Private Credit: An Introduction

Commentary • Education

Date posted

Aug 1, 2024

Private Credit, also known as Private Debt, is a broad investment category involving loans issued to companies that are not publicly traded on the capital markets. The Private Credit market is a growing asset class that offers investors higher yields, lower volatility, and portfolio diversification.

Following the Global Financial Crisis (GFC) in 2008, important changes to global banking regulations have caused a pullback in the availability of credit in the banking system. In the absence of available capital from the banks, many businesses have turned to private capital to fill the void.

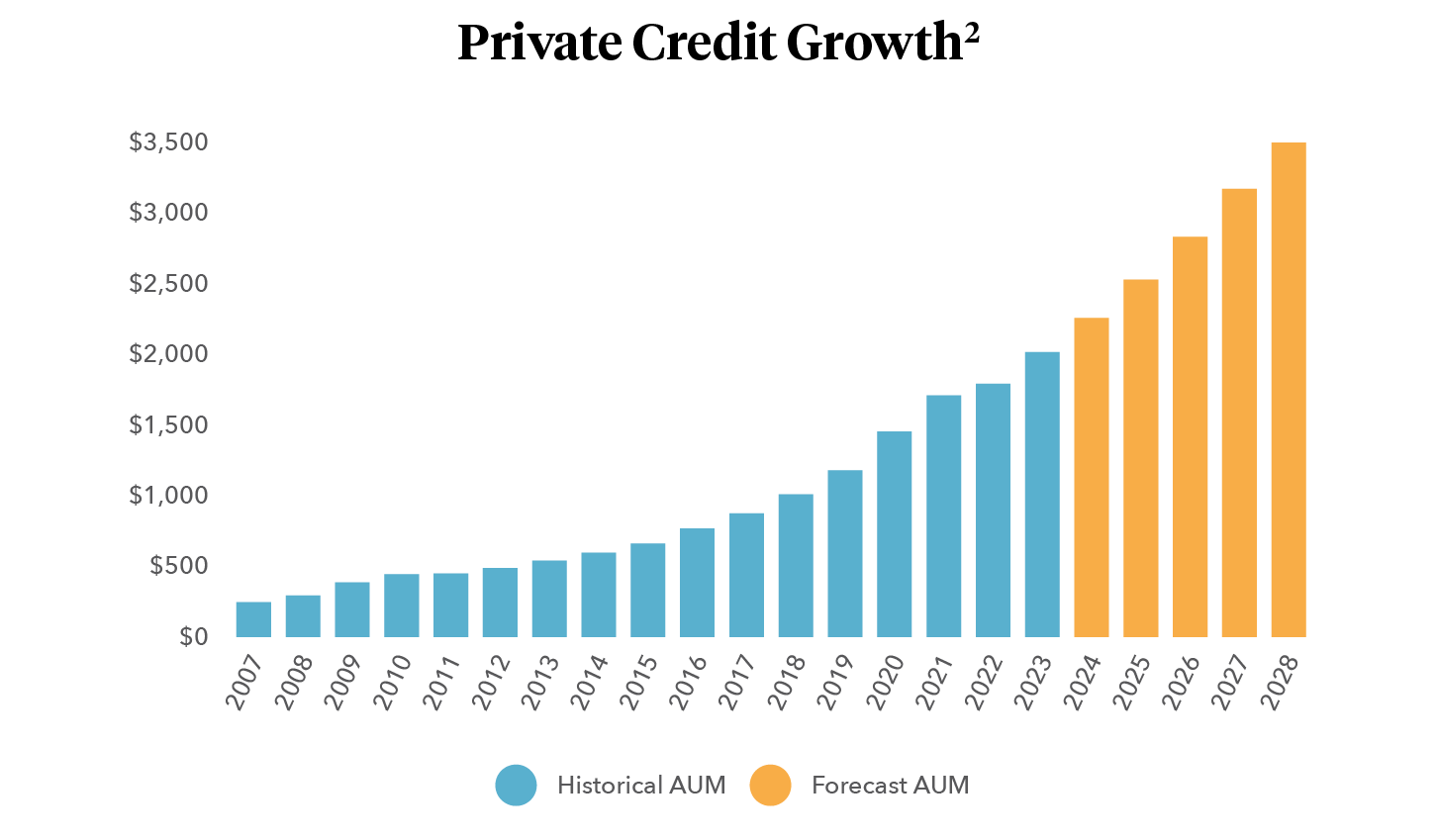

Since the GFC, the Private Credit market has grown from less than US$300 Billion to over US$1.5 Trillion and is expected to more than double in the next five years.1 In addition to the pullback in debt availability from the banking sector, Private Credit market growth can be attributable to other factors, including borrowers' preference for customized and flexible lending structures and investor appetite for Private Credit in their portfolios.

Private Credit can offer several benefits to investors, including:

- Higher yields:

Private Credit securities often offer higher yields than publicly traded bonds, making them more attractive to income-focused investors.

- Diversification:

Private Credit can provide diversification benefits due to the floating rate structure, lower volatility, and stability.

- Alignment:

Unlike the traditional bond market, Private Credit securities can offer more flexible terms and structures, allowing investors to tailor their investments to their specific needs.

Private Credit can be further broken down into various subcategories:

- Direct Lending/Senior Debt:

This involves loans made directly to companies backed by the companies' assets.

- Real Asset Debt:

This is debt used to finance real estate and infrastructure, secured by the real assets themselves (like mortgages).

- Special Situations:

This category targets unique opportunities from unusual events, where skilled investors can step in, reorganize, and find hidden value.

- Distressed Debt:

These funds invest in companies in financial trouble, allowing smart investors to buy securities at a significant discount due to short-term market disruptions.

- Specialty Finance:

A broad category that includes various niche strategies such as royalties, marketplace lending, and bridge loans.

Investors seeking to access Private Credit often work with specialized financial institutions, such as Private Equity firms or Wealth Managers.

Private Credit can be complicated and risky, so it's important to work with professionals who know what they're doing. Reach out to one of our Wealth Counsellors today to talk about your investment options and discover advanced strategies to diversify your portfolio.

At Kinsted Wealth, we prioritize diversification in investment strategies, offering access to private assets alongside traditional stocks and bonds. In today’s changing investment landscape, diversification is key to resilience. Private markets provide a range of alternative investments like private equity, credit, agriculture, infrastructure, and real estate, enhancing portfolio resilience. Embracing private markets strengthens portfolios against uncertainties and fosters sustainable growth and reduced risk. Interested in diversifying your portfolio? Contact one of our Wealth Counsellors to craft a personalized strategy aligned with your goals and circumstances.

Kinsted Wealth is a top independent firm in the private wealth management sector in Canada, providing tailored strategies to meet the unique needs of individual investors seeking to invest like institutional investors. Kinsted Wealth, a Calgary investment firm, is dedicated to helping you achieve financial stability and growth through a well-diversified portfolio and effective investment strategies.

- Source: "Private Debt: a primer" Blackrock, November 2023

- Source: Hamilton Lane Cobalt LP and Blackrock forecast assumptions

Contact Us

Click here to learn more about private infrastructure.

Regards,

Kinsted Wealth