Q4/2017

Q4 2017 Outlook and Beyond

Commentary • Outlook

Date posted

Nov 20, 2017

US economic growth is stable and sustainable. This is positive for the global economic outlook. A revival in US business investment and housing looks bright. US tax cuts raise hopes for further growth and higher corporate earnings. US job growth has slowed but is still positive and will continue to support consumer growth, which makes up 70% of the US economy. Strong global growth and low inflation will drive the stock markets higher in 2018.

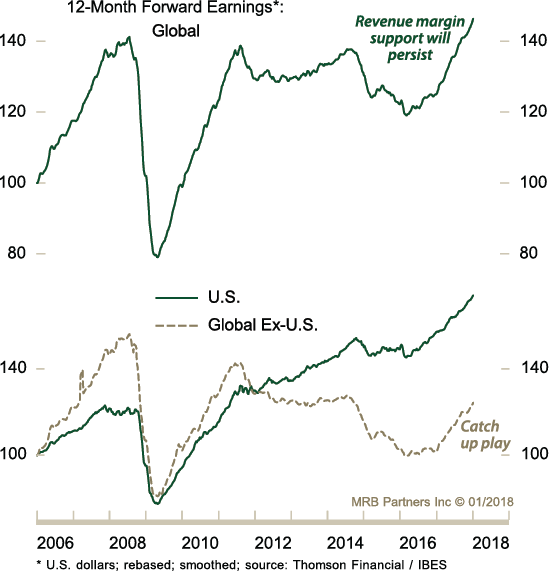

US market leadership will rotate to European, Asian and emerging markets due to improving global trade, better valuations as well as current and projected corporate earnings. The US economy is in its 9th year of expansion yet, this has been the slowest recovery on record. Europe is in its 6th year of recovery and is following a path similar to that of the US. European monetary policy will continue to be accommodative while employment and corporate earnings improve. This bodes well for European equities going forward.

Emerging markets are beginning a sustainable recovery and were the highest returning asset class in 2017. We see higher relative returns in this area as they have underperformed developed markets since 2010 by 35-40% and have lower relative valuations.

Global trade agreements, investment and cooperation like the Trans -Pacific Partnerships and the Silk Road show global progression. NAFTA is a concern locally, but all foreign trade and investment agreements don’t have to always include the US stamp of approval. China will continue to be an alternative for global leadership which will reinforce their credibility, currency and financial standing. The Chinese economy should grow at 6%+ and positively contribute to the global economy, more so for their local trading partners.

Oil prices should remain in the $45-$65 trading range. Prices have recently been in the higher end of this range, but US shale oil production should keep prices capped.

The biggest market risk we see is a greater-than-market-expectation jump in long-term bond yields due to an unexpected inflation pop. Despite being recently tame, we believe US inflation reports will start surprising the markets in 2018.

Another risk is a major swing in the USD which adds to instability and global imbalances. Also, if markets gain more momentum, valuations will get too far ahead of corporate earnings which could cause corrections and increase in volatility. Ongoing geopolitical risks, the Italian election in March, Brexit and Catalonia secession should be monitored but are expected to be relatively contained.

There is little on the horizon to indicate any recessionary concerns. A geopolitical shock can always derail the markets, usually only temporarily, but there is no reasonable way to quantify this risk other than all or nothing.

The US Fed intends to stick to its gradual hiking path and cutting reserves as they believe the US economy is strong enough to return to normal yields and not disrupt the expansion. We expect the European Central Bank to start sending the same tightening message of moving off zero interest rates and reverse Quantitative Easing, but no action until 2019 as they still have a lot of economic slack to soak up with job absorption and credit expansion.

In Canada, the economy and employment reports have been surprising to the upside. This has the markets factoring in one and maybe two BOC rate increases in Q1/18. However, the BOC acted too quickly last summer in raising rates twice which resulted in an unwanted strengthening CAD. The BOC rate increases should lag the US, as a weaker CAD is still necessary to help facilitate the multi-year rebalancing process of improving Canada’s productivity, rebuilding the manufacturing sector and assist the recovery of overextended Canadian household debt levels.

While the US economy will contribute to global economic growth, we believe European and Asian investment opportunities are still more appealing from a valuation perspective. This strategy now includes emerging markets which only started to show life in 2017 after lagging the developed markets for the last 8 years. For the next 6 - 12 months we still see room for market growth in more selected areas like emerging markets and small cap companies, in what we believe is the later stage of the investment cycle.

Regards,

Kinsted Wealth