Private Infrastructure: An Introduction

Commentary • Education

Date posted

Sep 19, 2024

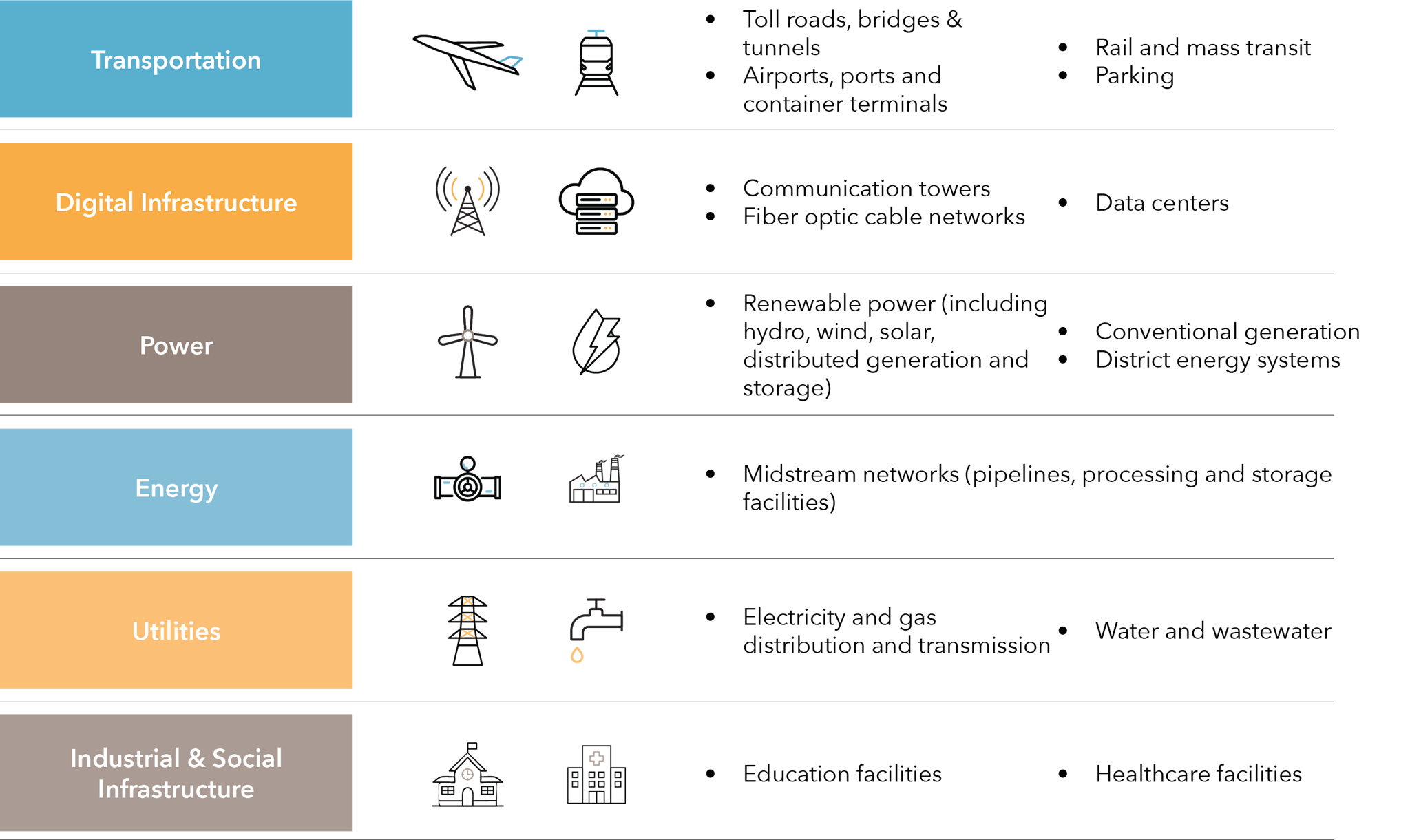

Private infrastructure refers to essential physical structures and facilities that are not publicly (government-only) owned or operated but are instead owned and managed by private entities. Unlike publicly funded infrastructure projects, private infrastructure investments involve capital from private sources such as institutional investors, pension funds, sovereign wealth funds, and private equity firms. These investors deploy funds to finance, develop, operate, and maintain infrastructure assets with the aim of generating long-term returns.

Investment Characteristics:

- Regulated:

Many private infrastructure assets operate within a regulatory framework or under long-term contracts that provide a degree of revenue certainty. Regulatory oversight can offer stability and predictability for investors by providing guidelines on pricing, operating standards, and revenue-sharing mechanisms. Furthermore, contracts often include provisions for inflation adjustments, ensuring that revenues keep pace with rising costs over time.

- Predictable long-term cash flows:

Private infrastructure investments offer the allure of stable and predictable cash flows over extended periods. Revenue streams typically derive from long-term contracts, concessions, or regulatory agreements that provide visibility into future earnings. For instance, a toll road may have multi-year agreements with government entities or commercial users, guaranteeing a steady flow of income regardless of short-term fluctuations in economic conditions.

- Hedge against inflation and economic volatility:

Inflation-linked contracts, regulated pricing mechanisms, and the essential nature of infrastructure services help insulate investors from the erosive effects of inflation. Moreover, infrastructure investments tend to exhibit resilience during economic downturns, as demand for essential services remains relatively stable even during periods of economic contraction.

- Promotes economic stability and positive social impact:

Infrastructure development plays a crucial role in fostering economic growth, creating jobs, and improving living standards. By investing in infrastructure projects, investors not only stand to gain financially but also contribute to broader societal benefits. Private investment can help bridge the infrastructure funding gap, particularly in regions where public budgets are constrained.

- Long-term growth potential:

The demand for infrastructure assets is closely tied to global population growth, urbanization trends, and economic development. Emerging markets, in particular, present significant opportunities for infrastructure investment, driven by the need to modernize aging infrastructure and accommodate rapid urban expansion. Investments in sectors such as renewable energy and digital infrastructure are poised to benefit from evolving technological advancements and changing consumer preferences.

- Diversification:

Private infrastructure investments offer diversification benefits within a broader investment portfolio. Infrastructure assets have historically exhibited low correlation with traditional asset classes like stocks and bonds. By adding infrastructure to their portfolios, investors can potentially enhance risk-adjusted returns and reduce overall portfolio volatility.

Recent Trends Supporting Infrastructure:

- Public Funding Gap:

In 2018, the G20 Infrastructure Outlook estimated a $15 trillion USD infrastructure gap between what the world needs and what governments can be expected to spend based on current trends between 2018 and 2040.[1] This creates a large opportunity for private investment to help close this gap.

- Global Digital Transformation Market:

The global digital transformation market size is expected to grow at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030.[2] This includes technologies such as cybersecurity, cloud computing, big data & analytics, artificial intelligence, mobility, and social media (Grandview Research).

- Decarbonization:

Net-zero initiatives drive substantial investment in infrastructure by necessitating the development and deployment of sustainable technologies and systems. These initiatives demand enhancements in renewable energy sources, energy-efficient buildings, and advanced transportation networks, fostering significant financial flows into these sectors. The transition to net-zero requires modernizing the grid to handle increased renewable energy input, expanding electric vehicle charging networks, and upgrading public transportation. This surge in infrastructure investment not only supports environmental goals but also stimulates economic growth, creates jobs, and enhances resilience against climate impacts.

Adding private infrastructure to your portfolio is a great way to introduce stable and uncorrelated income streams. It is crucial to work with someone who understands the risks and benefits of investing in this asset class.

At Kinsted Wealth, we emphasize the importance of diversification in our investment strategies, providing opportunities to invest in private assets alongside traditional stocks and bonds. In today’s evolving investment environment, diversification is crucial for building portfolio resilience. Private markets offer a diverse array of alternative investments, including private equity, credit, agriculture, infrastructure, and real estate, which collectively enhance the robustness of your portfolio. By incorporating private markets, you can fortify your portfolio against uncertainties, promoting sustainable growth while minimizing risk.

Explore these opportunities with us by connecting with one of our Wealth Counsellors today. Whether you're an individual investor, an advisor seeking tailored strategies for your clients, or a firm looking to add private assets to your client portfolios, we can help you develop an investment strategy that aligns with your specific goals and circumstances.

Kinsted Wealth stands as a leading independent firm in Canada’s private wealth management sector, offering personalized strategies tailored to the distinct needs of individual investors aiming to invest like institutional players. Based in Calgary, Alberta, Kinsted Wealth is committed to helping you achieve financial stability and growth through a well-diversified portfolio and strategic investment planning.

Click here to learn more about Private Credit.

- Global Infrastructure Outlook - A G20 INITIATIVE. (n.d.). https://outlook.gihub.org/

- Digital Transformation Market Size, share, Growth & Trends Analysis Report by solution, by deployment, by service, by enterprise size, by end-use, by region, and segment forecasts, 2024 - 2030. (n.d.). https://www.grandviewresearch.com/industry-analysis/digital-transformation-market

Regards,

Kinsted Wealth