Q2/2022

What Happened in Q2 2022

Commentary • What Happened

Date posted

Jul 13, 2022

On January 1st, 2022, most would not have foreseen the carnage markets would inflict on household wealth over the ensuing six months, with both stock and bond markets posting some of their worst returns in over forty years. While the market downturn in the first quarter of the year was a result of inflationary concerns and the war on Ukraine, the second quarter also had to contend with recession fears. Deteriorating economic activity alongside elevated inflation are toxic twins for the capital markets. With the global equity benchmark down 13.5% in the quarter and down 18.6% year-to-date (YTD) and the Canadian Bond Universe down 6.4% in the same period and down 13.6% YTD, one can certainly perceive their insidious influence.

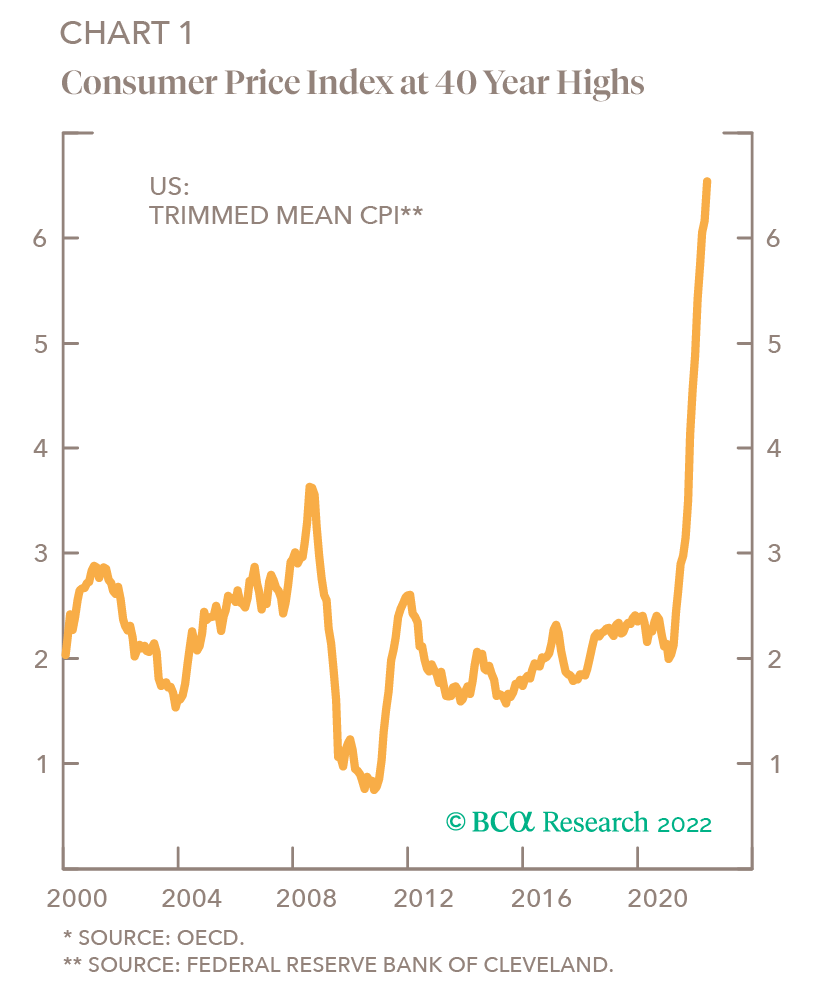

The economy of the past twenty years can be defined as one of low inflation, where supply and demand conditions remained relatively balanced. With the onset of the COVID-19 pandemic, these conditions quickly became disconnected as a collective $9.7 trillion of monetary and fiscal stimulus flooded financial and consumer markets impacting global supply chains. The convergence of these forces and searing energy and food prices, further exacerbated by the war, has led to a 40 year high in the inflation rate. With the largest amount of money circulating than at any other time in history, the price of goods and services had nowhere to go but up.

One consequence of inflation is the inevitability of rising interest rates. The current rate environment is one that may seem foreign to many individuals, as their experience with markets over the last few decades has been one where central banks have tended to ease rates during bear markets. With Central Banks now attempting to rein in inflation, 2022 will see the most severe monetary tightening in more than two decades.

The reality of portfolio management is that one has no control over what the market does in the short term. Given both stocks and bonds are down double digits since the beginning of the year, it has been virtually impossible for wealth managers who focus solely on traditional assets to control the volatility of their client’s portfolios. True portfolio diversification, which will reduce longer-term volatility and enhance returns, requires one to incorporate non-public market exposure in a portfolio.

By eliminating bonds, reducing public equity, and reallocating to private assets, our client portfolios have experienced less volatility than traditionally diversified portfolios, despite the poor Global Equity Pool results.

Kinsted Global Equity Pool

By incorporating private assets into our portfolios, we were able to reduce overall portfolio risk through diversification. As a result, we made the strategic decision to take more risk within our Global Equity Pool for long-term outperformance potential, acknowledging that also comes with short-term underperformance from time-to-time. With rates going up and inflation hovering near 40-year highs, the selloff in growth companies did not abate during the quarter.

The Nasdaq is down 29% YTD, and the Russell 1000 Growth index is down 28%. As the Fed’s tone on rate hikes became more pronounced, investors reacted by increasing the discount rate in their models. This, in turn, cut the accepted valuations of growth stocks. In a very short period, the Nasdaq was trading at a value far above what the market thought it was worth, thus precipitating the correction that remains in place today.

We materially reduced our exposure to US growth-oriented technology stocks in our Global Equity Pool in Q4/21, but this was not enough to mitigate the significant selloff of growth-oriented equities. In Q2/22 we further rotated to hold more value-oriented stocks to balance out the US growth-oriented stocks, but the carnage in growth stocks continued. Going forward, we are comfortable with the current allocation of growth-oriented companies along with US and international value-oriented securities.

Kinsted Real Asset Pool

Real estate, farmland, timberland, and infrastructure are 4 of the asset classes that are components of the real asset pool. Historically, each has provided investors with attractive excess returns over equities and bonds when inflation and interest rates were rising. These assets tend to provide long-term stable cash flows with embedded inflation-linked pricing, since the economic drivers of their returns are typically tied to price trends. In other words, these assets may not only reduce portfolio volatility in environments such as the current one but may also provide enhanced returns over traditional stocks and bonds, as history has shown.

The pool finished up the quarter with a positive return of 3.0%, and a twelve-month return of 12.0%. All sectors of the pool contributed to the strong performance, and in particular real estate. We continue to invest in real assets not only in inflationary environments, but in all economic environments given the stable cash flows they provide. During the quarter, we increased the pool’s agriculture exposure by allocating to a strategy focused on permanent crops such as blueberries, cherries and apples which have seen strong organic growth in both North America and globally. We are always exploring new opportunities within real assets and expect to make some new commitments over the next several months.

Kinsted Strategic Income Pool

The pool finished the quarter marginally up 0.6%, while the 12-month return of 6.7% firmly outpaced the Canadian Bond Universe. While most of the pool’s private holdings provided steady returns, high yield and bank loans were negatively impacted as a result of rising rates and widening credit spreads.

While Macroeconomic issues impact all private asset classes, we see the value in private credit, especially during volatile times, in part because of its resilience to market risks.

Due to the contractual nature of private credit, they should continue to provide higher income, even in volatile markets or market downturns, providing a “smoothing” effect to portfolios through those cycles. Despite macroeconomic headwinds for the broader market, private credit offers opportunities to mitigate against and capitalize on these conditions.

Kinsted Strategic Growth Pool

The strategic growth pool closed the quarter down 0.6%, with a twelve-month return of 16.0%. While the pool’s private equity and venture capital holdings have been quite resilient through the public market downturn, we will not be surprised if we see some holdings come under pricing pressure over the coming quarter. With that said, it’s important to understand that experiencing some pricing pressure in the private equity space is an opportunity. Given that the pool has a significant amount of uncalled commitments, our private equity managers will likely see significant opportunities to purchase securities below their fair value. The structure of the pool means that we will continuously be “averaging” into private equity throughout an economic cycle, which will help smooth long-term pool volatility and enhance returns.

Regards,

Kinsted Wealth