The Benefits of Diversification

Commentary • Education

Date posted

Feb 15, 2022

What is diversification?

We have all heard the classic investment advice, "don't put all your eggs in one basket," – but what does that actually mean for your investment portfolio? Concentration can make you a very wealthy or a very poor investor, while a well-diversified portfolio provides consistent returns.

If we had a crystal ball that told us which individual company would provide tremendous investment results or which asset class would perform better over a given year, we wouldn't need to diversify our client's portfolio. We would simply invest entirely into that one company or that single asset class. The reality is, no one has a crystal ball.

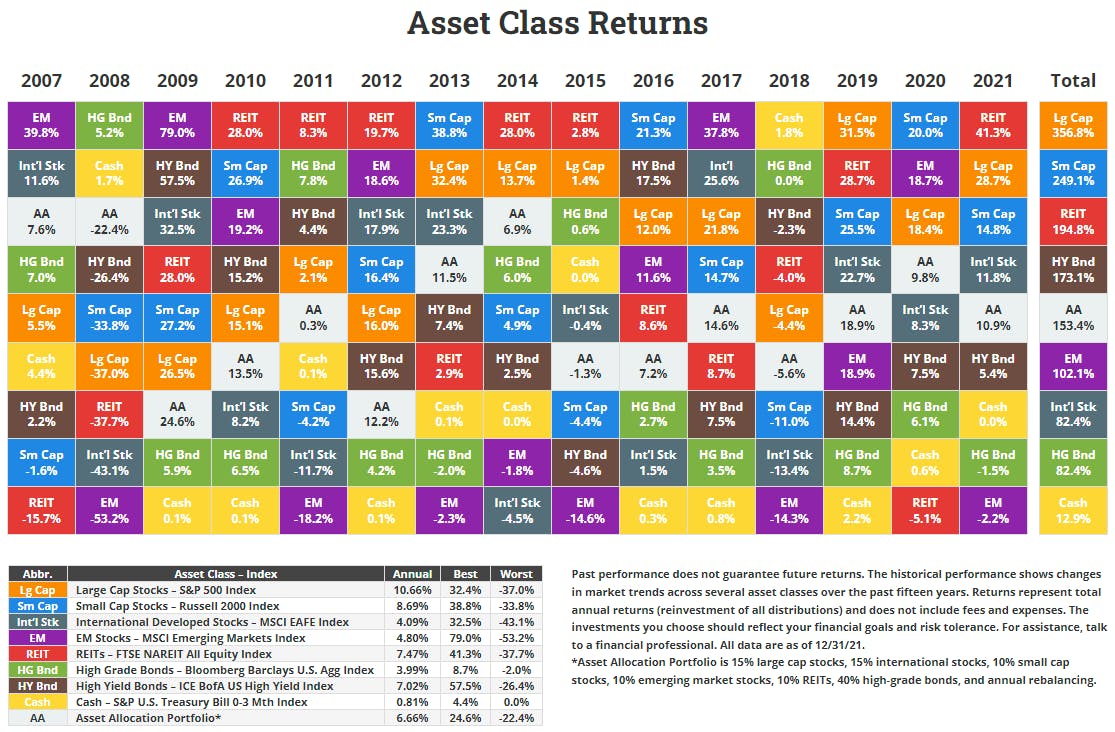

Diversification is about protecting your portfolio when one investment or asset class is not performing well. As mentioned before, it is very challenging to predict which sectors or asset classes will have the top performance in any given year. Below's chart from the Novel Investor illustrates this point – sometimes the best performing asset class in one year can be the worst performing the next.

As investors, our goal is to spread the risk of your portfolio. After all, if we can avoid large losses, we have a better chance of growing wealth through compounding returns. This leads to our next point;

How do you diversify?

Start by focusing on what you can control. The risk of any investment is tied to two factors:

- Broad market risk

Overall market risk, including market cycles (recessions, booms) or black swan events (significant unforeseen events that negatively impact market performance), for the most part, are outside of our control. - Risk that is specific to an investment

This is where we have the opportunity to employ diversification. Especially now more than ever, we see companies lose significant value while the overall market enjoys positive performance. The old-school method of diversification was to mitigate this risk by diversifying a portfolio into different sectors or industries and even geographies around the world. What we found is that traditional diversification is a thing of the past. Given a globalized investment community, we believe investors face a new reality when it comes to constructing their portfolios.

Out with the old, in with the new

Let's look at an example from recent memory to explore the challenge of employing the old method of diversification – we all remember the market correction we saw in March 2020 as a reaction to the global pandemic. What we observed is this: all public market stocks had negative returns. Regardless of your portfolio mix, each sector or industry was 'in the red.' Taking it a step further, having investments out of Canada also didn't make much of a difference to investors' returns as markets around the world were also 'in the red.' We find that when diversification is needed the most (during a market correction or crash), public investments tend to move in the same direction.

At Kinsted, we have evolved our portfolio-building process and found a solution to properly diversify a portfolio by including non-public asset classes. Investing in markets such as agriculture, infrastructure, and real estate allows us to invest in these assets directly. The volatility (or how much the value of the investment fluctuates) is relatively low compared to the public markets; we call this low correlation. Simply put, when public stocks are going down, these asset classes do not follow the same direction. These non-public asset classes also offer incredibly consistent results. Going back to our example of March 2020, Kinsted’s non-public asset classes did not experience negative returns. This shows exactly how diversification is designed to work; providing investors a better chance of growing wealth by controlling risk.

Contact one of our Wealth Counsellors today if you’re interested in diversifying your potfolio with more than just stocks and bonds.

Regards,

Kinsted Wealth