Q1/2022

What Happened in Q1 2022

Commentary • What Happened

Date posted

Apr 12, 2022

The first quarter of 2022 can be summed up by a famous quote from Arnold Toynbee, “just one damned thing after another”. After almost two years of market uncertainty caused by COVID, it felt as though we were finally getting to the point where market fundamentals prevailed. Unfortunately, rising inflation coupled with hawkish rhetoric from central banks, and Russia’s unprovoked attack on Ukraine once again threw the markets into another quarter of turmoil.

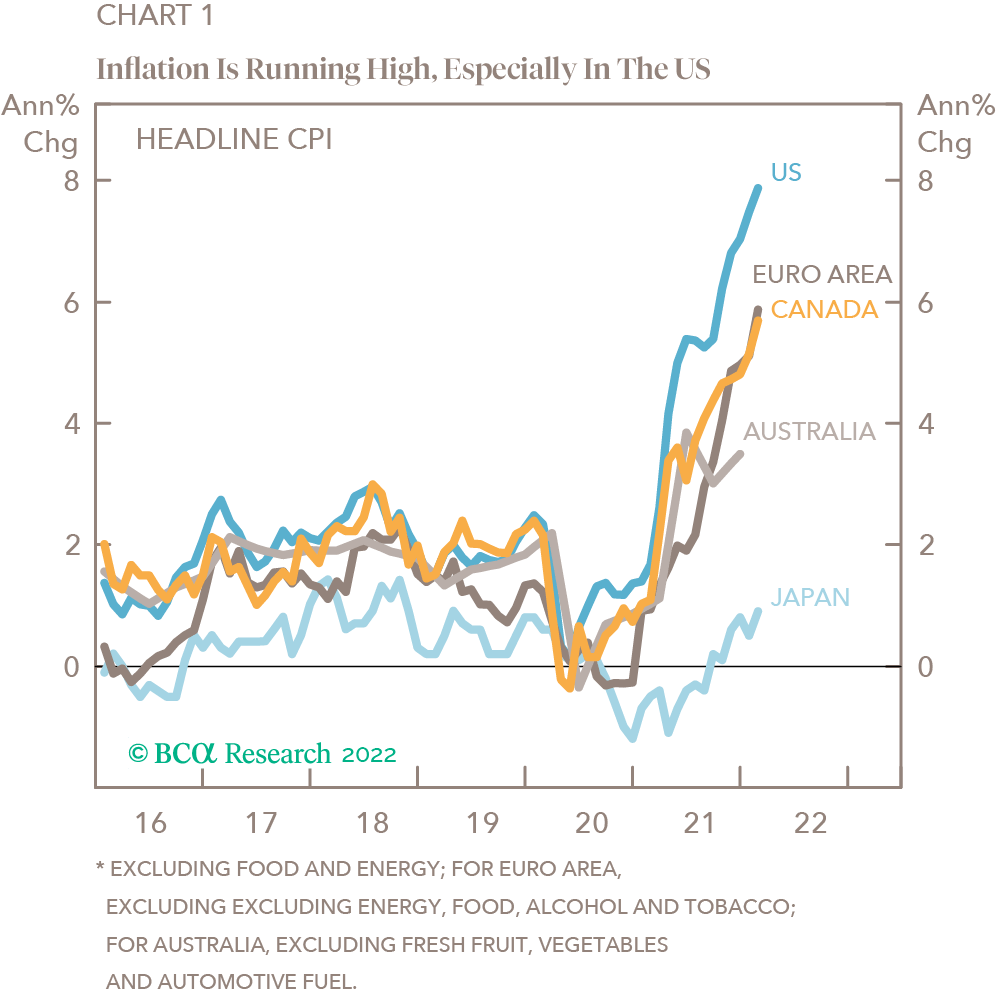

While some may say that inflation had already become a concern, many believed that it would be transitory, and recede as Covid gradually declined. Unfortunately, that scenario is not likely to play out over the short-term as inflation has become more entrenched beyond a few pandemic-related items. There are also signs that rising prices are passing through in the form of wage increases in some of the larger world economies.

The war in Ukraine, while unlikely to be a risk in itself, (unless it spills beyond the Ukrainian border) continues to have an inflationary impact due to rising oil prices and other commodities that both Ukraine and Russia are major producers of. We would be remiss to mention that our global equities’ revenue is less than 1% attributable to Russia, offering very little direct exposure. Any impact on our holdings will come from increased input costs in the form of higher energy and basic material costs. That said, in the current inflationary environment, many of these costs are being pushed through to the end consumer.

Even with these uncertainties, it is impressive that the broad global equity index (MSCI ACWI) only finished down 6.1% (in CAD) in the quarter. On the other hand, the Canadian bond universe index finished down 7.2% in the same period. Given those returns, it is probable that conservative portfolios with only exposure to traditional, publicly traded assets, performed worse than more growth-oriented portfolios. We’ve been writing about our aversion to traditional fixed income assets for close to two years now given their poor risk/return characteristics. Those views were certainly proven accurate over the past three months.

We believe many investors will be taken aback to learn that the conservative part of their portfolio may have been the worst performing assets they had exposure to in the quarter. Most of Kinsted’s clients will be happy to know that they had zero exposure to traditional fixed income in the period, but rather exposure to non-traditional income-oriented assets such as private debt, mortgages and music royalty trusts, among others, which all posted positive returns during the quarter.

Similar to Q4 2021, Kinsted’s global equity pool had another difficult quarter to start the year. The reason? Rising interest rates are having a much more pronounced impact on companies whose earnings are projected further into the future, eroding their current value.While we are certainly disappointed with the volatility of our US equity holdings (which are primarily responsible for the sub-par performance), we have confidence that over the long-term, this “growth” style investment approach will add significant value over the index. On that note, we have been taking steps to gradually reduce the volatility of our global equity pool.

Apart from the global equity pool, all Kinsted pools had strong performances in the quarter. The Kinsted Strategic Income Pool posted a positive return of 2.7% for the quarter, an outperformance of 10.4% versus its benchmark. A big contributor to this performance came from the Pretium Residential Credit Fund, which we have written about in previous commentaries. Pretium’s year end commentary stated that the initial portfolio of assets is projected to exceed the fund’s targeted returns of a mid-to-high teens figure. We are very encouraged by how well the fund has done since our initial investment and expect it to add tremendous value to the Strategic Income Pool in the years ahead.

The Kinsted Strategic Growth Pool’s 8.5% performance for the quarter was driven primarily through its private equity holdings. Some of the pool’s holdings had exceptional quarters, but one standout was SpaceX which was revalued upward by approximately 33%, adding a nice boost to the overall performance of the pool. There are still many holdings within the funds that will be looking to go public over the next year, which we are hopeful will add incremental returns to the Pool.

The Kinsted Real Asset Pool’s return of almost 4% for the quarter was certainly in excess of what we’re looking to achieve for a relatively low volatile holding. Contributions came from all categories of the pool: real estate, agriculture, and infrastructure. Our agriculture holdings came in over 4% for the quarter, while infrastructure performed comparably. One of our real estate holdings did exceptionally well (which had a large contribution to the performance) in the quarter due to the sale of a property in the US at approximately three times what they paid for it a year ago.

Overall, our longer-term outlook is very favorable for all private investment areas ranging from private debt to real assets to private equity. During the quarter, each pool saw a lot of activity as new capital calls came in for some private equity funds as well as infrastructure.