Q4/2021

What Happened in Q4 2021

Commentary • What Happened

Date posted

Jan 10, 2022

Just over two years ago, Kinsted embarked on a unique journey with our clients to further enhance long-term returns and reduce portfolio risk. While our strategy has worked brilliantly versus the fixed income markets thus far, 2021 proved to be one of those short-term periods where reallocating public equity exposure to private pool funds was not beneficial on a relative return basis.

Kinsted's private pool funds did as well or better than expected, as you will see in this commentary. However, the global stock market return of 21.3% in 2021 is tough to match with Kinsted's more conservative private real estate, agriculture, and infrastructure investments.

We've consistently stated that our strategy will work in most types of market cycles – except a raging bull market, which remained intact in 2021. However, we maintain high conviction in our strategy and investment process as "raging bull markets" do not go on forever.

Kinsted Global Equity Pool

In 2021 there was a shift from technology-related public stocks to "economy opening stocks" such as energy, restaurants, and airlines. This was unfortunate as most of the Kinsted Global Equity Pool's US holdings are technology-related and sold off heavily in the last half of 2021, resulting in relative underperformance versus the global equity index. We think it's important to understand why the technology names that we hold have declined as significantly as they have. It is not because these companies are broken, nor because their revenue is declining, and it's not because demand for their products is shrinking.

The main reason for the selloff is rising inflation and the narrative surrounding interest rates. For many of these companies, most of their earnings are projected to be made at some point in the future, hence the growth aspect. As a result, one dollar of earnings five years from now is not worth as much (due to inflation) as a dollar of earning today. Due to that fact, the markets have adjusted their prices downwards to reflect this.

We suspected that there might be a "temporary" shift away from technology for a period due to the significant run-up in 2020 (which we highly benefitted from). Still, we did not foresee such a significant selloff as the one we've experienced. Even looking back a year, the consensus was that the global economy would ultimately revert to the deflationary environment it's been mired in the past decade, which is ultimately good for higher-growth companies. Given COVID induced supply chain issues and generous government subsidies has led to the highest inflation readings in decades, that consensus is now in doubt.

Technology stocks have since been caught in the crosshairs. That said, in a year's time, inflation will presumably be lower than where it currently sits, which should provide some relief to the beaten-down technology sector that we still believe in for the long-term.

In our 2020 year-end review, we stated the following:

"As far as bonds are concerned, we see very little value, especially within government sectors. Bonds offer very little yield and muted downside protection going forward."

Given the Canadian bond Universe was down -2.5% last year, we'd say we were correct with that assessment. While we assumed that inflation would gradually rise (and thus not adhere to the "deflation forever" view), we did not anticipate the significant rise we've seen. Regardless, if your view is that inflation will remain elevated for an extended period, traditional bonds are a poor choice for a portfolio due to their negative real yields.

However, there are secure income-oriented assets that can serve as a substitute for fixed income, which Kinsted is excited to offer.

Kinsted Real Asset Pool

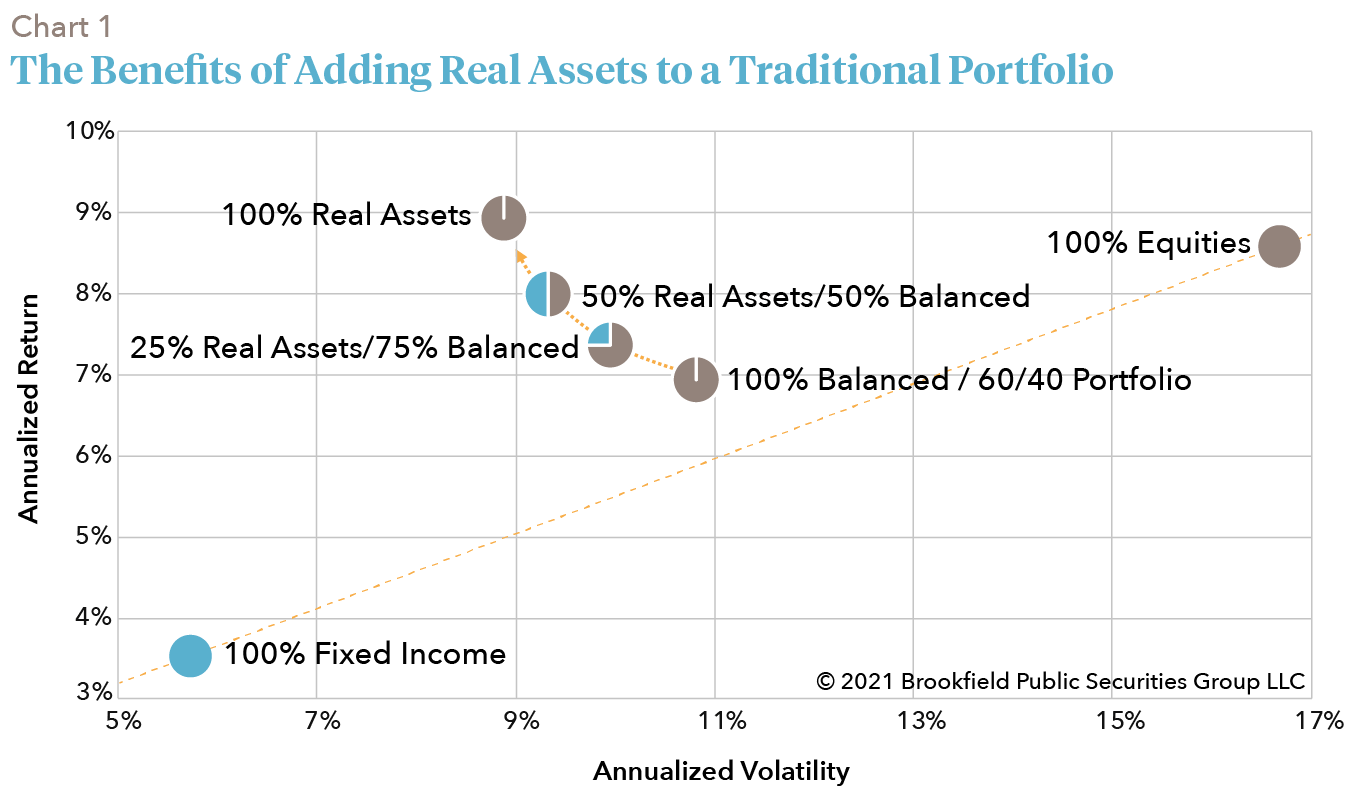

The Real Asset pool had a solid performance in 2021, finishing the year up 8.3%. We've spoken throughout the year about our enthusiasm for private real assets (especially in a rising inflationary environment), as they're one of the few true diversifiers available to investors. As this chart from Brookfield illustrates, adding portfolio exposure to real assets (real estate, agriculture and infrastructure) will reduce portfolio volatility and enhance returns.

Over the past year, we've made great progress in increasing our client's exposure to real assets and expect that to continue. As we've explained in the past, gaining exposure to private investments takes time due to the nature of these strategies. That said, we recently received a capital call for our commitment to the Brookfield Super-Core Investment Partners fund (BSIP). BSIP invests in essential infrastructure assets (electricity transmission, gas distribution, and water treatment facilities), with a targeted return of 8% and a cash yield between 5%-6%.

Apart from BSIP, we also committed a considerable amount to Brookfield's Global Transition Fund. The fund is Brookfield's primary vehicle for investing in and facilitating the global transition to a net-zero carbon economy. Mark Carney, Brookfield's Vice Chair and head of transition investing said the following:

"Achieving net zero will require a whole economy transition, creating the greatest commercial opportunity of our time."

- Mark Carney, Vice Chair and Head of Transition Investing, Brookfield

In addition to Brookfield investing $2B to their fund, other key investors include the Ontario Teacher's Pension Fund and the Government of Singapore. We couldn't be more excited about this opportunity targeting net returns over 10%.

We're also thrilled to announce an investment in the Henderson Park Real Estate Fund II, a Pan-European Opportunistic value-add real estate fund targeting a net IRR of 14%-16%. We should start to see several capital calls for this position over the year, which will provide further real estate diversification across the globe.

Kinsted Strategic Income Pool

The Strategic Income Pool had a stellar year, finishing with a return of 6.9%, with very little month-to-month volatility. The Strategic Income pool is one of the vehicles at Kinsted to provide exposure to income-oriented investments, along with the Real Asset Pool. While there are no investable indices to compare the Strategic Income pool to (given how diversified it is in assets ranging from music royalty trusts to private debt), a good barometer to gauge its performance would be the Canadian bond universe, which was down -2.5% for the year.

One notable holding of the pool is the Morgan Stanley Direct Lending Fund, which pays a quarterly distribution and is currently yielding ~10.7% on a trailing twelve-month basis.

Many of the other private debt holdings delivered returns in the 8% to 10% range for 2021, significantly higher than what was available in the public fixed income markets.

One holding that we are extremely excited about is the Pretium Residential Credit Fund. This fund was launched to take advantage of the dislocation in the US mortgage markets because of COVID and is targeting a return significantly higher than what one can get in traditional fixed income securities. We're accruing a 5% yield on the fund, which is still attractive given current interest rates, along with a high potential for price appreciation on the underlying mortgages bought at significant discounts due to the COVID crisis.

Overall, we were delighted with the performance and stability of the Strategic Income Pool over the past twelve months and have no reason to believe this will not continue.

Kinsted Strategic Growth Pool

The Strategic Growth Pool posted another great year, finishing up 18.8% and 20.1% (annualized) since the pool's inception (11/30/19). While 2020's performance was driven primarily by the pool's market-neutral holding, its private equity holdings drove this past year's performance. As we've mentioned throughout the year, we believe that private equity can have a generational impact on one's wealth.

Blackrock expects private equity to deliver ~18% over the long term, which compares to ~6.5% they expect the S&P 500 to achieve over the same period. With that said, we have talked about the need to be patient with private equity, as it doesn't trade like the public markets, so prices tend not to move very frequently. In some cases, it may take several years to realize some of those gains, but the wait can at times be very well worth it.

A great example of this is our holding in SenseTime, a Chinese Artificial Intelligence company. SenseTime's most recent valuation (September 30) was around HK$3.00 and hadn't moved significantly in over a year. On December 30, SenseTime went public and, at its most recent price of HK$7.95, implies a return of ~165%.

The pool currently has exposure to several other holdings such as SpaceX and Bullish (a Crypto exchange) that should provide some meaningful upside when they eventually IPO.

We added to several new private equity funds over the past year and are actively looking to add additional exposure. We believe many of these funds have significant upside potential that is currently not being reflected.

Regards,

Kinsted Wealth