Q3/2022

Q4 2022 Outlook and Beyond

Commentary • Outlook

Date posted

Oct 13, 2021

Going Forward

The great Canadian-American Economist John Kenneth Galbraith had a great quote about forecasters. He said there are two kinds of forecasters: those who don't know and those who don't know they don't know. We'll put ourselves in the first category. Forecasting is notoriously difficult, if not impossible to do consistently over short-term time periods. Thus, the reason we prefer to build and manage well-thought-out, strategic portfolios that we believe will meet client return expectations over the long term. Doing so requires more than just stocks and bonds.

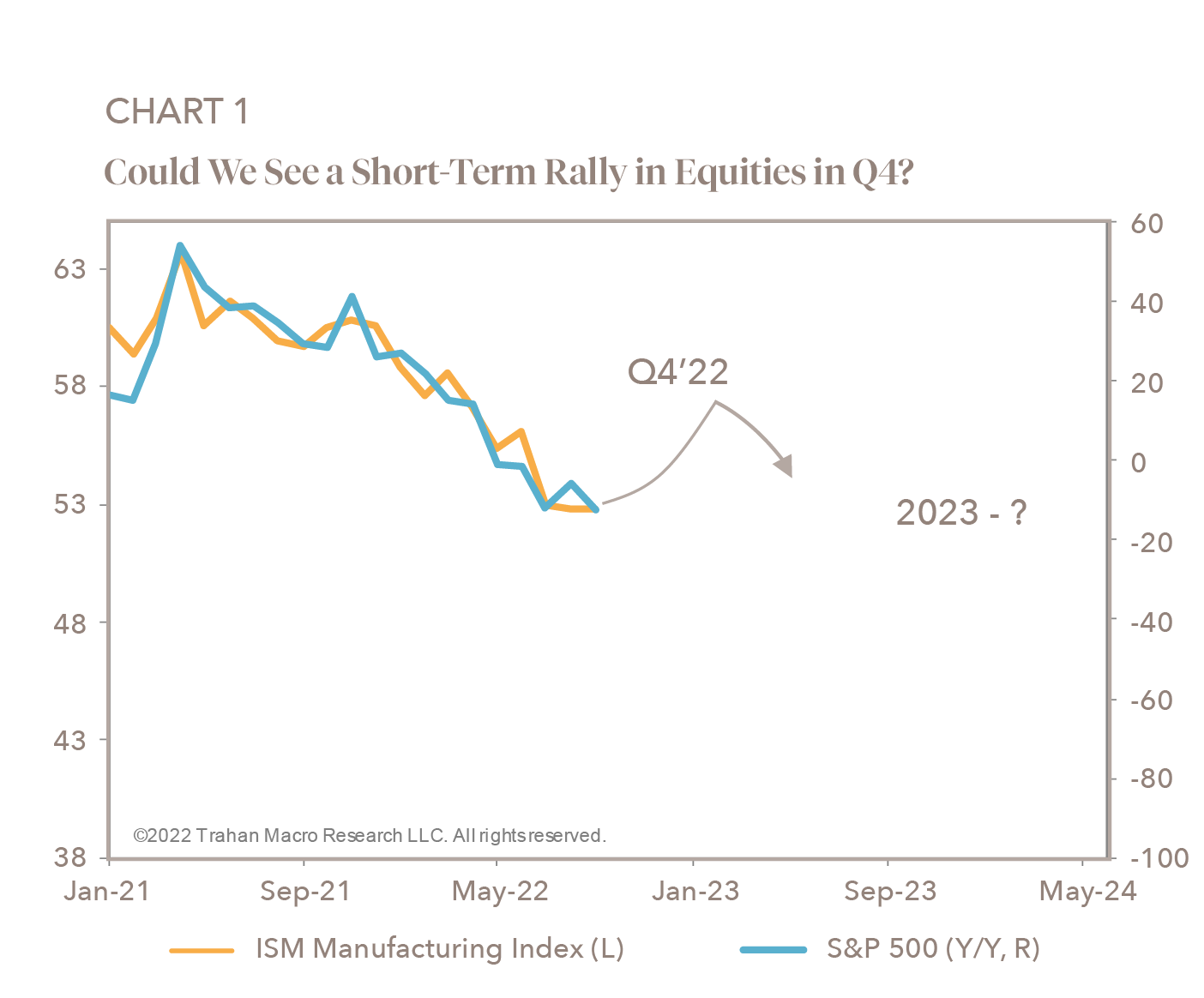

While forecasting the economy's direction (and the markets) is challenging, we know that stock markets have tended to bottom about six months before the economy bottoms. So, the big question is: when should we expect to see the economy bottom? Given the Fed (and other central banks) are still not done in their battle to rein in inflation, a bottom could still be a year or two away.

Even during economic slowdowns, bear market rallies do occur. We would not be surprised to see one of these rallies over the next several months as the lag effect of lower yields in the spring of 2021 begins to impact leading economic indicators positively.

Improving economic data will be viewed by the market as a bottoming process, but we believe it will be a temporary reprieve. With all of that said, as mentioned earlier, forecasting is notoriously difficult. Much of the negative capital market sentiment is already discounted into the markets.

Things will change, so one must always be open to changing their views as economic or geopolitical data changes. We are very fortunate that we have more arrows in our quiver than simply stocks and bonds, which has allowed us to soften the blows for our clients versus a portfolio comprised solely of traditional assets. This should help our clients tolerate market turmoil a bit better until the economy and markets recover.

Regards,

Kinsted Wealth