Q4/2023

Q4 2023 Outlook and Beyond

Commentary • Outlook

Date posted

Oct 19, 2023

In our previous commentary, we underscored the significant advantages of Private Credit as an alternative investment. In the current quarter, our focus shifts to Private Infrastructure—a compelling investment opportunity shaped by transformations in asset class ownership and funding dynamics. Traditionally, governments led the charge in infrastructure initiatives, but the aftermath of the Global Financial Crisis saw reduced government budgets, creating a void in capital that the private sector has since filled.

The infrastructure landscape is evolving beyond conventional sectors like energy and transportation. To facilitate the projected $3.7 trillion global infrastructure expenditure by 2035, private sector investments assume paramount importance. Governments worldwide incentivize private participation through legislative measures, committing funds to initiatives like broadband expansion, water infrastructure, and climate change mitigation. A noteworthy example is the U.S. Infrastructure Investment and Jobs Act, earmarking substantial funds for broadband and clean water infrastructure.

The demand for digital infrastructure, propelled by the "Internet of Things," and sustainable infrastructure, aligning with the global energy transition, is robust. The potential for expanded data usage, coupled with the imperative to enhance global broadband access, represents an untapped market. Additionally, the ongoing shift towards renewable energy, energy storage, and grid enhancements creates a sizable investment arena.

Amid shifts in the makeup of infrastructure investments, enduring characteristics render it as a highly appealing asset class. Infrastructure is regarded as non-cyclical, boasting extended useful life, predictable cash flows, and the potential to serve as an inflation hedge, all while maintaining a low correlation to other asset classes. These qualities underscore its significance as a crucial component in a well-diversified portfolio.

Further emphasizing the value of private infrastructure, the strategic approach of the Ontario Municipal Employee’s Retirement System (OMERS) is noteworthy. With OMERS allocating 25% to infrastructure, it prompts a reconsideration of private infrastructure as more than a mere "satellite" exposure within an investment portfolio. This strategic allocation speaks to the robust merits of private infrastructure as a core element deserving serious consideration and integration into one's broader investment strategy.

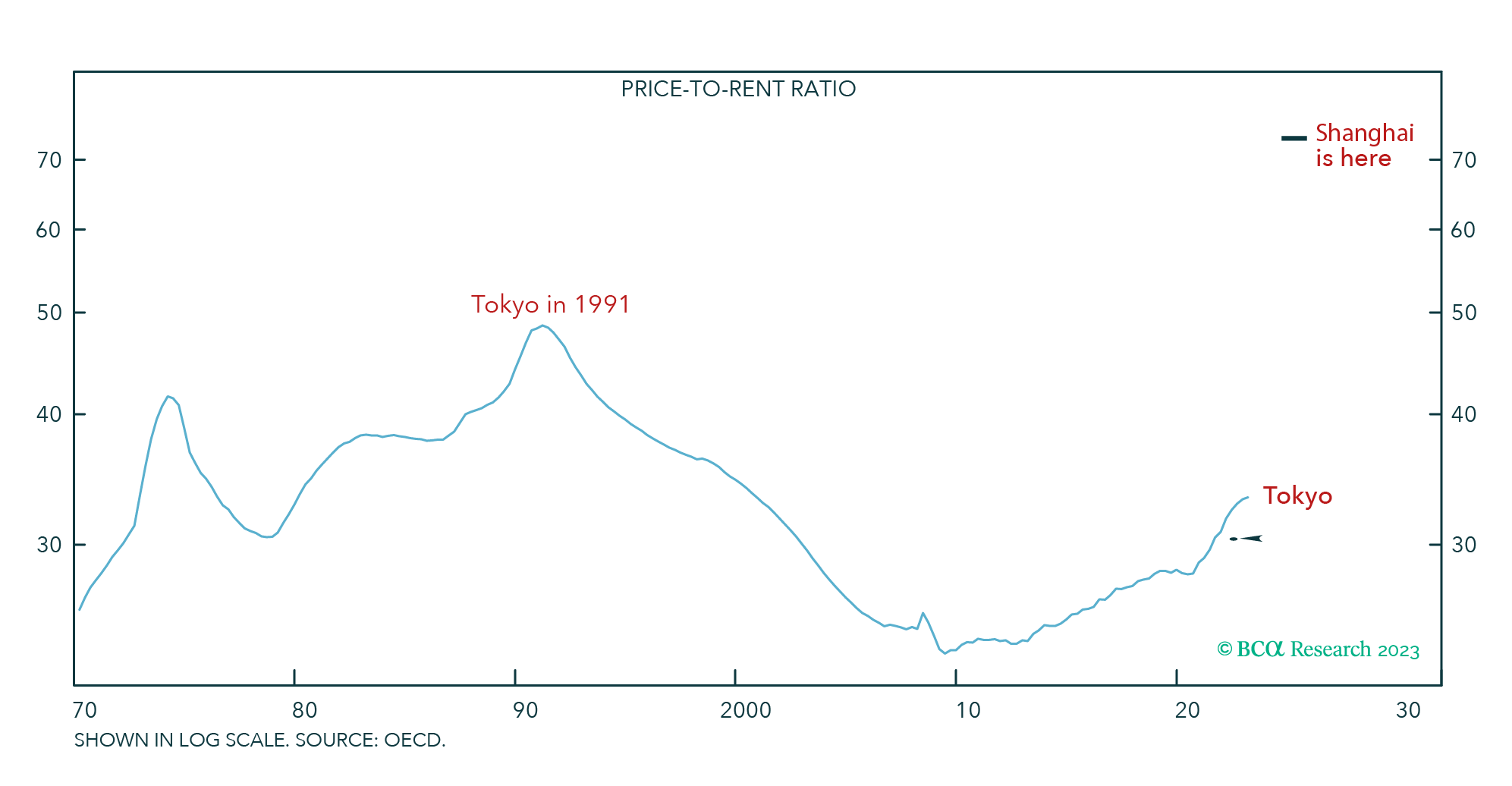

"Food for thought: China could potentially experience a comparable decline in its real estate sector, reminiscent of the downturn that resulted in a prolonged decrease in Japanese equities spanning decades."

As we started formulating our insights on the global economy and capital markets, we recognized the significance of the ongoing events in Israel, prompting us to assess their potential implications. While our initial perspective centered on the anticipated repercussions of substantial central bank tightening, the effects will gradually start to impact the global economy, potentially leading to a recession and a bear market in equities. The ongoing geopolitical crisis prompts a reassessment of our outlook.

Looking forward to the coming year, there's a heightened apprehension regarding a significant disruption in the oil supply. The geopolitical landscape, particularly with the developments involving Hamas, is becoming increasingly intricate, introducing an unexpected variable to the delicate balance in the Middle East.

The situations in Saudi Arabia and Israel are in a state of flux as they navigate discussions on a security pact and diplomatic relations. The looming prospect of Iran acquiring nuclear capabilities, with backing from Russia and China, is causing widespread concern and sparking discussions about the United States' role in the region.

The disruptions caused by Hamas, potentially linked to Iran, are introducing additional uncertainties. While the direct involvement of Iran remains uncertain, the potential for further escalation adds complexity to the situation. The Biden administration is proceeding cautiously, likely deferring significant actions until after the election.

In light of these developments, it becomes imperative to consider the potential impact on investments. The Middle East, known for its geopolitical intricacies, is living up to its reputation. The increased likelihood of oil shocks, with various actors facing both opportunities and challenges, introduces a layer of complexity to the investment landscape.

As the US election unfolds, observing how the US and Israel navigate this complex scenario underscores the intricate nature of geopolitics. While accusations directly pointing at Iran are avoided, leaving room for diplomatic maneuvers, the real possibility of military intervention, whether to curtail Iran's influence or address its nuclear program, remains tangible.

For our clients, the critical insight lies in the possible unpredictability within the oil markets. The anticipation of rising inflation, heightened oil prices, and increased bond yields underscores the necessity for a prudent approach to investment strategy. In light of the imminent potential for disruptions, embracing a more diversified investment approach will offer protection as we navigate the uncertainties ahead.

In light of these uncertainties, maintaining a truly diversified portfolio is key to weathering potential storms. At Kinsted, diversification has been a cornerstone of our approach for quite some time, ensuring our clients are well-positioned to maintain a stable and reasonable return through changing market conditions. By incorporating alternative investments and diverse types of assets, we provide stability and growth opportunities, giving individual investors the opportunity to invest like institutional investors. As a Wealth Management Calgary firm, we are committed to offering innovative investment strategies that cater to varied risk appetites and investment decisions, aiming to achieve a balanced and diversified portfolio that aligns with our clients' long-term financial goals and helps reduce risk.

Regards,

Kinsted Wealth