Q4/2021

Q4 2021 Outlook and Beyond

Commentary • Outlook

Date posted

Oct 13, 2021

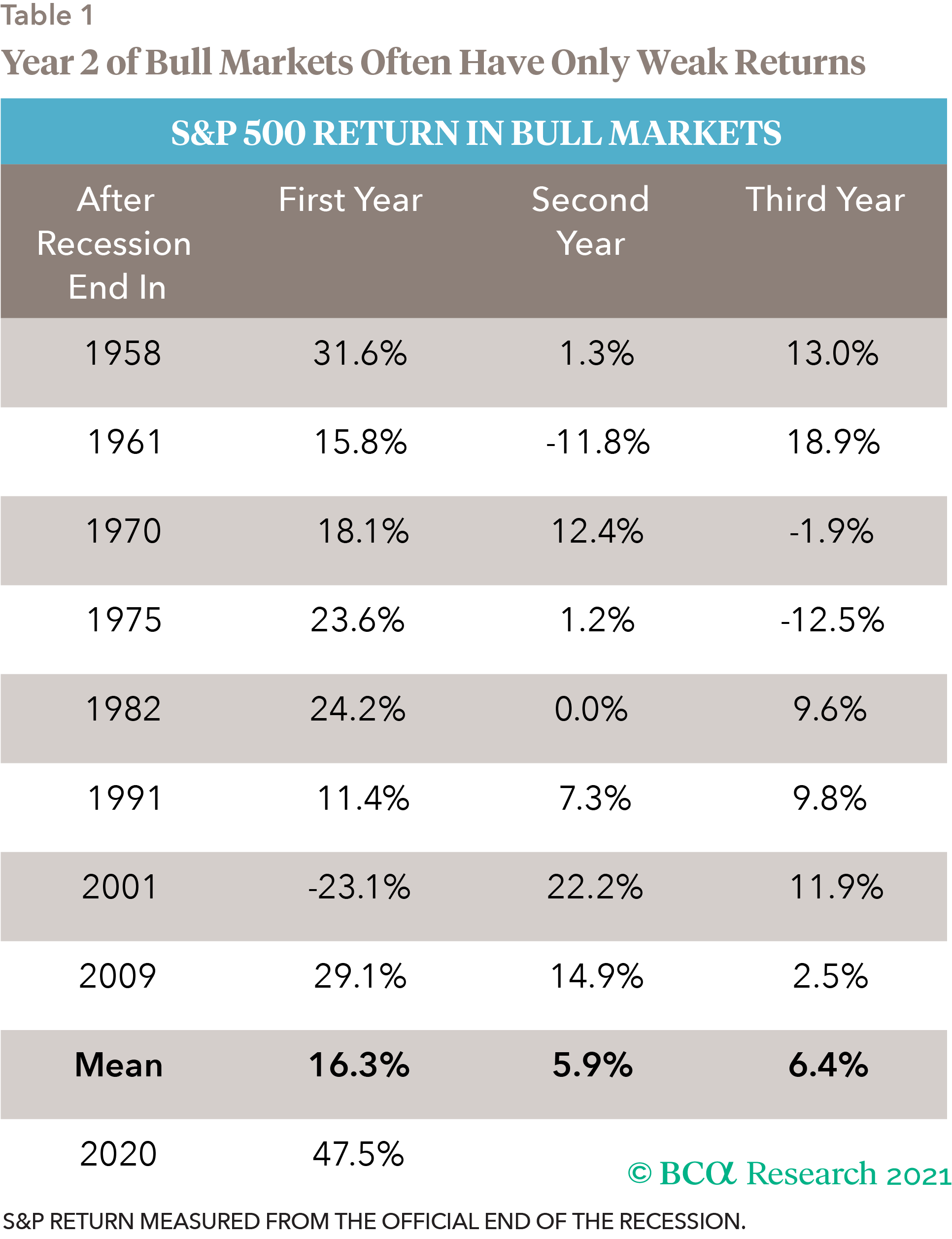

Historically, the second year of a bull market tends to be challenging to navigate. Growth begins to slow after its initial rebound, while central banks move towards tightening policy. This does not necessarily point to the end of the bull market, but equity returns in Year 2, on average, are typically lackluster (see Table 1).

Unfortunately, that is the situation markets are now facing. Growth has been surprising on the downside, while inflation is on the upside over the past few months - Not a good scenario for those fully invested in public stocks and bonds. As mentioned previously, if those are the only arrows in one's quiver, it becomes exceedingly difficult to protect on the downside. That said, we're fortunate at Kinsted to have more than two arrows in our quiver. As a result, one should expect to see a few asset mix changes over the coming quarter.

If one is concerned or believes that inflation is higher than official estimates, investing in private real estate, agriculture/timberland and private infrastructure should provide some inflation protection given their strong correlation to inflation. As inflation rises, so do those asset classes. As a client, you should expect to see an increased allocation in all three of these asset classes over the quarter and further into the future. On the private real estate side, we are going through the final process of committing to a UK-based opportunistic real estate firm. This firm's clients are predominately large pension plans, but we will be the first Canadian wealth management firm that partners with them (alongside a Canadian pension plan located in eastern Canada).

We've been told to expect a full capital call for our investment in the Brookfield Super-core Investment Partner's (BSIP) fund by year-end. BSIP is a fund that invests in "essential and mature" assets across the energy, power, utilities and transportation sectors in North America, Western Europe and Australia. Since inception, this fund has been delivering a 5-6% cash yield, so we are excited to finally get all the capital called.

Besides BSIP, we're going through the initial steps of committing to the Brookfield Global Transition Fund, a fund that will pursue large scale "decarbonization-driven" investment opportunities. Some other founding partners are the Ontario Teachers' Pension Plan and Temasek, owned by the Government of Singapore. Partnering with these leading global investors reinforces our belief that private capital plays a critical role in accelerating climate action. Enabling the transition will require global reach, large-scale capital, and deep operating expertise in renewable energy and decarbonization to scale clean energy to move us closer to a zero-carbon emission world.

We are also excited about our private equity and venture capital (PE/VC) allocation. We truly believe that investing with the right partners will have a generational impact on one's wealth. Both asset classes have outperformed their public equity counterparts by a significant margin over the past 10-20 years, and we expect that to continue. Currently, we are looking at increasing our exposure to PE/VC over the next quarter and longer term, given the potential for these assets. While some holdings may see meaningful increases in their value quickly, in other cases, patience will be required, but rewarding in the long term.

Ultimately, what we are trying to achieve for you is an exceptionally well-diversified portfolio that will not only have lower volatility, but also enhanced return potential versus a traditional portfolio over the longer term.

As a steward of one's wealth, measurement of how we are doing should not be measured in days, quarters, or even twelve months, but rather over an economic cycle. We hope you've been pleased with how your portfolio has held up since Kinsted's transition to an "institutional-pension" style investment approach. The best is yet to come.

Regards,

Kinsted Wealth