Q1/2019

Q1 2019 Outlook and Beyond

Commentary • Outlook

Date posted

Apr 16, 2019

The keys to Capital market performance over the balance of the year are two fold: central banks must remain on hold, and more importantly, it’s imperative we begin to see signs of a pickup in global growth. Recent economic releases in Europe registered their weakest reading since the great recession which took the 10-year German bund yield into negative territory. As mentioned earlier, the yield curve in the U.S. inverted which has been a reliable predictor of U.S. recessions.

So given these worrisome developments, is it time for us to turn bearish on risk assets? We don’t believe so. Wayne Gretzky once said, “I skate to where the puck is going, not to where it has been”. To paraphrase Gretzky, we want to figure out where the economic data is heading, not where it has been. One must understand why the data is unfolding the way it is.

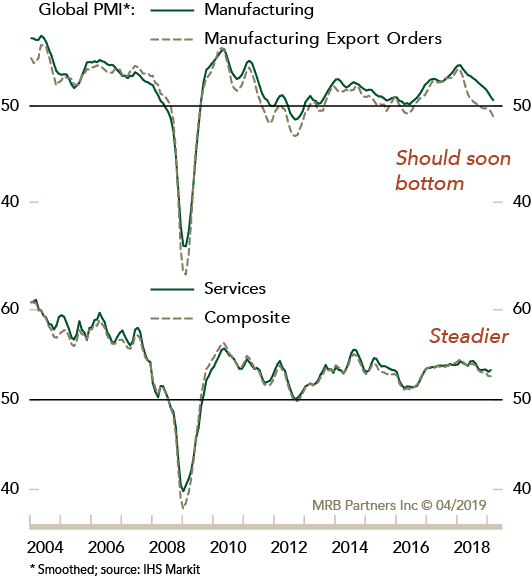

We believe that we are in the midst of a bottoming phase in global economic growth. We are seeing a number of countries with rising leading economic indicators (LEI’s); while measures of global manufacturing health continue to decelerate, the same data is showing that the health of the services industry is continuing to accelerate. Couple that with central bankers on hold for the foreseeable future, and we’ve got an environment ripe for continued strength in risk assets.

Global credit growth has always had a significant impact on global economic growth (typically with a 9-month lag). Surprising to many, China now has the largest impact on global credit growth. Yes, more than the U.S. and more than the EU. Last year, global growth was weighed down by a slowing Chinese economy as they took their foot off the growth accelerator. We know where it was, but where is it going? Chinese credit growth started to explode upward in the second half of last year, which should lead to an improvement in overall global growth sometime over the second half of this year.

Manufacturing and trade have weakened, but services are holding up

Source: MRB Partners © 04/2019

Stronger Chinese growth will also help the European export sector, as well as emerging markets given their tight correlation to Chinese growth. A decline in European yields, and a pickup in consumer confidence should ensue as well.

The U.S. economy continues to lead the pack; unemployment levels are near record lows, there’s more jobs available then people looking for work, mortgage rates are very positive for the housing market…a great combination for consumers.

Here in Canada, the global economy is hurting Canadian exports and the domestic economy is marred by soft corporate and household spending. The bottom line is that while the global economy has slowed, it does have some tail winds. The policy mistakes that led to last year’s slowdown are now unwinding, thus our optimistic view on global growth.

Outside of Canada, the strong equity performance in the quarter was led once again by the U.S. While Emerging markets performed well on an absolute basis, the bulk of the return came from the strong performance of Chinese equities. So, the question is: should we be shifting more out of the U.S. and into Emerging Markets and Europe? While we anticipate the opportunity to present itself, we are holding off right now. Once we get confirmation of a bottoming in global growth and more confident that China’s stimulus is on track, then we’ll be more confident in that shift. Until then, we’re happy with our current stance.

Although we are sanguine about the economic outlook, we’re aware of the risks that would challenge our view:

- If the current inversion of the yield curve extends for a longer period.

- If Chinese stimulus is not as robust as expected.

- If the U.S. dollar continues to appreciate. The U.S. dollar is a counter-cyclical currency and therefore should weaken once signs of global growth emerge.

In summary, we view the soft economic environment of the past year as a late-cycle slowdown rather than the beginning of a prolonged contraction, and expect a recovery during the second half of the year, leading to outperformance of risk assets.

Regards,

Kinsted Wealth