Q4/2019

Q4 2019 Outlook and Beyond

Commentary • Outlook

Date posted

Jan 20, 2020

While it’s too early to tell when this current, extended growth cycle will come to an end, we do know that equity bear markets have historically coincided with the end of economic cycles. The good news is that markets tend to sprint to the finish line. The S&P 500 has returned an average of 14% in the 6-18 month period preceding the beginning of a recession. Because there’s no expectation of a recession within the next 18 months or so, if history repeats itself, equity markets should deliver solid returns before the next bear market hits. Unfortunately, these late-cycle periods tend to be characterized by above average volatility. Something that investors should be aware of.

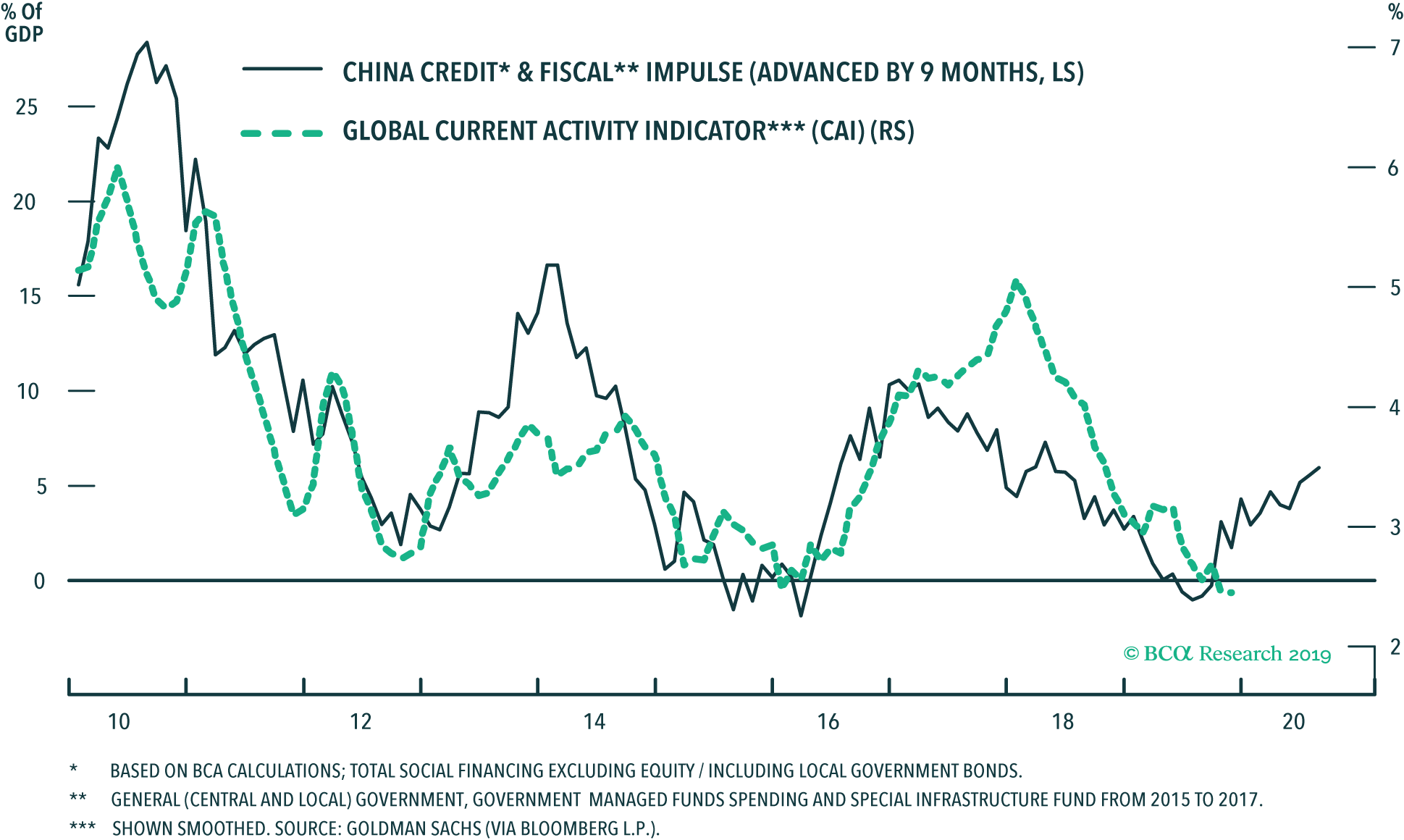

In any regards, as mentioned in our opening piece, we do believe that we will see a rebound in global economic growth due primarily from a resurgence in Chinese growth, and the lagged effect of global monetary easing implemented over the last year.

Chinese Stimulus Should Boost Global

In the absence of inflation, we don’t expect any reversal in last year’s global central bank easing, with the potential that it remains easy for an extended period of time, thus prolonging the current expansion.

Given the US economy is much more domestically focused, it was able to remain resilient amid slower growth abroad. If, as expected, we see a recovery in growth outside of the US, shifting global growth leadership will impact global equity leadership as well. It’s important to recognize that the US equity market is not as leveraged to global economic growth given its domestic focus. As a result, the US equity market tends to lag, on a relative basis, equity markets which are leveraged to global economic growth, such as Europe, Japan and emerging markets.

Since 2008, US equities have outperformed their overseas peers by 137%. We believe that this outperformance will begin to unwind at some point. It’s important to remember that prior to the global financial crisis in 2008, both European equities and emerging market equities outperformed US equities in the decade up to 2008. In fact, between 1970 and 2008, those same overseas peers outperformed their US counterparts by 234%. We believe that non-US stocks will outperform US stocks going forward for a couple of reasons:

- They are quite a bit cheaper on a valuation basis than their US peers

- Profit margins have less scope to rise in the US than the rest of the world

- Uncertainty over the upcoming US election is likely to limit the gains in US equities

As far as bonds are concerned, while core inflation seems to be quite sticky at the present time, we expect to see long-term government bond yields move up as investors revise their inflation views in response to faster economic growth which will be a negative for bonds (higher yields corresponds to lower bond prices). As a result, we don’t believe the bond markets will provide anywhere near the returns they did in 2019 unless global growth is somehow derailed.

While the equity markets may well provide another year of substantial returns, we believe that returns over the next decade will be relatively modest. We’d like to re-emphasize what we wrote in our Q3 commentary about the need to embrace non-traditional assets like infrastructure, private real estate, agriculture, etc. going forward. As we mentioned:

"Had this past year’s returns been significantly higher or lower, it still would not deflect us from the path we are pursuing."

In other words, regardless of what we think equities will do in any particular year, the need to truly diversify one’s portfolio beyond just equities and bonds will be critical in the decades to come. We genuinely believe we are building one of the premier investment platforms for private clients in Canada. One that will consistently provide investors superior risk adjusted returns.

Regards,

Kinsted Wealth