Investing During Uncertain Times

Commentary • Education

Date posted

Oct 20, 2020

In 1989, a fellow by the name of Sean Lennon complained to his friend about the difficulties of living in 80’s era. That friend, who turned out to be Billy Joel, provided the ultimate response in writing the song “We didn’t start the Fire” (go listen now if you haven’t). The song is an eclectic debrief of headline events during the mid to late 1900’s that were a cause of uncertainty, polarization, and mania. “Moonshot, Woodstock, Watergate, punk rock, Begin, Reagan, Palestine, Terror on the airline” are a few of the many events referenced in the song that many of you might remember living through. Joel would of had a heyday had he written the song later this year, considering all the events that have transpired thus far.

So, what does classic rock have to do with investing? Well, the events mentioned were influential in shaping the markets in one way or another, something we are bound to experience again in some form down the road. You only need to look ahead a few weeks with the uncertainty surrounding the outcome of the US presidential election. In fact, inspiration for this piece originated from the inbound of questions from clients regarding the US election and their investments. We have no intention of forecasting outcomes in this piece but instead. So, let us look back at some of the few in the last half century:

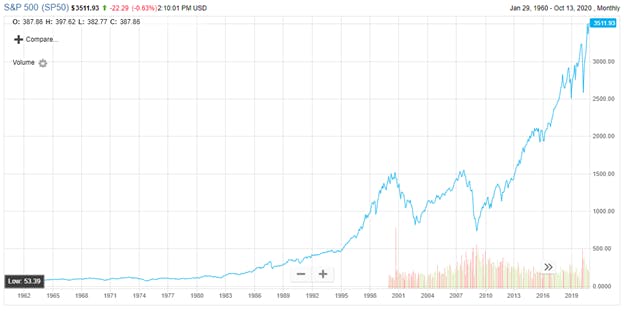

- Watergate & inflation (1970’s): government coverups that lead to Nixon’s resignation in 1974, followed by high inflation during the latter part of the decade helped push the S&P 500 to a 50% decline from its peak in 1972

- End of Cold War & Black Monday (1980’s): Increased tensions between the Soviet Union and the West increased the threat of Nuclear War to a point not seen since the 60’s. Computerized trading also lead to Black Monday which led to a 34% decline in the S&P 500.

- 9/11 & Tech Bubble (late 90’s – early 2000’s): The rise of the internet lead to ridiculous valuations amongst tech companies that resulted in the bursting of the “tech bubble” & a 49% decline in the S&P 500.

- Great Financial Crisis (Late 2008): Overleveraging & the collapse of the housing market caused global chaos, and a 57% decline it the S&P 500.

- Coronavirus: Although not concluded, the recent decline of 34% from the peak is likely still fresh in everyone’s memory.

Viewed in isolation, the large market drops can be seen stressful and difficult to comprehend. Although, when viewed from a visual perspective through a chart, each major decline tends to smooth over time. The market corrections of 2001 & 2008, although significant at the time, will recede in appearance as time progresses. The upward trend seen in the chart reconfirms the concept of long-term investing and demonstrates that it has been possible to achieve return objectives via traditional stock portfolios.

Source: FACTSET S&P 500 chart

Looking at the chart, one can presume that had you invested in the markets over any 20-year period, your investment would have appreciated in value. Unfortunately, it is the short-term periods of volatility that create emotional responses that lead to illogical decision making. The problem hasn’t been about obtaining required returns, but rather stomaching the short-term volatility that arises during uncertain events. This brings us back to the US election. Frankly, no one has a crystal ball to determine if markets are going to see heightened volatility over the coming months. There is little clarity to be gained from an election outcome as there may very well be extraneous events that occurs after the fact.

While you shouldn’t sacrifice long term objectives with short term decisions, one should always be prepared for unexpected volatility by properly diversifying. Poor decisions are a result of increased volatility, even though hindsight has taught us that volatility tends to be short lived. It is the emotional aspect of investing that becomes most difficult.

Based on this past March, we have witnessed how difficult it is to truly diversify via stocks (& bonds) alone due to their increasing correlations during times of crisis (check out our diversification piece). We’re also firm believers that equity returns will not be as robust as they have been in the past. So, what do you do? As we have been touting over the past year, it’s an opportune time to look at how non-traditional investments could fit within your portfolio (i.e. Agriculture, Infrastructure, Private Equity, Private Debt, Factoring, etc.) as they have proven to help reduce volatility during times of crisis without sacrificing the required return to reach your goals. One thing is certain; there will be more influential events that occur in our lifetimes, along with heightened volatility that accompanies those periods. It is important to plan accordingly and talk to your advisor on strategies that might help alleviate this concern. The investable universe is very large and includes opportunities that the majority of Canadians have never incorporated into their portfolios. We believe incorporating some of these into one’s portfolio will lead to superior risk adjusted returns, providing more peace of mind whilst eliminating the destructive emotional aspect of investing.

- Mike van Son

Reach out to your Wealth Counsellor if you want to learn more.