Q3/2017

What Happened in Q3 2017

Commentary • What Happened

Date posted

Aug 16, 2017

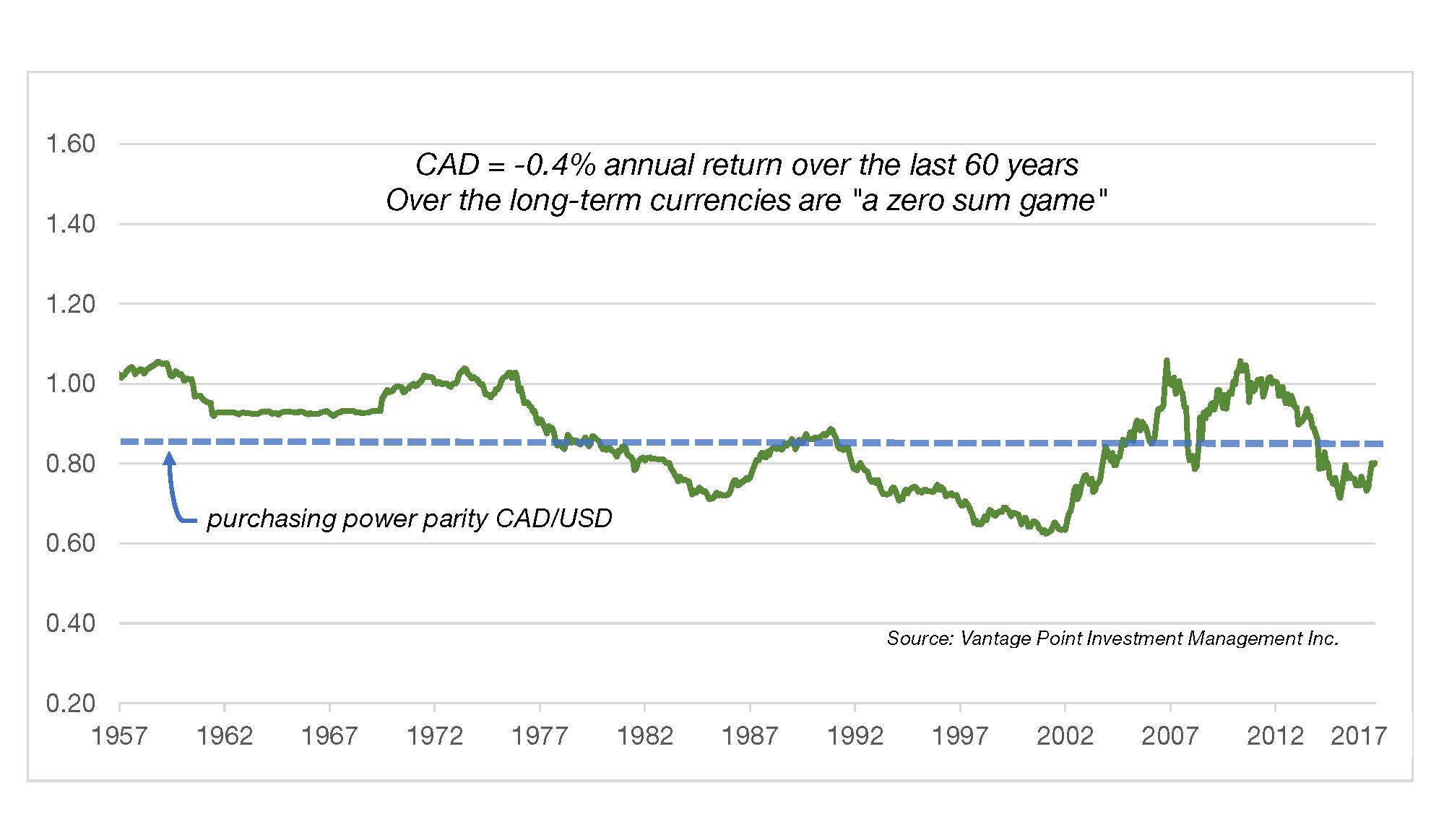

The main factor that effected portfolios in Q3 was currency. The CAD appreciated vs. the USD by 4% in Q3 and 7% YTD. This resulted in negative attribution for USD-based assets. US markets may be at all-time highs, but not when converting back to CAD.

We would like to reiterate that currencies can have an impact on returns in the short-term but this is mitigated over the long-term. Currencies tend to fluctuate around their purchasing power parity (relative valuation), and are mainly affected by relative growth and interest rate differentials. As a result, we consider currency trends in our asset mix strategy and may hedge from time to time at extreme values, but it is usually harmonious with the equity market we want to be allocated to.

This summer the Bank of Canada changed to a tightening bias with a 0.25% rate hike in July and again in September due to surprisingly strong economic results. This was a primary factor driving the CAD up vs. the USD. The US Federal Reserve did not increase their central bank rate in August but announced further tightening measures by shrinking the $4.5 Trillion in US Treasury bonds and mortgage-backed securities it purchased in the open market under the quantitative easing (QE) program.

On the fiscal side, President Trump is taking another run at his campaign promises. After the final repeal of the Affordable Care Act failed, he’s moved on to announce his tax reform plan which includes repatriation of offshore funds, as well as deregulation. Infrastructure spending will be expected in response to the hurricane destruction. Implementing tax reform policies will be critical for determining whether Trump will be a lame-duck president as both parties have been supportive of tax reform.

Many trade agreements are being revisited including NAFTA. New tariffs on Bombardier and the temporary duties on softwood lumber create uncertainty for key Canadian industries to plan and invest. If trade protection persists, it will ultimately have negative economic implications around the world.

Geopolitically, the “Little Rocket Man” of North Korea continues to be at the forefront of global tensions, creating challenges for country alliances and the United Nations. The market appears to believe that cooler heads will somehow resolve this potential crisis or keep it contained. In Europe, Germany’s election went as expected, while Catalonia’s controversial succession vote now shares the political spotlight between Spain and the continuing Brexit saga. Even with the political turmoil, Europe’s economic fundamentals continue to improve.

In Asia, Japanese President Abe’s popularity is on a stronger footing due to economic progress which has caused Abe to call a snap election in October. The domestic Chinese economy is starting to show weakness in the industrial and housing sectors. However, it is expected to be a managed slowdown and not an economic “hard-landing”.

Kinsted’s Position

We remain underweight in bonds and have a short duration, which mitigates price adjustments as interest rates slowly rise. We remain fully invested in preferred shares, as our pool continues to outperform the market and has nicely complemented the bond component of our client portfolios.

Our Canadian equities fell behind the TSX composite in Q3 due to the resource sector recovering, as we have minimal exposure. But we continue to outperform YTD with our stable dividend-growth stocks. We increased Small Cap equities due to the positive economic outlook. Emerging market equities are volatile but continue to add value.

Reducing US equities to rotate into European and Asian equities over the first half of 2017 has benefitted our client’s global equities, as this reduced USD exposure and also captured the recent outperformance of Europe and Asia over the US equity market.

Regards,

Kinsted Wealth