RESPs: Who, What, When, Where, Why and How

Commentary • Education

Date posted

Sep 6, 2022

You may be a parent, grandparent, or family member of a young child looking to start saving to provide them the opportunity to achieve a post-secondary education. If you have heard of an RESP, you may know that they are a great way to accomplish this goal, but do you know much more about them? This blog is intended to answer a few simple questions to get you started:

Who is involved?

There are three subgroups involved in an RESP:

Subscriber - The individual(s) who opens up an RESP and contributes to it. For example, the parents, grandparents, or other family members who wish to assist financially with a child’s education.

Beneficiary - The individual(s) who can receive contributions from the RESP account to help pay for their education.

Promoter - A promoter is an organization that offers RESPs, such as a bank, credit union, or group scholarship provider.

What is an RESP?

RESP stands for “Registered Education Savings Plan.” The RESP program was created and sponsored by the Canadian Government to help Canadians invest and save to provide educational assistance to future generations.

When should I start?

Short answer: as soon as possible. By starting to save and invest today, you can take advantage of your initial investment’s long-term, compounding growth to maximize your savings when the child reaches post-secondary age.

Where can I open an RESP?

Any large financial institution, such as a bank, credit union, or group scholarship provider, will allow you to open an RESP account.

Why use an RESP?

There are multiple benefits for both subscribers and beneficiaries of using an RESP. The two main reasons to open an RESP include: “Free Money” and “Tax-Free Growth.”

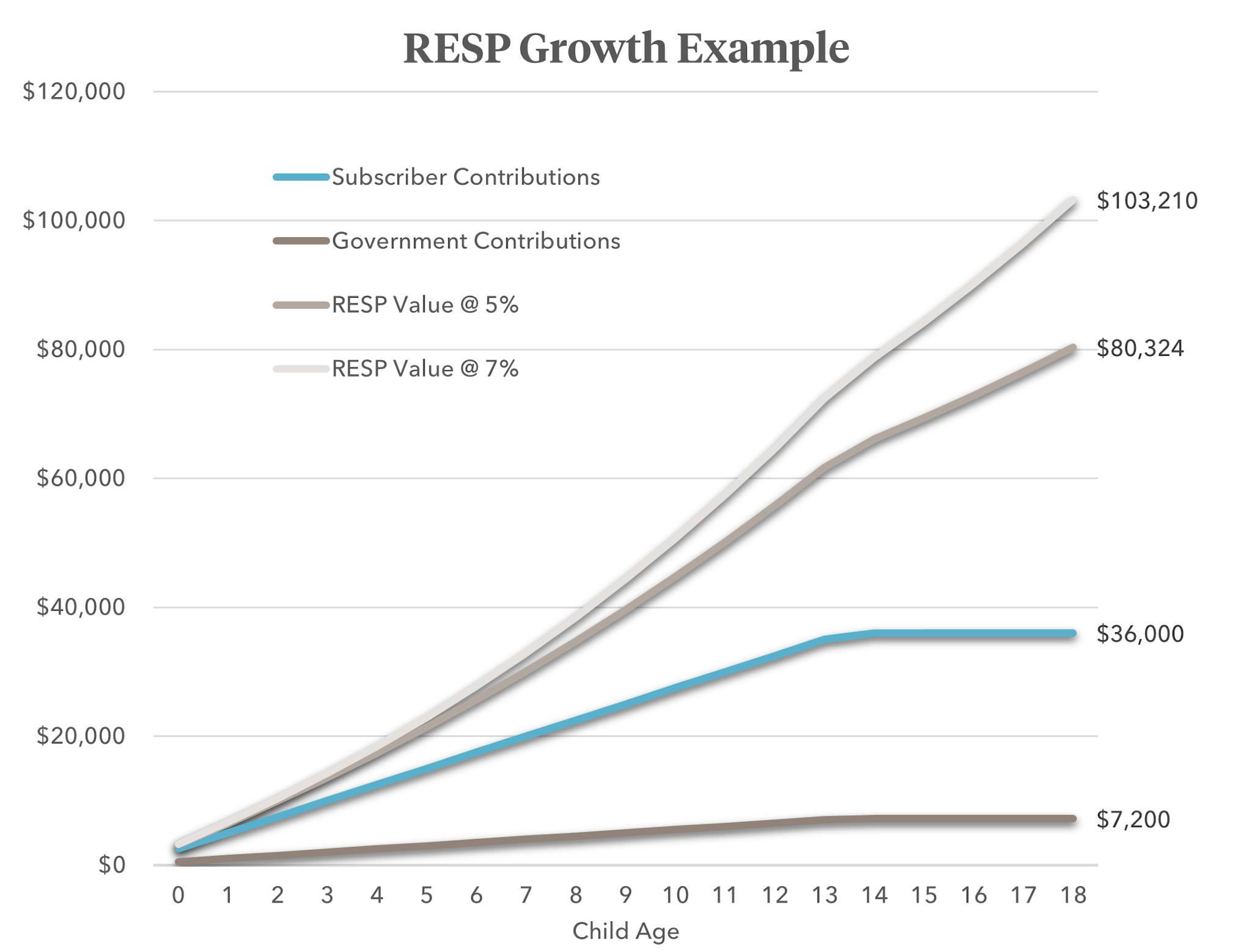

The Canadian Government pledged to contribute an additional 20% on top of your contributions to a maximum of $500 a year, with a lifetime maximum of $7,200 per beneficiary. The additional assistance can be invested and grow tax-free in the RESP account over the child’s life, with potentially dramatic results (see below).

How do I Maximize my RESP benefits?

To maximize the benefit of an RESP, you want to take advantage of the two benefits mentioned above:

To maximize your ‘Free Money,’ you would want to contribute $2,500 a year (per beneficiary), up to a maximum lifetime contribution of $36,000 per beneficiary. Anything you contribute over and above $36,000 will still grow tax-free, but the Government will not match your contributions. Note that you cannot contribute more than $50,000 per beneficiary to an RESP.

To maximize your Tax-Free Growth, saving for your child’s education as soon as possible would allow you to take advantage of long-term compounding growth.

By maximizing your ‘Free Money’ and Tax-Free Growth, your RESP account could look like this by the time your child is 18:

The benefits of an RESP can immediately be seen in this simplified example above. By contributing a total of $36,000, you would have received $7,200 of contributions from the Government, and your total investment could be worth over $100,000 (assuming 7% annual growth).

How do I get started?

Opening an RESP is as easy as getting in touch with one of our Wealth Counsellors; we are here to help you. We will work with you to understand your objectives and circumstances and create and implement a personal investment plan that works for you and your family.

Let’s keep this simple. Reach out to a Kinsted Wealth Counsellor, and start saving for your child’s education today.

Regards,

Kinsted Wealth