Kinsted’s Real Asset Pool. Private Equity is reflective of Kinsted’s Strategic Growth Pool. Global Equity is reflective of the ACWI iShares MSCI ACWI ETF (in CAD).

Regards,

Kinsted Wealth