Q3/2021

Q3 2021 Outlook and Beyond

Commentary • Outlook

Date posted

Jul 9, 2021

As we look out to the balance of the year and into the first half of 2022, we must acknowledge that many factors will influence the markets. While growth certainly has improved from the pandemic-induced recession, it is slowing. The good news is that it is slowing from a high level. While inflation has picked up quite sharply, it's probably transitory and will return to lower levels. Central banks have indicated that while they will be looking to normalize monetary policy, they will remain very tentative with their levers given fear about tightening too soon. Economic growth, inflation, and monetary policy are the three variables that can materially influence the capital markets, so any unexpected changes to any of them will see risk assets wobble over shorter time frames.

Nevertheless, over the next 12 months, economic growth should remain robust, while monetary and fiscal policy will continue to be hyper-accommodative (although reined back to a degree). Given this scenario, one should remain positive on risk assets versus defensive assets like bonds.

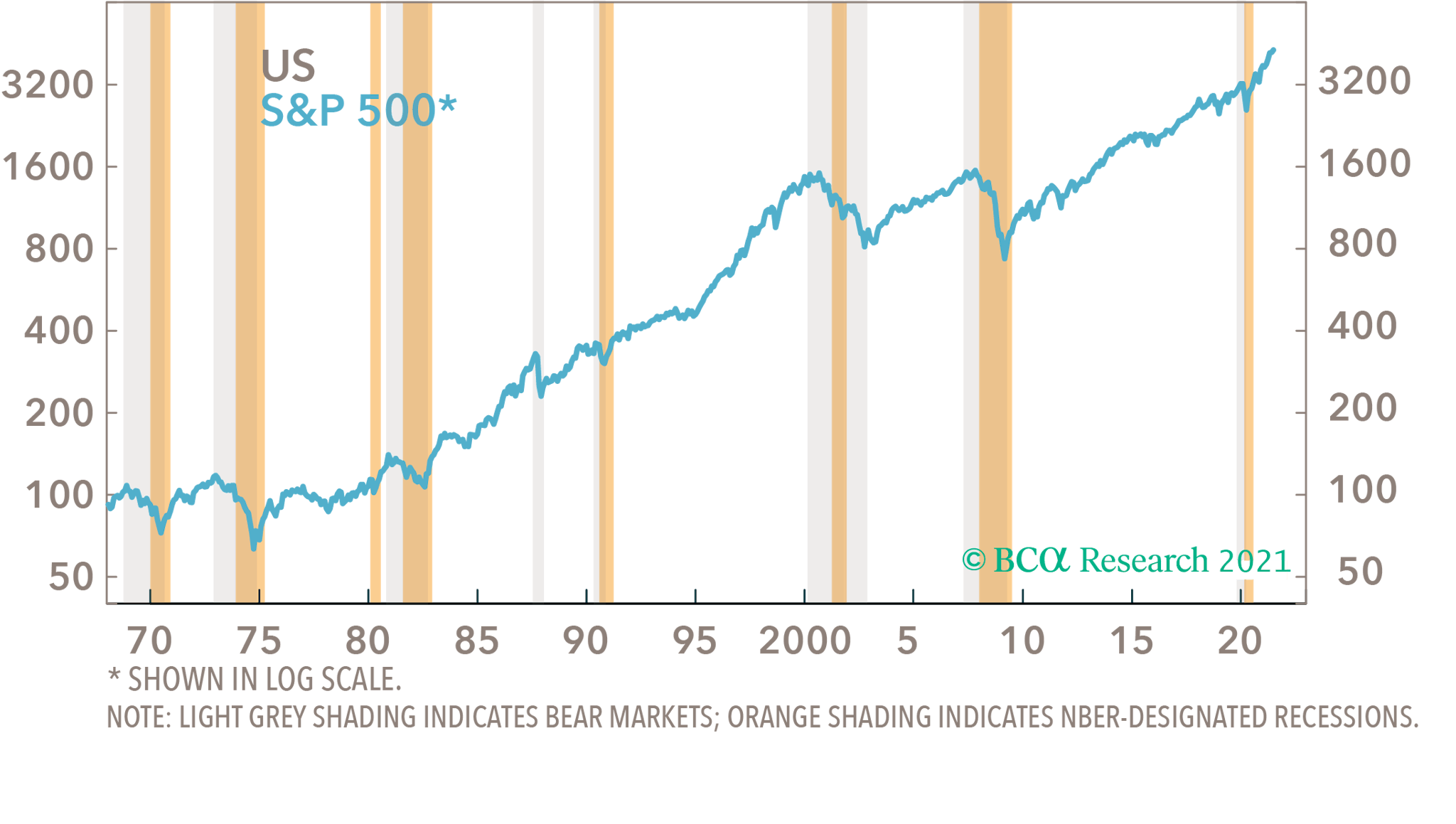

One of the golden rules of investing is to "remain bullish on stocks as long as growth is likely to remain strong for the foreseeable future." Historically, bear markets have rarely occurred outside of recessions.

As mentioned, with both fiscal and monetary policy still accommodative and households in many countries sitting on plenty of cash, we believe it's doubtful that the global economy will experience a significant downturn within the next 12 months. As a result, the golden rule should still apply over the next year. That said, we must acknowledge that the risk-reward profile for stocks is not as attractive as it was at the start of the year. As we've mentioned, economic growth has probably peaked in the US and China and will gradually peak in the other major economies through the second half of the year. Slower growth is usually associated with lower overall equity returns.

Global stocks have risen more than 10% year-to-date, implying that investors have priced in an increasingly optimistic economic outlook. While stocks may still deliver decent returns over the next 12 months, long-term future returns, particularly in the US, are relatively bleak.

While equities may be expensive from a valuation perspective, government bonds are even more expensive. Real yields are negative in most G7 economies (meaning the yield you get after factoring in inflation, is negative). We've mentioned our thoughts on bonds in prior commentaries (particularly government bonds). To reiterate, we don't believe the risk-reward profile warrants holding much, if any of them. Our rationale comes down to the following: Given their exceptionally low yields, it will be challenging for bonds to provide much downside protection "IF" we experience significant market volatility. If economists are wrong in their assessment that inflation is "transitory," and we see a sustained pickup in inflation over the next five years or so, bonds will provide inferior returns.

We have received several questions recently regarding our view on the Canadian dollar vis-a-vis the USD. While the USD has rallied over the past month or so, we believe that may be temporary and will see the USD weaken over the balance of the year. Why? Among the G7 economies, the Bank of Canada is the closest to raising rates, and interest rate differentials greatly impact currency valuations. Additionally, oil prices have increased, and Canada is regarded as a "petro-dollar". As a countercyclical currency, the US dollar typically does poorly when global growth is strong, especially when growth is rotating away from the US to other countries. Bloomberg consensus estimates imply that the US economy will transition from leader to laggard over the coming months, which should be interpreted as bearish for the US dollar.

In summary, while global growth will moderate over the next 12 months, equities should outperform bonds given the fiscal and monetary support. With that said, those returns may be relatively muted with occasional speed bumps along the way.

As we've been saying for well over a year, it is imperative for investors to be invested in asset classes outside of the public markets in the future. Here at Kinsted, we've been increasing your exposure beyond stocks and bonds for almost two years now. It will be during periods of prolonged sub-par stock performance where this approach will provide significant value. While we are not hoping it occurs anytime soon, we believe that this will occur at some point in the coming years. It's best to be prepared for the eventuality, and we genuinely believe your portfolio is properly positioned to withstand the turbulence that will eventually pay us a visit.

Regards,

Kinsted Wealth