Q2/2024

Q2 2024 Outlook and Beyond

Commentary

Date posted

Apr 16, 2024

Looking Forward

Looking ahead, our stance on the public equity markets remains consistent with our previous outlook, that a correction is overdue. Even a slight economic downturn resulting in a roughly 10% decline in earnings and a reduction in the forward P/E ratio to around 16 could trigger a significant drop in stock prices. Investors often overlook historical patterns. Currently, Nvidia is the darling of the market, trading at 37 times its sales. Similarly, in 2000, Cisco was a market darling and the most valuable publicly traded company, also trading at 37 times sales. Interestingly, Cisco remains 38% below its 2000 peak. While we're not predicting that Nvidia will follow Cisco's trajectory, it's crucial to acknowledge that excessively high valuations have historically resulted in poor long-term performance.

We hold the view that the easing of financial conditions seen since last October, which has bolstered aggregate demand positively, has postponed the onset of a market correction. The recovery in both equity and real estate prices has also contributed to a solid rise in household wealth, thereby enhancing consumer confidence and consumption levels. Additionally, fiscal policy remains highly stimulative, with the US federal budget deficit estimated to have reached 6.2% of GDP in 2023, significantly higher than the 2.4% recorded in 2015 prior to the Trump tax cuts. Manufacturing activity is showing signs of stabilization, with increased capital expenditure intentions and booming construction, particularly in the tech sector.

However, there are considerations regarding how the capital markets will respond to this positive news, particularly in light of the rally fueled by expectations of significant rate cuts by the Federal Reserve. The prospect of limited rate cuts in the face of strong economic activity raises questions about market reactions, especially considering the substantial rally witnessed over the past year.

Even as the performance of traditional fixed income for the remainder of the year depends significantly on the trajectory of inflation, it's noteworthy that we've reintroduced Canadian bonds into some clients' portfolios as government bonds are now yielding in the 4% range. If inflation becomes more entrenched in the short to mid-term, there remains a risk that fixed income will continue to experience volatility; however, we believe that the current environment presents a favorable opportunity for strategic additions to portfolios with a conservative mandate.

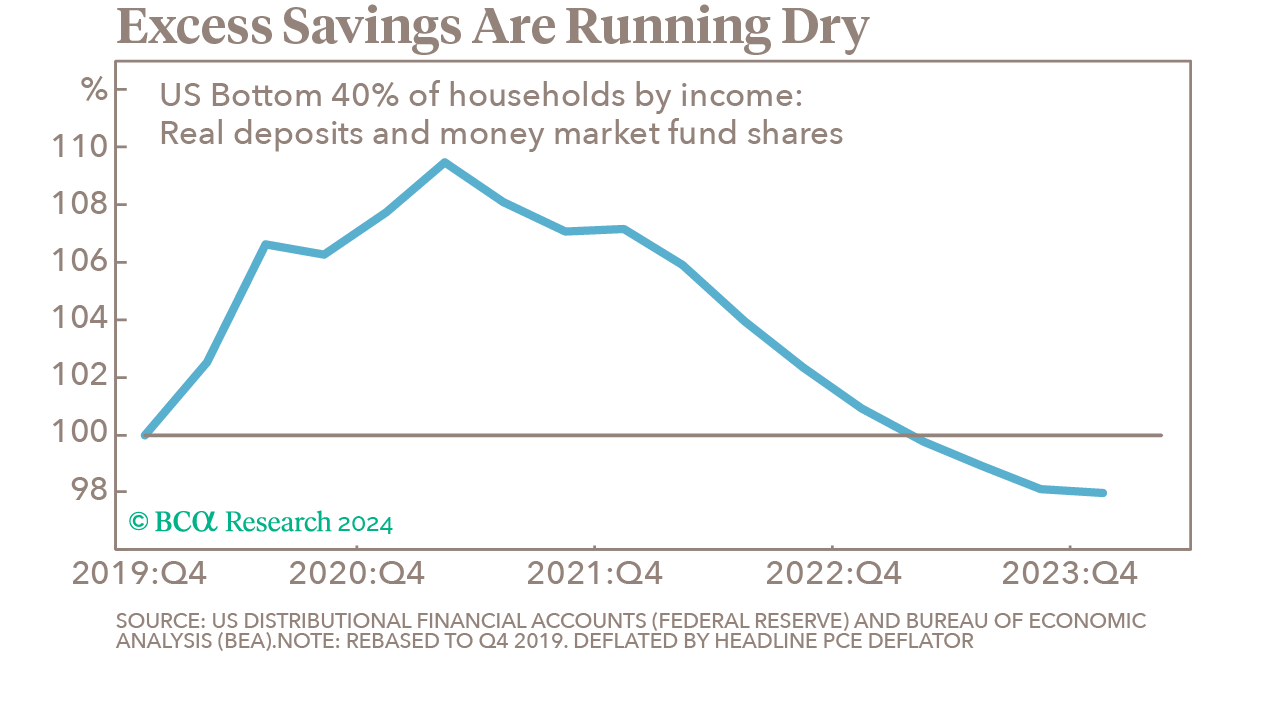

Another aspect investors should note is the exhaustion of accumulated pandemic savings, particularly among less wealthy households, which had fueled consumption growth over the past three years. This demographic has seen their savings now below 2019 levels, which may face challenges as they tighten their belts after exhausting their pandemic reserves. This could potentially impact the personal savings rate and overall economic strength, with the risk of a recession approaching if consumers as a group opt to spend less and save more.

While we aren't anticipating an economic scenario similar to the Great Financial Crisis, it's quite likely that we'll see higher unemployment rates and some economic slowdown towards the end of this year or early 2025. Despite central banks and governments' efforts to avert prolonged recessions over the past two decades through aggressive monetary and fiscal policies, there's a growing belief that these measures may have reached their limits. As a result, the factors that once propelled capital markets higher may now transition into headwinds, underscoring the potential for a normalized economic environment in the future.

In light of these uncertainties, maintaining a truly diversified portfolio is key to weathering potential storms. At Kinsted, diversification has been a cornerstone of our approach for quite some time, ensuring our clients are well-positioned to maintain a stable and reasonable return through changing market conditions. By incorporating alternative investments and diverse types of assets, we provide stability and growth opportunities, giving individual investors the opportunity to invest like institutional investors. As a Wealth Management Calgary firm, we are committed to offering innovative investment strategies that cater to varied risk appetites and investment decisions, aiming to achieve a balanced and diversified portfolio that aligns with our clients' long-term financial goals and helps reduce risk.

Regards,

Kinsted Wealth