Q1/2025

What Happened in Q1 2025

Commentary • What Happened

Date posted

Apr 11, 2025

Economic & Market Review

Trade Tensions, Inflation Pressures, and Policy Uncertainty

The first few months of 2025 were eventful, to say the least. A new U.S. administration coincided with increased market volatility around the world, driven by a sharp rise in trade tensions and continued inflation worries. While trade-related headlines aren’t anything new, this time has felt different—less political posturing and more policies being rolled out. This shift has had some real effects on the global economy and, by extension, on markets.

2025 kicked off with the U.S. imposing tariffs on imports from countries like Canada, Mexico, and China. As expected, other countries responded with their own trade barriers, which put pressure on the flow of goods and services globally. That led to renewed fears about supply chain issues and rising costs. Markets responded quickly; the S&P 500 dropped more than 10% from its highs, and big-name tech stocks—the so-called “Magnificent Seven”—lost nearly $2 trillion in market value. Investors started shifting money away from high-growth areas and toward more conservative or value-based investments.

Inflation hasn’t helped calm public markets either. The U.S. core PCE index, which is closely watched by the Fed, jumped to 2.8% year-over-year—higher than most expected. Tariffs are inflationary and, therefore, tend to push up the cost of materials and goods, making current and future inflation pressures worse. As companies pass these higher costs on to consumers, concerns about stagflation have begun to resurface. Stagflation happens when the economy slows down, prices keep rising, and jobs are harder to find—all at the same time. It’s a difficult situation as fixing one problem makes another one worse. For example, if central banks raise interest rates to fight inflation, it can slow the economy even more. But if they lower rates to help the economy, it might cause prices to rise even faster.

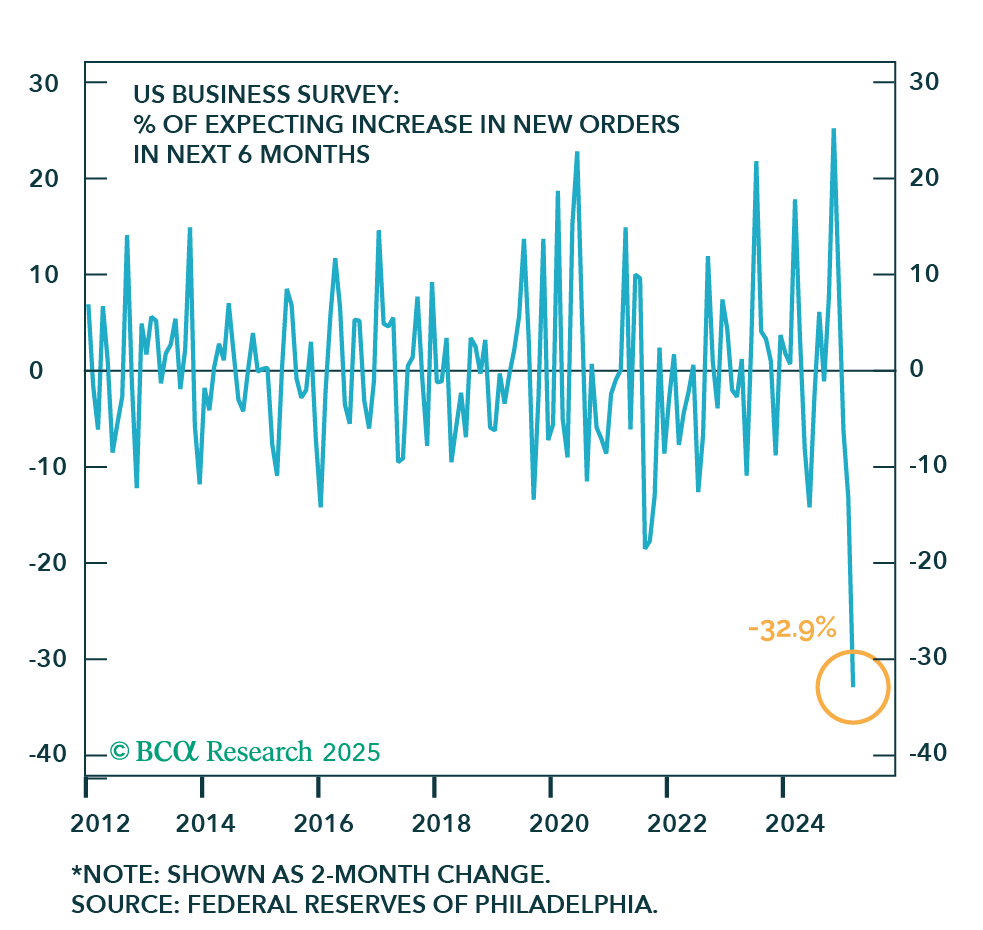

In Canada, consumer confidence dropped to its lowest point in history, and business sentiment fell even further than it was during the 2008 financial crisis and the early onset of COVID. In the U.S., we saw similar patterns. Confidence levels dropped significantly as people and businesses tried to make sense of policy changes, slowing demand, and rising costs. This is further illustrated in Chart 1, where the U.S. Business Survey reveals that the percentage of firms expecting increased new orders has fallen to its lowest point in over a decade.

Chart 1: Future Orders Slowing

Before any tariff concerns emerged, the Bank of Canada pre-emptively cut interest rates by 0.25% to support economic stability. It remains to be seen whether this move will be sufficient to support economic growth.

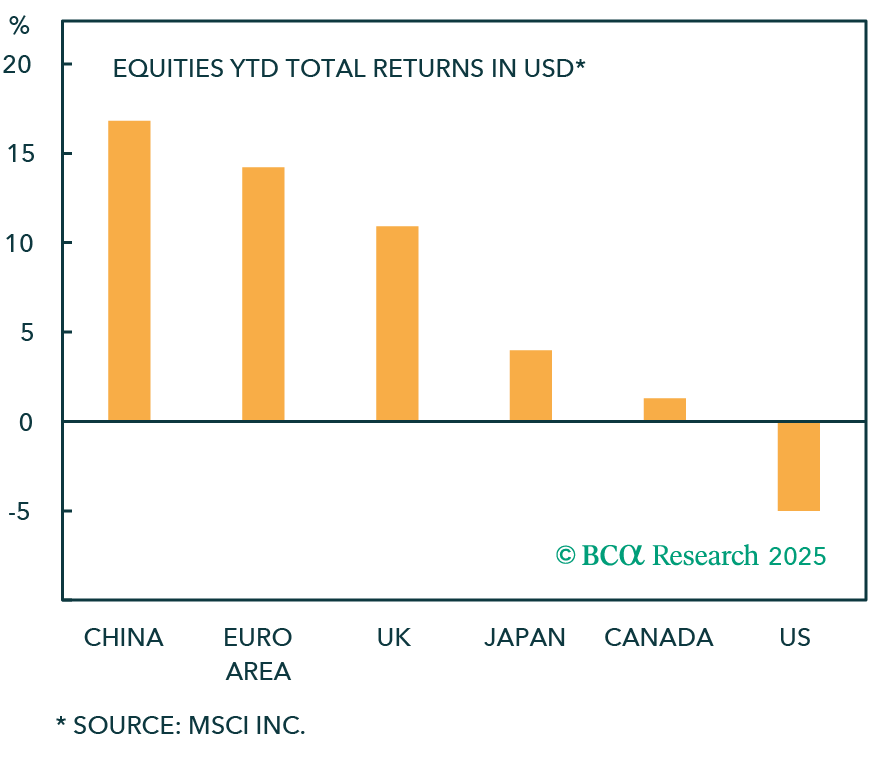

An interesting dynamic is unfolding in global markets. U.S. stocks appear to be overlooking weakening economic signals, maintaining valuations consistent with a best-case outcome. This contrasts sharply with the performance of international markets, where non-U.S. stocks, as illustrated in Chart 2, have delivered superior returns year to date, especially in Europe.

Chart 2: Are we sure this is a Tariff Selloff?

Big picture: the spike in tariffs seems to have acted as a trigger, revealing deeper cracks in an economy that’s still adjusting to higher rates, slower growth, and the winding down of COVID-era support. History tells us that rising protectionism can have real consequences. Just look back to the 1930s, when rising trade barriers deepened the global economic downturn. While today’s global economy is more resilient, it’s a reminder of the risks that come when countries begin closing off trade.

Client Experience

Resilience Amid Market Volatility

Despite a challenging start to the year for public markets, the typical Kinsted client experience was meaningfully more positive than broader index performance might suggest. Thanks to our disciplined investment philosophy and the strength of a globally diversified, multi-asset approach, client portfolios weathered the first quarter’s volatility relatively well.

All investment pools across our platform ended the quarter in positive territory—a noteworthy outcome given the difficult market environment. Leading the way was our Global Equity Pool, which posted gains for the quarter and outperformed its benchmark. This success can be attributed to our prudent management style, which is focused on quality, value, and risk mitigation. A significant contributor to performance was a revised valuation of SpaceX, one of our private equity holdings, which saw its value increase by more than 60% from its previous mark. This highlights the important role private investments can play in driving portfolio performance, particularly when public markets are under pressure.

Equally important was the pool’s exposure to a value-oriented U.S. manager. While many growth strategies experienced sharp drawdowns, these held up relatively well, demonstrating once again the benefit of style diversification within the equity portion of portfolios.

Our Strategic Income Pool also finished the quarter in positive territory, albeit with more muted results. Some of the daily liquid holdings of the pool experienced short-term volatility, which weighed on quarterly returns. Nonetheless, the pool remains a dependable source of yield and plays a vital role in enhancing portfolio resilience.

Our private assets, including investments in infrastructure, private real estate, and private credit, once again played a key role in stabilizing your portfolio and providing valuable diversification this past quarter. Keep in mind that the valuations of these private investments are usually reported with a delay of one to three quarters. Therefore, the Q1 results primarily reflect the performance of the underlying assets from the final months of 2024. While this creates a slight difference from what's happening in the public markets right now, it also offers a buffer against day-to-day market swings.

Our approach is intentional. Rather than chase short-term trends or attempt to time markets, we focus on long-term capital preservation, income generation, and the integration of institutional-calibre private investments that can offer differentiated sources of return.

Periods like this remind us why diversification across asset classes, geographies, and liquidity profiles is so critical. Despite economic headwinds and heightened market stress, our portfolios held up well.

Looking Forward

Staying Disciplined in an Uncertain Environment

As we look ahead to the remainder of 2025, we expect volatility across the public markets to continue. Trade tensions remain high, and protectionist policies—measures that limit imports to protect local businesses—in key global economies could impact corporate earnings, supply chains, and overall growth. If tariffs continue to rise and implementation persists, market and economic risks could increase significantly.

We are closely watching how these changes unfold and how they interact with broader economic trends. One key factor is the challenge central banks face in balancing the need to support economic growth while managing inflation. Their decisions will play a crucial role in determining market direction.

We remain confident in our positioning, focusing on building resilient portfolios rather than predicting short-term market movements. This includes continuing to make investments in private equity, where we believe the current environment offers an opportunity.

We are confident in our manager's abilities to invest in companies that will contribute meaningfully to long-term portfolio growth.For long-term investors, these dynamics offer great opportunities.

We are also optimistic about infrastructure investments. Assets like utilities, transportation networks, and digital infrastructure offer stable, inflation-protected returns, and tend to be less affected by short-term economic changes. In an uncertain environment, these qualities are particularly valuable.

Agriculture will continue to play a meaningful part in the real asset strategy. Global food demand is largely unaffected by trade issues or economic volatility. With climate disruptions and evolving supply chains, high-quality farmland and food production assets offer a reliable, long-term value that is becoming increasingly difficult to access.

Overall, we believe the current market conditions strengthen the case for not only global diversification, but asset class diversification, and disciplined portfolio management. As economic pressures grow and policies diverge across countries, the ability to invest across a broad range of opportunities becomes even more important.

We continue to monitor risks and opportunities closely and adjust our strategy as needed. Our focus remains on prioritizing quality, managing risk carefully, and investing with a long-term perspective. While we cannot eliminate volatility, we aim to build portfolios that can absorb shocks and remain strong over time.

Thank you for your trust in Kinsted. We are committed to managing your capital with the same discipline and care that has always guided our approach, and we look forward to navigating the coming months together.

Regards,

Kinsted Wealth