Q3/2024

What Happened in Q3 2024

Commentary • What Happened

Date posted

Oct 9, 2024

The third quarter of 2024 was a period of notable gains across global markets despite several headwinds that briefly rattled investor confidence. A mid-quarter spike in volatility was triggered by a combination of weak U.S. labour data and an unexpected rate hike from the Bank of Japan (BoJ). These factors initially raised concerns about global economic stability. However, interest rate cuts by the U.S. Federal Reserve (Fed), Bank of Canada (BoC), and the European Central Bank (ECB) played a pivotal role in stabilizing financial markets.

These rate cuts supported equity and fixed-income markets, resulting in a fourth consecutive quarter of global equity gains. Despite softening oil prices, which are often a gauge for economic growth, markets demonstrated remarkable resilience, showing that investor sentiment remained largely optimistic in the face of global economic uncertainties.

Outside of the U.S., China's aggressive stimulus measures stole the spotlight. The country introduced its most significant economic stimulus package since the pandemic, aimed at reviving its slowing economy. These efforts propelled China's equity markets to their best quarterly performance in over a decade, reflecting both the impact of fiscal stimulus and investor optimism about the country's economic recovery.

Meanwhile, European and U.K. markets posted more modest gains. In contrast, Japan's market faced challenges from tighter monetary policy, as the BoJ's unexpected rate hike dampened investor sentiment.

Sector-wise, there was a notable rotation from the high-flying technology stocks that dominated much of the past few years into more defensive areas such as utilities and real estate. This rotation indicated a growing appetite among investors for stability and income-generating assets as concerns about stretched valuations in the tech sector began to mount. Private assets, especially private credit, remained stable, offering attractive returns amid broader market fluctuations.

Fixed Income Pool

The Kinsted Bond Pool had a solid quarter, posting a 2.8% return, bringing the year-to-date performance to 4%. This performance was bolstered by the BoC's decision to cut its policy rate twice, reducing it to 4.5%.

The BoC's actions were driven by easing inflationary pressures and weak economic data, including lower inflation and rising unemployment rates. These economic conditions provided the central bank with room to make rate cuts, supporting fixed-income markets.

Looking ahead, the monetary policy outlook remains data-dependent. Future rate changes will likely hinge on inflation and broader economic performance, but expectations are that further rate cuts may be on the horizon.

Strategic Income Pool

The Strategic Income Pool experienced a modest 0.9% gain for Q3, bringing its year-to-date performance to 4.9%. Private credit holdings performed well, providing steady returns. However, publicly traded business development corporations (BDCs) delivered weaker results, dragging down overall quarter performance.

One of the fund's most significant holdings (the Pretium Residential Credit Fund), which reports semi-annually, also negatively impacted the quarter's results. Despite some short-term challenges, the fund manager remains optimistic about the long-term prospects of the Fund. Overall, the underlying fundamentals of the private credit market remain strong, and the pool is well-positioned to meet its long-term return targets.

Looking forward, there is potential for regulatory changes tied to the upcoming U.S. presidential election, which could introduce some uncertainty within the private credit market. In this uncertain environment, alternative assets like music royalties are gaining traction as attractive sources of stable, uncorrelated returns, especially given the continued growth of streaming services.

Real Asset Pool

This quarter, the Kinsted Real Asset Pool delivered a 2.1% gain, bringing its year-to-date performance to 5.4%. Public Infrastructure investments were a standout performer, with two infrastructure exchange-traded funds (ETFs) held in the fund posting gains of over 10%.

The Manulife Global Infrastructure Fund, another holding, also grew strongly, rising nearly 4%.

In private real estate, despite broader sector challenges, the Pan-European real estate fund, Henderson Park which is another holding, continued to outperform, delivering a 3.7% gain. As the global economy transitions towards renewable energy, we anticipate ongoing strength in regulated utilities and clean energy investments. While traditional power generation will remain crucial during this transition, it presents opportunities for stability and growth in the real asset space.

Strategic Growth Pool

The Strategic Growth Pool closed out the third quarter with a solid 2.9% gain, bringing its year-to-date return to 11.2%. Private equity holdings contributed mid-single-digit returns, bolstered by the continued strength of high-quality companies.However, exposure to publicly traded business development corporations (BDCs) weighed slightly on performance.

New investments like the Arctos Professional Sports Ownership Fund have yet to impact returns fully.

Private equity remains a crucial driver of long-term outperformance relative to public markets. We can anticipate additional upside as the IPO market continues to recover and merger and acquisition (M&A) activity picks up.

In addition, sectors like artificial intelligence (A.I.) and clean technology provide exciting growth opportunities for private equity investments. We remain optimistic about the Strategic Growth Pool's future performance, particularly as global demand for innovation continues to rise.

Global & Canadian Equity Pool

The Kinsted Global Equity Pool returned 3.2% for the quarter, bringing its year-to-date performance to 13.7%. Similarly, the Kinsted Canadian Equity Pool outperformed with a 10.7% gain for the quarter, pushing its year-to-date return to an impressive 14.7%.

Volatility in August, spurred by weak U.S. labour data and the BoJ's unexpected rate hike, caused short-term disruptions in global markets. However, both pools benefitted from broader market strength, supported by central bank rate cuts and improving global economic conditions.

Real estate, utilities, and industrials were the top-performing sectors, while technology stocks saw reduced enthusiasm due to concerns over high valuations and profitability. As we move forward, we expect defensive sectors to continue leading the market within the global equity space.

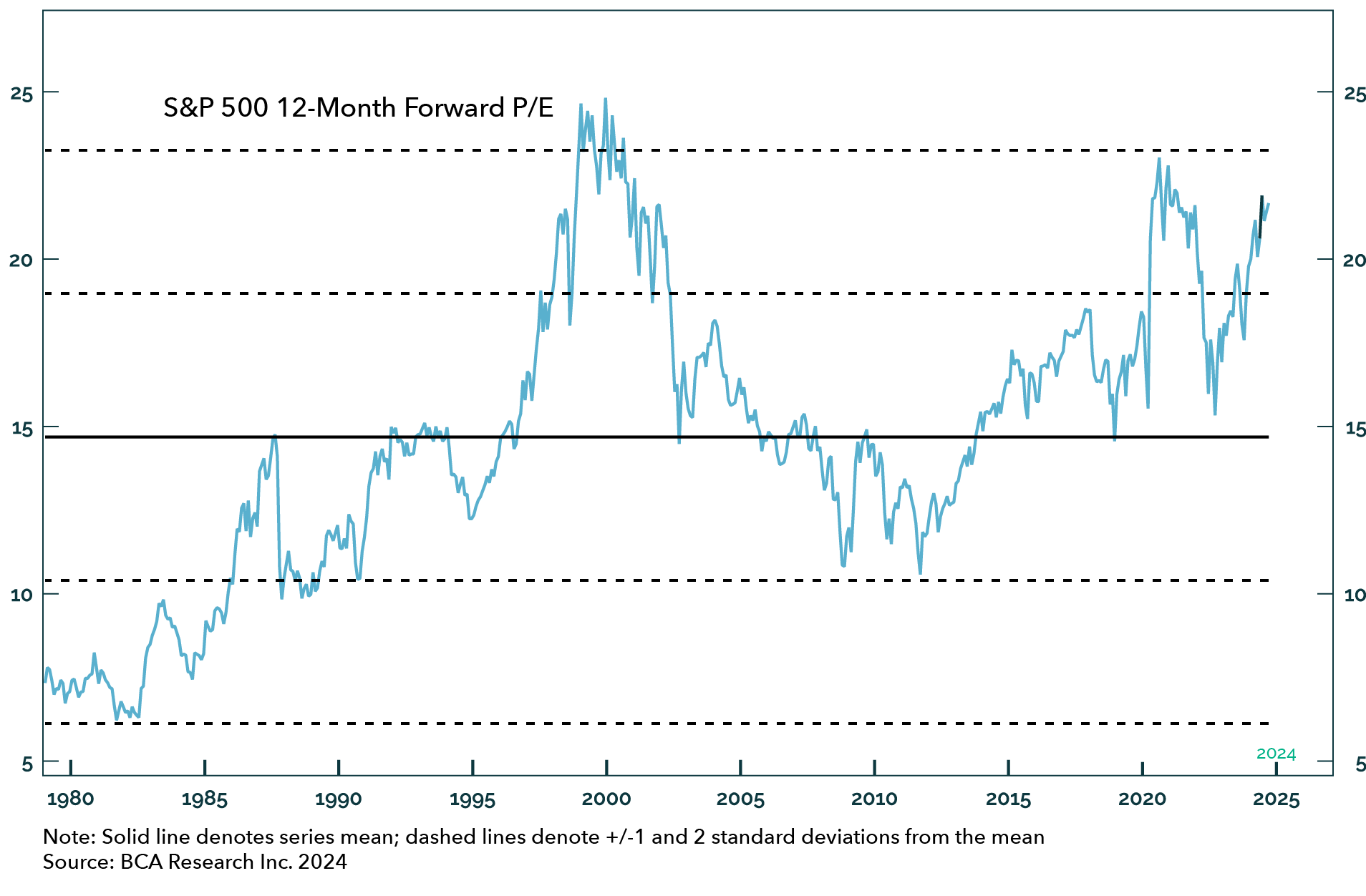

Excluding the 2020 anomaly, the S&P 500's forward P/E ratio is approaching levels last seen before the late 1990s tech bubble, signaling a need for caution in public equity exposure.

Excluding the 2020 anomaly, the S&P 500's forward P/E ratio is approaching levels last seen before the late 1990s tech bubble, signaling a need for caution in public equity exposure.

Outlook: Navigating Uncertainty

As we look toward the final quarter of 2024, several potential risks and opportunities are on the horizon. The upcoming U.S. presidential election may introduce short-term volatility into the markets. However, we believe that long-term economic fundamentals will remain the primary drivers of market performance. Key factors to watch include labour market strength and inflation trends, with particular attention to initial jobless claims, often serving as a leading indicator of broader economic health.

Kinsted's portfolios are well-positioned to navigate a wide range of economic scenarios. By focusing on diversified and resilient investments across asset classes, we are confident that our client's portfolios will continue to deliver long-term growth and stability, regardless of political or economic changes on the horizon. As always, our commitment remains to provide thoughtful and strategic investment management to safeguard and grow our client's wealth in any market environment.

Regards,

Kinsted Wealth