Q2/2019

What Happened in Q2 2019

Commentary • What Happened

Date posted

Jul 16, 2019

The phrase attributed to Mark Twain, "History may not repeat itself but it often rhymes” can certainly be used when talking about the capital markets. While not every market and economic cycle is identical, there certainly are many similarities. For example, as the economic cycle matures, the ripples to the capital markets caused by central bank reaction to incoming economic news, become larger and larger. In other words, negative (or positive) economic news tends to be magnified the more mature the cycle becomes. To illustrate that, let’s look at the S&P 500 in the second quarter. For the month of April, the S&P 500 was up close to 4%. By the first week of June, it was down over 3% quarter to date, and then ended the quarter up over 4.5%.

Now, most investors looking at the volatility in the markets would expect incoming (and forecasted) economic data to be quite weak. Looking at the US though, credit spreads have narrowed significantly (a sign that corporations are doing fine); the unemployment rate is below what most economists consider “full employment”; and outside the manufacturing sector, the economy continues to grow at an above-trend pace. Apart from that, the Atlanta Fed sees domestic demand increasing significantly in the just finished second quarter (versus Q1). In fact, personal consumption is tracking to rise at a 3.7% annualized rate.

So, while economic conditions in the U.S. are relatively good, and China is beginning to prime the growth pump, and monetary policy across the globe is still extremely accommodative, Central banks everywhere have taken an even more “dovish” stance. For example;

- The US Federal Reserve said that “uncertainties about the outlook have increased….and will act as appropriate to sustain the expansion”

- The Bank of Japan stated they would “take additional easing action without hesitation”

- The European Central Bank once again mentioned that they, as well, will take any measure to ensure the economy continues on its growth path.

Given global economic conditions are not terrible and real interest rates are barely above zero, why are central banks getting back on the dove train? A couple of reasons come to mind:

- Global growth has slowed

- Continuing trade tensions

- Falling inflation expectations around the world

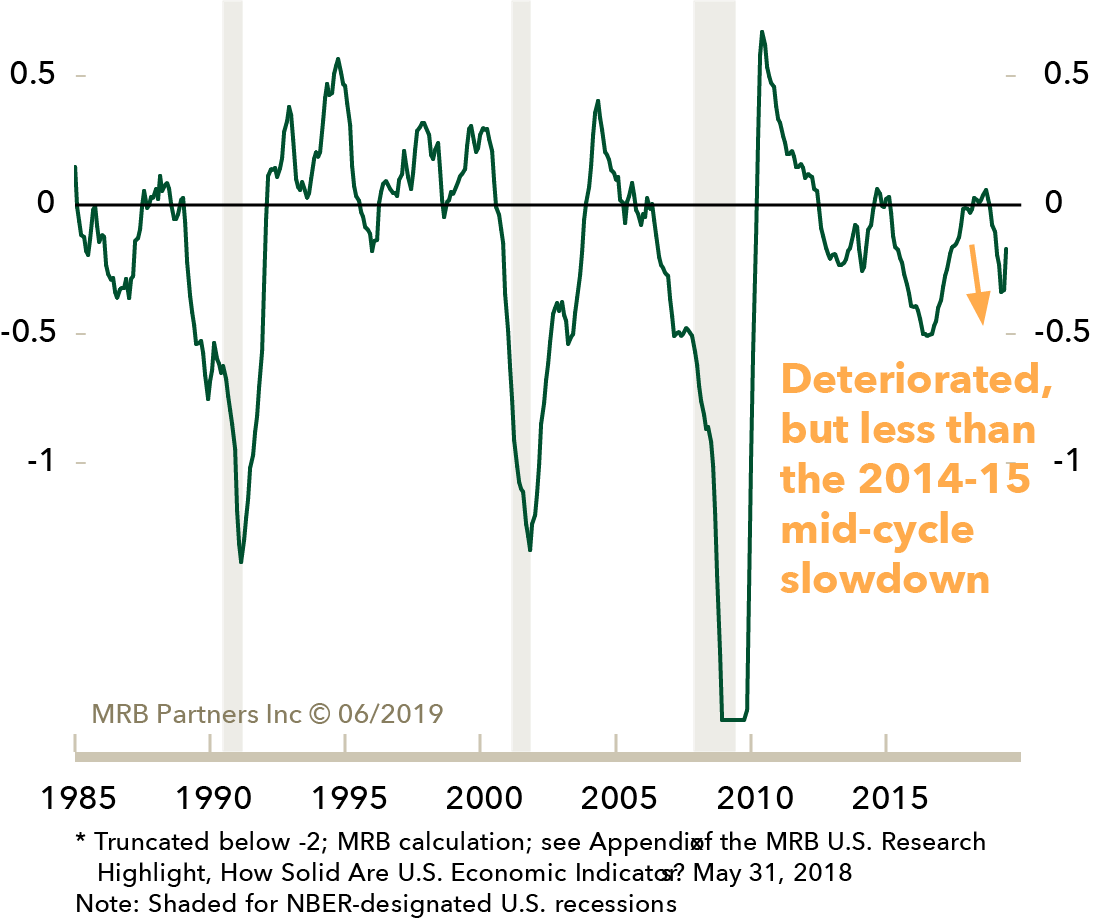

US: Economic Activity Indicators*

Source: MRB Partners © 06/2019

As problematic economic data comes in, the markets sell off in anticipation of a recessionary environment, only to rally again as central banks come to the rescue. Thus, the main culprit in the up and down markets we’ve being experiencing for a while now.

While we hate using the phrase “it’s different this time” (which it never is!), there may be one instance where we could possibly use that phrase, and that’s with central banks. Recently, most central banks had been more concerned about ensuring inflation did not get out of hand. That has changed most recently due to concerns amongst central banks that deflation is more of a threat to economic growth, than inflation is. In other words, we should expect the Fed (and other central banks) to err on the side of being overly accommodative in the face of economic uncertainty, with the understanding that inflation can always be constrained by raising rates. In effect, this new approach by central banks should continue to be supportive of the capital markets for the foreseeable future.

Kinsted's Position

We continue to remain underweight in bonds as they offer a very poor risk return profile, while continuing to believe that interest rates will over time eventually rise to “normal” levels. We trimmed more of our preferred share exposure during the quarter in anticipation of allocating some of the exposure to non-traditional income-oriented asset classes such as private lending and mortgage loans.

Within equities, we trimmed our exposure to emerging markets and eliminated exposure to global small cap equities, essentially taking exposure to equities down to a neutral target. While we are not outright negative on equities, there’s currently no compelling reason to be overweight equities either. In the absence of a convincing argument to be overweight equities, we’d prefer to be market weight, given many geopolitical risks on the horizon.

Regards,

Kinsted Wealth