Q2/2018

Q2 2018 Outlook and Beyond

Commentary • Outlook

Date posted

Jul 15, 2018

Sometimes the best time to be invested in the market is when vision is partially obscured by uncertainty. At these times, this uncertainty, or risk, gets priced into the market – which means although we may have to slow down and watch the road more closely, as equity investors when things go right we get rewarded for taking that risk. This past quarter was a case in point. It was an ugly quarter for sure, but as far as returns go it was solid for North American equities while emerging market equities were down hard (-6.1%). We enter Q3 in much the same way. So, we are slowing down going into the turn as there is uncertainty as to exactly what is around the next corner. But uncertainty and volatility create investment opportunity and it can be a great time to be an active investor. Let’s drive!

1. Trade Wars

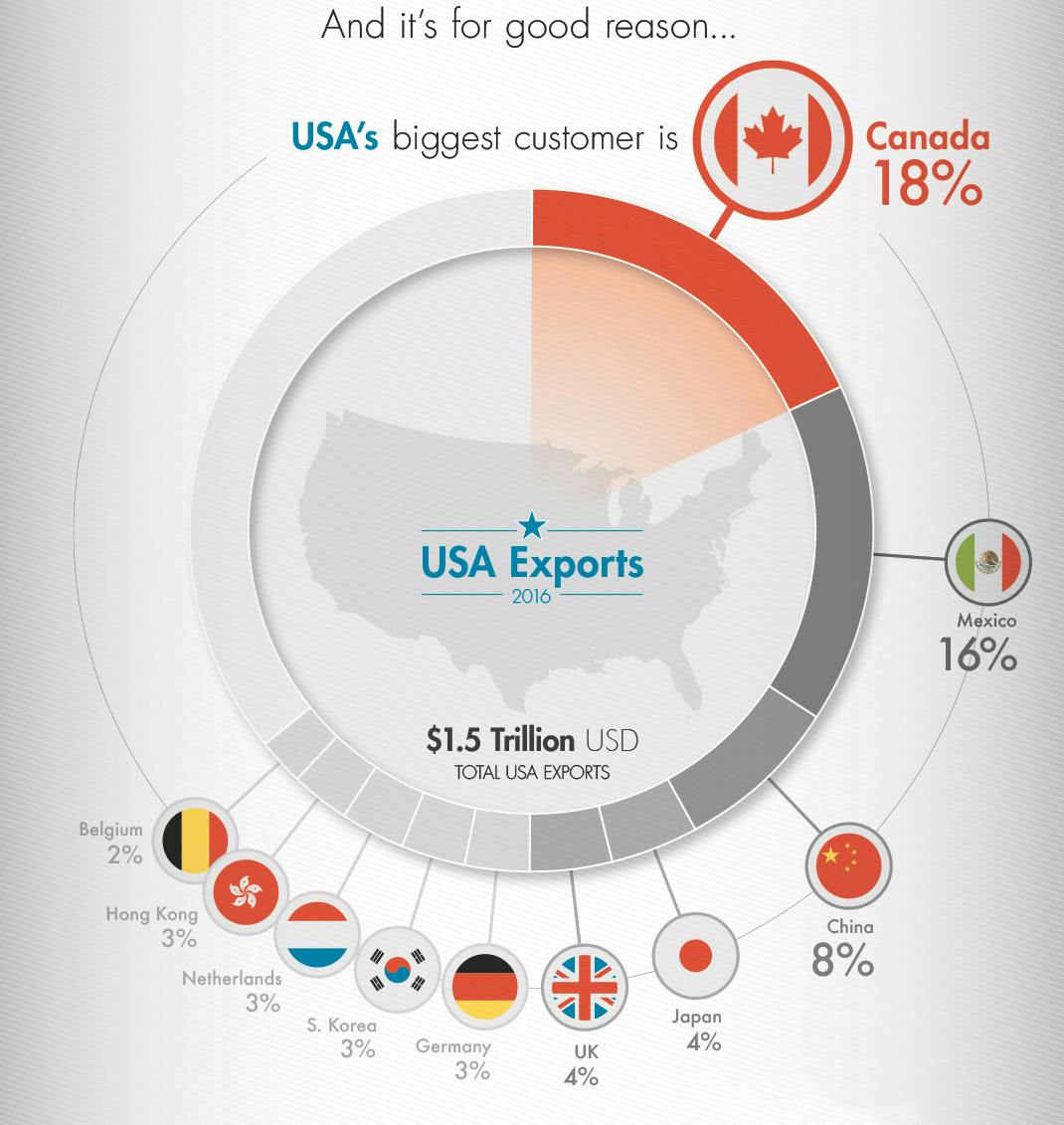

By far the largest risk is that the US engages in increasingly escalating trade wars with more and more countries such that global trade is dampened, and global growth is ultimately derailed. Protectionist measures such as tariffs are essentially taxes and create capital market allocation inefficiencies. Furthermore, the threat of trade wars undermines business confidence and raises the investment hurdle rate for firms everywhere. In this context, the “peace-dividend” gets replaced with increased corporate and government spending on product protection as well as the reallocation of resources seeking to minimize penalties.

The Numbers Behind the World’s Closest Trade Relationship

* The Numbers Behind the World’s Closest Trade Relationship - Author: Jeff Desjardins Copyright © 2017 Visual Capitalist

View complete infographic

2. Higher Interest Rates

Currently the bond market is taking a wait and see approach to the forecast of higher US inflation and thus bond yields are range-bound. There are some concerns that the Fed expects more growth and inflation than will occur and in effect oversteer the economy right into a recession by raising interest rates too much and invert the yield curve. Although we agree this is a potential risk, this may take several months if not quarters to play out. Another way this could unfold is if actual inflation surprises and is much higher than expected which would cause bond yields to pop. Regardless of how it could happen, a surge in bond yields would be very negative for both equity markets and the economy, which would likely fall into a recession. This is not our base case but is a risk we are monitoring closely.

3. US Dollar Volatility/Strength

If the Fed is the only central bank raising interest rates or there is a flight-to-quality, the US dollar is likely to appreciate. Volatility of the US dollar undermines trade and creates global imbalances.

From our vantage point, we are constructive on global growth, led by the US. That said, our view has been dimmed by rain clouds in the distance and a curve on the horizon. We recognize that the growth trajectory of the global economy cannot be positive forever but are optimistic in the short-to-medium term given strong corporate revenues and earnings, a robust capital investment cycle and moderate inflation in the US, which is supportive of global growth. In turn, we continue to like equities and remain overweight the sector. We like our overweight exposure in small-cap, tech and emerging market stocks but we will be looking for opportunities to take profits and tuck away some cash for a rainy day.

Regards,

Kinsted Wealth