Q1/2020

Q1 2020 Outlook and Beyond

Commentary • Outlook

Date posted

Apr 20, 2020

To begin with, we hope that everyone and their families has remained safe throughout this unprecedented environment. While things look miserable today, we do believe in the resiliency of the global economy. There’s no doubt that an extraordinarily brutal global recession is currently underway. The length and severity are anyone’s guess. What we do know is that the next few quarters will result in some of the worst economic numbers since the Great Depression.

While we were diversifying our client portfolio’s into more stable asset classes since July 2019, and reducing our exposure to publicly traded equities, we were relatively optimistic on the global economic outlook as we entered 2020 given the improvement in economic indicators across a wide swath of the world. Unfortunately, that came to a screeching halt as the COVID-19 virus entrenched itself across the world.

The global economy has been hit with an exogenous shock that has had a simultaneous blow to both demand and supply. Environments like this leads to increased precautionary savings from households, as well as decreased business spending in an effort to preserve cash. All of this reduces aggregate demand. On the supply side, production has been damaged because of workers’ inability to get to their jobs or even keep their jobs. Combining these two is something the modern world has never experienced.

Social and economic disruptions will continue to intensify until the spread of the virus begins to abate. Uncertainty in the time frame makes predicting the economic and market outlook an exercise in futility.

Markets across the globe have sold off extensively and continue to exhibit outsized volatility on a daily basis. This is understandable given the difficulty to price unknown risks. The difficult question is whether the sell-off has completely priced in the collapse in corporate earnings, or have they not. This is still to be seen. If the current recession is no more than a two-quarter downturn followed by a sharp recovery, then we believe stocks may offer a good buying opportunity given fiscal policy and monetary policy will stay extremely accommodative for a considerable time. If the downturn lasts much longer than that, then stocks will continue to be at risk. While we are not making a prediction, we are remaining disciplined by buying equities at these lows with the cash we have raised while transitioning to the new non-publicly traded asset class pools.

Rather than trying to gauge a timeline on when a bottom may take occur, we believe it’s more helpful to monitor some indicators that may provide clues whether a durable bottom has been found. Several that we are monitoring are:

- A peak in new COVID-19 cases in the U.S. Once this occurs, markets will begin to factor in a pickup in economic activity sometime in the future.

- Chinese economic data starts improving. The Wuhan lock-downs are slowly being eased and news reports suggest a tentative recovery in economic activity.

- The U.S. dollar rally starts to cool off. The U.S. dollar is a “risk-off” currency, so a sustained reversal of recent gains will be a sign that the “risk-off” phase is getting long in the tooth.

Profile Of The Recovery: L, U, or V?

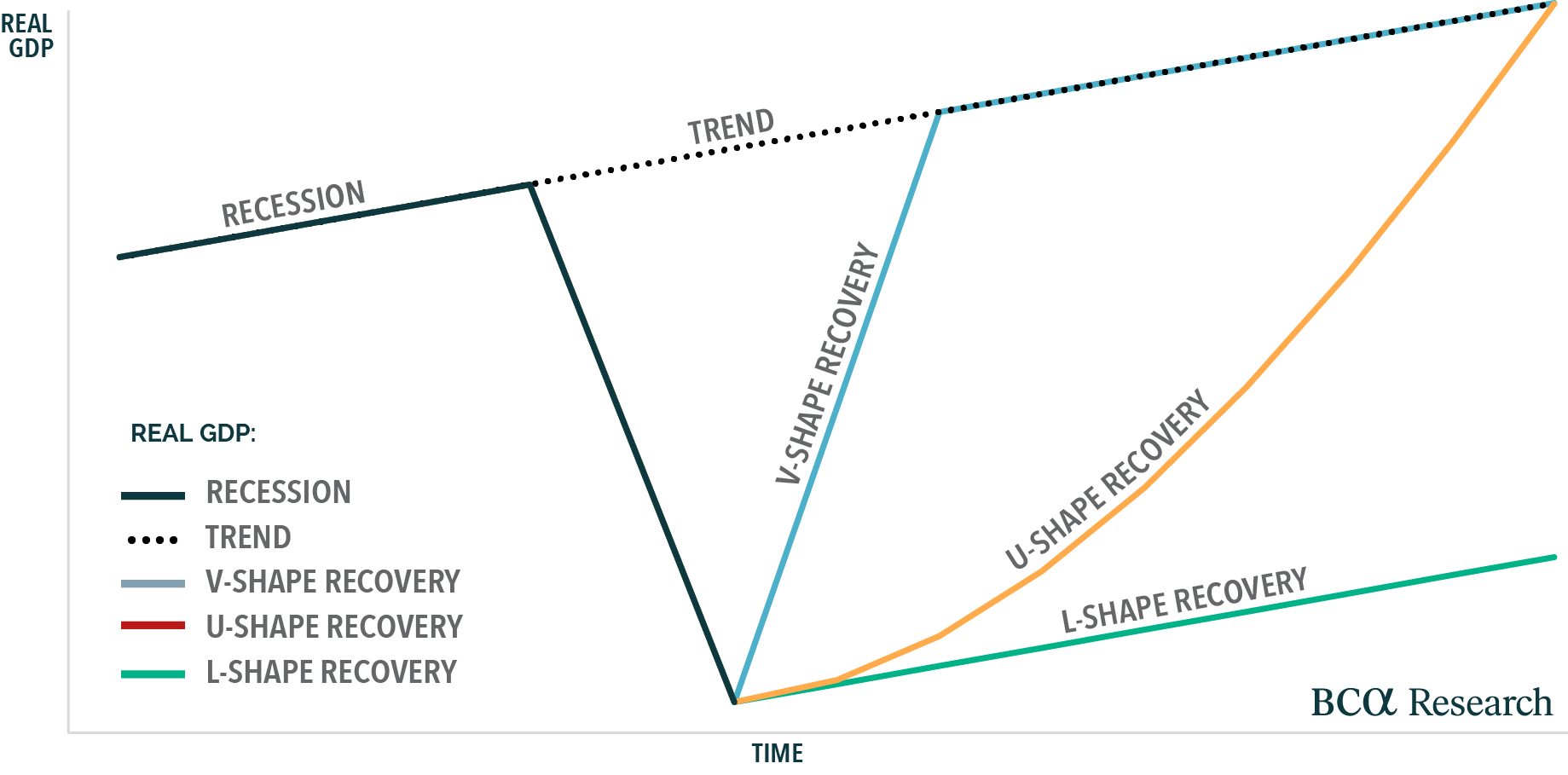

We are only seeing tentative signs of some of these stabilizing. COVID-19 cases and deaths in the U.S. are mounting by the day. While it may take longer for cases to peak than some other countries, we are relatively optimistic it may occur by the end of the month. Once the recovery in economic activity begins, how swift will it be? Will it be as sharp as the decline (V-shaped), or will it be a sluggish recovery where output slowly rebounds starting in the second half of the year (U-shaped). We believe it will resemble more of a U-shaped recovery given some sectors of the economy will take much longer to recover (airlines, hospitality, etc.). Remember that markets are forward looking and factor in variables as they become more evident.

The concern many have is that while we end up in a world where the virus is contained, and people are ready and able to work, will our jobs still be available? While we can’t dismiss such an outcome, we believe the economy will gradually recover in the second half of the year. Unlike in 2008/09 when many businesses and households went bankrupt due to their own reckless behavior, no one in their right mind today would argue that workers losing their jobs and the companies facing bankruptcy today is somehow their fault.

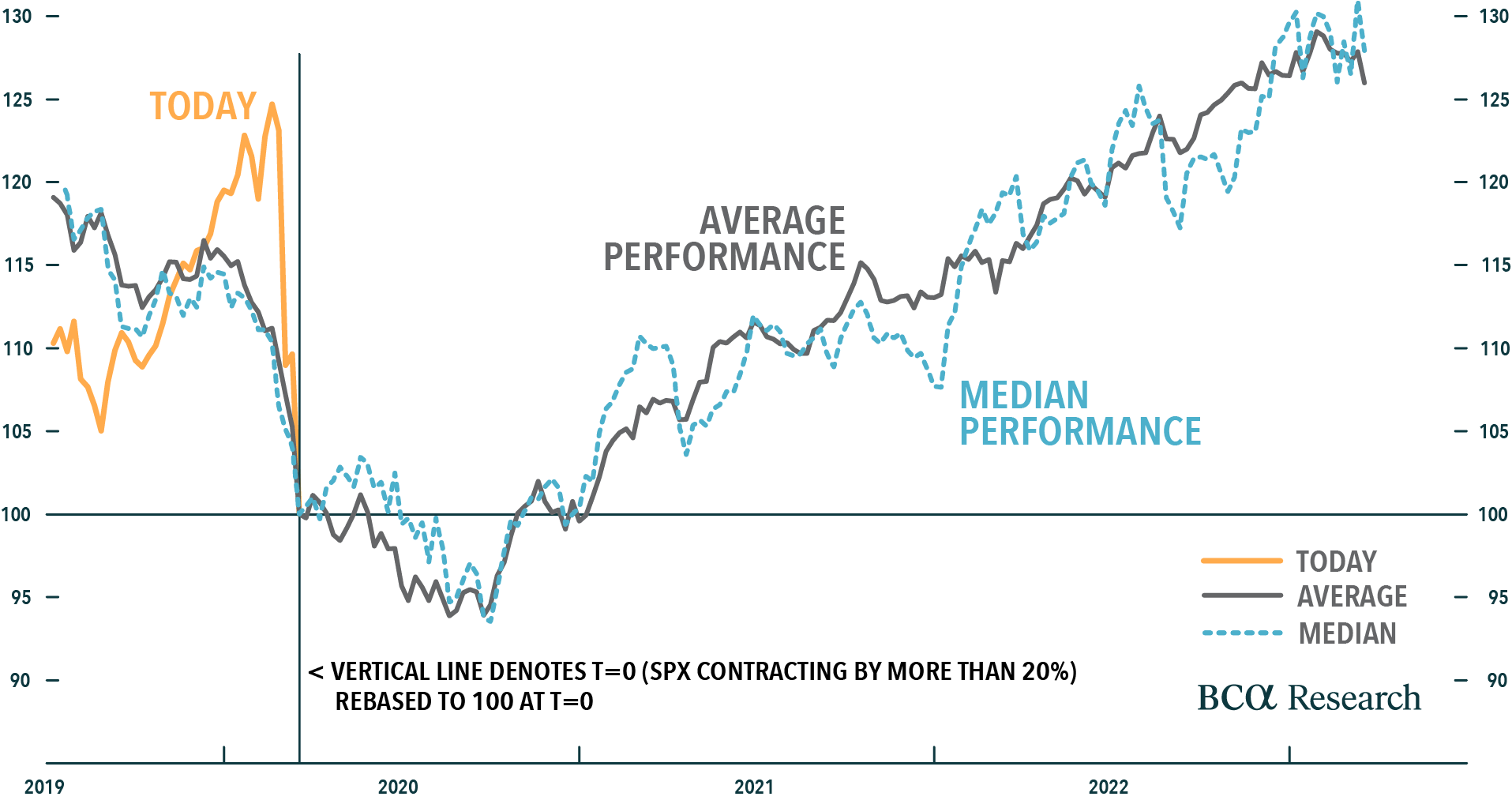

Profile of a Bear Market

© BCA Research 2020

While Central Banks have been doing their utmost to provide liquidity to the economy, fiscal stimulus is what is needed to help provide support to households and businesses in times of crisis. Today, businesses have shuttered their doors and workers have confined themselves to their homes. Yet, financial obligations have not ground to a halt. This implies that in the near term, the correct course of action is for governments to transfer money to households and firms to allow them to service their financial obligations. This is being achieved through wage subsidies, direct payments to households, loan guarantees to businesses, and many more ways. While these measures don’t boost GDP, they do alleviate household and business hardship, while creating pent-up demand for when businesses start to open their doors again.

Governments around the globe have opened the spending spigot to the tune of trillions of dollars. The $2 trillion stimulus bill in the US amounts to 10% of GDP. While these number are huge, and deficit hawks will be outraged, please keep in mind that given interest rates are below the growth rate of the economy, governments could permanently increase their budget deficits by any amount they want while still achieving a stable debt-to-GDP ratio over the long haul. We are not even talking about a permanent increase in the deficit, but a temporary increase that could last a few years at most.

From a short-term investment perspective, as mentioned previously, it all comes down to getting some visibility on when businesses will begin to reopen and when “self-isolation” restrictions begin to be lifted. Until these occur, volatility will remain elevated for stocks, while bonds will be a store of value. Today, bonds are extremely expensive with very limited upside. The long-term outlook for government bonds is miserable, especially if the massive fiscal and monetary stimulus eventually leads to a renewed bout of inflation down the road. Looking out more than a year, equities are much more attractive than bonds. That’s not to say that over the short term, bonds continue to out-perform stocks, but anyone with a longer time horizon should certainly be favouring stocks.

As most of you who’ve read our quarterly commentary know, we began to transition out of riskier asset classes like stocks and preferred shares and into private asset classes like private debt, equity, infrastructure and agriculture about 8 months ago. The rationale at the time, which hasn’t changed, was that the long term expected returns for assets such as public equities were going to be lackluster in the years ahead, and one would need to gain exposure to alternative assets to achieve superior risk-adjusted returns in the future. While we’ve made great strides in providing more exposure to these assets, there’s still more to come.

It’s important to understand that given non-public assets don’t trade on the public markets, they are therefore not available to buy at any given time For example, a toll road is not available to purchase any day of the week; same goes with an apple orchard, almond farm, or even exposure to a light transit rail system. The point is that when we co-invest alongside large pension plans (like the CPP), or sovereign wealth funds and endowments, one must be willing to be patient in order to acquire exposure to institutional quality assets.

While we still believe publicly traded stocks will be attractive versus bonds over the next 12 months, and longer, attaining portfolio exposure to alternatives such as agriculture, private equity, infrastructure and private debt will provide substantial benefits to one’s portfolio over the long term.

While in the eye of the storm, it’s next to impossible to see beyond the next quarter, let alone the next day. If you can think back to March 9, 2009, sentiment in the equity markets and economic expectations were at their bleakest. That also happened to be the day the markets bottomed after one of the worst bear markets since the Great Depression. Although the markets bottomed on that day, the economic environment bottomed three months later. The point is the markets will bottom months before the economy begins to look brighter. Remember that markets are always forward looking and usually overreact during periods of fear and optimism.

While everything looks extremely bleak at this point, we thought we’d finish with a quote by one of the greatest investors of all time, Sir John Templeton:

"Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria."

Regards,

Kinsted Wealth