Q1/2019

What Happened in Q1 2019

Commentary • What Happened

Date posted

Mar 12, 2019

What a quarter it was for potentially market shattering news: ongoing China/US trade talks; failure of the US/North Korean nuclear talks; the Mueller enquiry into potential Trump/Russia collusion; ongoing Brexit talks; inverted yield curve; the deteriorating environment in Venezuela; Boeing problems; Trudeau’s troubles…we can go on, but suffice to say that the news could not have been any poorer for investors.

So, with all these headline risks, how did the equity markets end up having one of their best quarters in recent memory? To answer that, we must go back to the fall of 2018. Despite the fact global economic growth was clearly slowing, the US Federal Reserve (The Fed) remained very hawkish. This resulted in a very painful 4th quarter for equity holders, but also set the stage for the equity rally in Q1 2019.

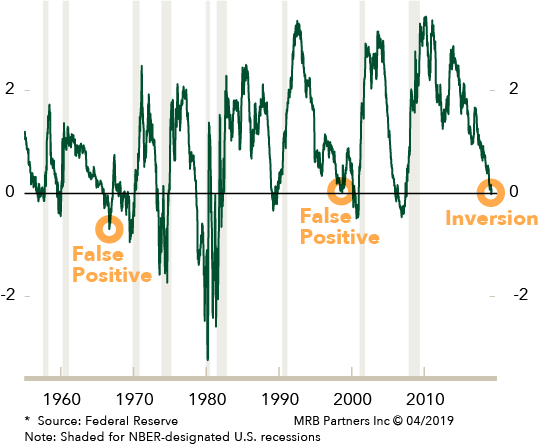

U.S.: 1/10 Treasury Curve* (%)

Source: MRB Partners © 04/2019

The Fed eventually took direction from the markets, recognizing the last thing the global economy needed amid an economic slowdown, were more rate hikes. As a result, the Fed and all major developed central banks, including the Bank of Canada, turned much more dovish – putting any future rate increases on the backburner. What all of this comes down to is the following; while headlines may certainly add to market volatility in the short term, the performance of risk assets comes down to a battle between economic growth and monetary policy/interest rates. In Q1, monetary policy won the day.

The strong returns in the equity markets reflects more of a snap back from the deep selloff in the 4th quarter rather than renewed optimism on global growth. To see continued recovery in the equity markets, global growth will also have to improve in order to help extend the longest economic expansion on record. With that said, it’s important to recognize that economic expansions don’t die of old age, they tend to be murdered by the Fed. And given the Fed has put its murder weapon of choice away (rate hikes) for the time being, we are optimistic the current expansion will continue.

"Economic expansions don’t die of old age, they tend to be murdered by the Fed."

Back home in Canada, stronger-than-expected growth put the first quarter on the path of modest economic expansion and temporarily quelled fears of a looming recession, though it will unlikely change the Bank of Canada's cautious stance on rate hikes.

The inverted yield curve certainly received attention over the past several weeks. But with that said, what the heck is an inverted yield curve, and why is it so important? An inverted yield curve occurs when the yield on 10-year government bonds are lower than what you can get on shorter term bonds. Typically, the longer the term to maturity of a bond, the higher the yield should be. An inverted yield curve suggests that the long-term economic outlook is poor and that yields offered by long-term fixed income will continue to fall. It’s a much-followed indicator that has forecasted the prior 7 recessions, along with 3 false positives. While its forecasting abilities have been remarkable in the past, we believe they have now diminished for several reasons:

- Quantitative easing has artificially pushed down the yield on longer maturity bonds.

- The yield curve tends to invert in the midst of ongoing policy tightening, which is not the case today.

- U.S. treasury bonds are global debt instruments that are impacted by yields on other government bond like the German or Japanese bonds which are now below zero.

Kinsted’s Position

We remain underweight in bonds as we do expect interest rates to eventually rise to a “normal” level (a premium above inflation). We remain underweight in preferred shares as credit spreads in Canada have continued to widen due to the relatively weak economy, and we are comfortable holding more cash for future buying opportunities.

We maintain our underweight allocation in Canadian equities as we believe there are better opportunities globally. While we rotated from mid-cap global equities to large cap global equities, we maintain our overweight position in global and emerging markets, which benefitted from the recovery in equities in Q1.

Regards,

Kinsted Wealth