Reversion to the Mean: A Powerful Market Force

Commentary • Education

Date posted

Jan 10, 2025

This post is part of a series exploring Kinsted’s investing philosophy—taking a deeper dive into the enduring principles that guide our approach. Over the next few months, we’ll explore topics such as risk premiums, the cycles of markets and economies, and effective portfolio diversification. Together, these concepts weave a thoughtful narrative around building resilient portfolios that thrive over the long term.

Is the US stock market overvalued? Yes.

Can the US stock market continue to provide returns well above its long-term average of 9% over the short-term? Yes.

Will the US stock market continue its above average returns indefinitely? No, the stock market currently has a higher-than-normal risk of a significant correction.

Note: We’re referencing the US stock market as it represents 67% of the world’s stock market capitalization and has the most robust economic data.

Long-term Averages

Academia and convention state that stock prices should be based on the present value of the total future earnings of a company. While an individual company's projected earnings can vary significantly, the overall market’s projected earnings should be relatively stable as corporate earnings are directly linked to, and therefore constrained by economic growth. So, when the market value drifts too far from this long-term average growth rate, a correction is required to bring valuations back into equilibrium. This concept is thoroughly covered by Bradford Cornell in the Financial Analysts Journal Vol 66, Jan/Feb 2010:

“Earnings, the source of value for equity investments, are themselves driven by economic activity. Unless corporate profits rise as a percentage of GDP, which cannot continue indefinitely, earnings growth is constrained by GDP growth. This dynamic means that the same factors that determine the rate of economic growth also place bounds on earnings growth and, thereby, the performance of equity investments.”

Economic growth (as measured by Gross Domestic Product or “GDP”) is limited due to population growth, productivity improvements, the law of diminishing returns, and that the world is a closed economy. As a result, real GDP growth (net of inflation) has averaged 3% per annum for the last 80 years and is expected to continue at this pace[1].

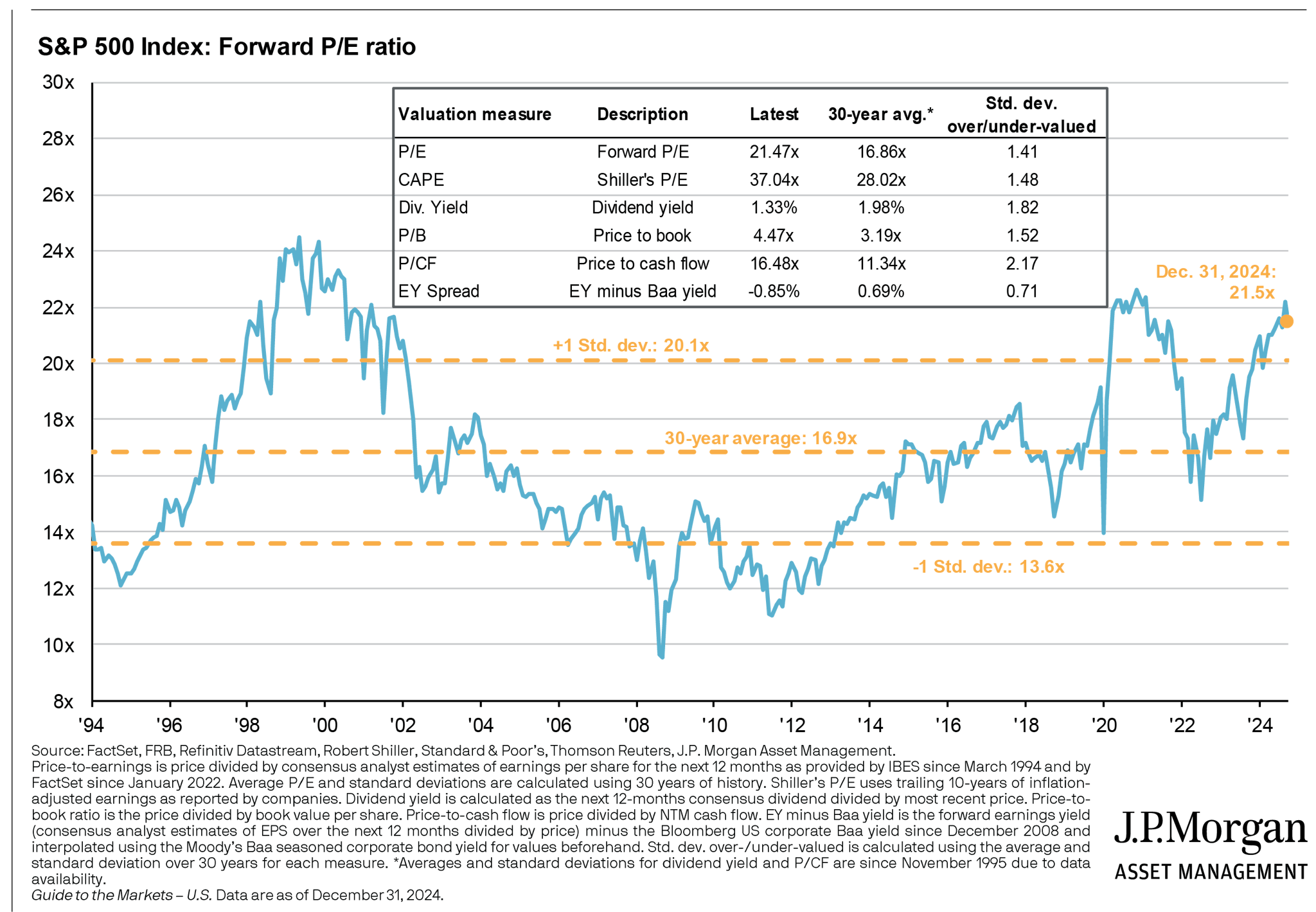

Markets naturally move in cycles due to normal economic expansion and contraction (somewhat predictable), plus the valuation multiple applied to these earnings which also fluctuates due to market sentiment (unpredictable). The long-term price-to-earnings (P/E) valuation multiple has been 17x’s earnings (ref: JP Morgan slide below). This inherently makes sense as the reciprocal of 1/17th is the earnings growth rate of 6% (1/17 = 0.0588), made up of the 3% GDP growth rate plus the 3% historical inflation rate[1].

The fluctuations in market sentiment are primarily caused by human nature’s herding mentality and the tendency to extrapolate shorter-term trends into the future based on fear or greed. Understanding that there is a natural gravitational pull back to the market’s long-term average earnings growth rate and valuations, can sometimes save you a lot of pain. This phenomenon is referred to as “reversion to the mean” and is a powerful force in the capital markets, especially when valuations reach extremes.

This sounds simple, but it isn’t easy to determine when the market pendulum is getting near the top or bottom because there are shorter-term cyclical fluctuations around the mean, the market environment is always different, and most importantly, human nature can be irrational for a long time.

Applying the Reversion to the Mean Concept

The current P/E multiple of the S&P500 is ~29x earnings, which is determined by dividing the S&P500 level of 5,882 by its current earnings of $200[2]. The forward P/E multiple in JP Morgan’s chart below is 21.5x, which implies earnings growth to be $274 (5,882/21.5)[3]. The key here is that “forward earnings estimates” come with a wide range of projections. In this case, if the current earnings per share is $200, this projects a higher than normal 35% ($274/$200) projected earnings increase for 2025.

The market currently justifies this elevated multiple based on the tailwinds of relative economic stability, technological advancements, fiscal spending, expected lower interest rates, etc. However, when applying reversion to the mean - why would an investor pay $29 for $1 of current earnings when earnings are constrained by GDP growth? Another perspective is why invest in a 3.5% current earnings yield (1/29) with equity risk when you can get a bond for 3.5%, or in Kinsted’s case, investing in private assets with a 5-10% earnings yield?

[4]

This is a simplified analysis, but the conclusion is the US market appears overvalued as the earnings growth rate is projected to run well above the constraints of economic growth, plus the market itself is being priced well above its average P/E multiple. In order for the S&P500 P/E multiple to revert back to its long-term mean of 17x, we would need:

- The stock market (numerator) to decline by ~30% from today’s valuation levels.

i. E.g. Using a 1 year “healthy” earnings increase of 20% to the S&P500 current earnings of $200 = $240 x 17 = 4,080 vs. the current 5,882 level.

ii. E.g. Using JP Morgan’s projected earnings of $274 x 17 = 4,658 is a 21% decline.

- Corporate earnings (denominator) need to grow by ~73% over the near term to justify today’s valuation levels.

i. E.g. 5,882/17x = $347/$200 = 73%. This is unrealistic based on the above rationale of corporate earnings growth eventually being constrained by GDP growth.

- The risk-free rate declining to 0% would help valuations, but this would only occur due to deflation, a recession/depression, or a crisis – all not good for the markets or the economy[5].

- Nothing moves in isolation, so it could be a combination of these three outcomes.

Growth investments like stocks do provide a return premium over the long-term, but a reversion to the mean will be painful, which should caution many investors against being overly exposed to the US stock market at this time.

Know Your Risk Tolerance

The most important thing is for every investor to know how much risk they are willing to accept and to manage this risk by holding assets that appreciate above the risk-free rate over time and have low correlations to one another. Kinsted’s investment platform manages these risks exceptionally well by investing in institutional quality private debt, private equity, infrastructure, agriculture, and private real estate, along with public stocks and bonds.

In conclusion, the market can certainly continue higher into 2025 as human nature can be irrational for a prolonged time. However, the further the market goes up, the larger the correction needs to be to bring valuations back into equilibrium. Be aware that when the market does turn down, it will likely turn down in a fast and furious manner. For this reason, you should have your plan set out beforehand so you will be well positioned versus having to “ride out” another correction or bear market.

[1].TRADING ECONOMICS. (n.d.). United States GDP annual growth rate. https://tradingeconomics.com/united-states/gdp-growth-annual

[2]FactSet Research Systems Inc., & Butters, J. (2025). EARNINGS INSIGHT.

[3] The forward P/E multiple estimates the price-to-earnings ratio based on projected earnings for the future, rather than current earnings which is more straightforward. In this case, the forward P/E of 21.5x implies that JP Morgan expects earnings to grow to $274, reflecting optimism about future profitability.

[4] Guide to the markets. (n.d.). https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

[5] The risk-free rate represents the return on an investment with no risk of financial loss, typically associated with government bonds from stable countries (e.g., U.S. Treasury bonds). It serves as a baseline for evaluating other investments. A declining risk-free rate generally boosts valuations by lowering the discount rate used in financial models, but such a decline often signals economic distress, such as deflation, recession, or crisis.

Regards,

Kinsted Wealth