Q2/2024

What Happened in Q2 2024

Commentary • What Happened

Date posted

Jul 8, 2024

What Happened in Q2?

While we may sound like a broken record, inflation and interest rates are the primary forces driving economies and market responses in capital markets. The Federal Reserve has held rates steady to subdue lingering inflation, while the Bank of Canada made its first rate cut since March 2020.

The US unemployment rate reached 4.0% in June, the highest since January 2022, while Canada's unemployment rate hit 6.4%. Major indices in the US showed steady growth throughout the year, supported by strong job growth, whereas Canadian markets declined.

The US inflation rate remains above 3.0% year-over-year, with the latest data indicating 3.3% for the 12 months ending in May.

These conditions have led the Fed to maintain its prime interest rate, with no clear projections on potential rate cuts. In Canada, inflation unexpectedly rose to 2.9% year-over-year from the prior month's 2.7%, raising concerns that the Bank of Canada cut rates too soon.

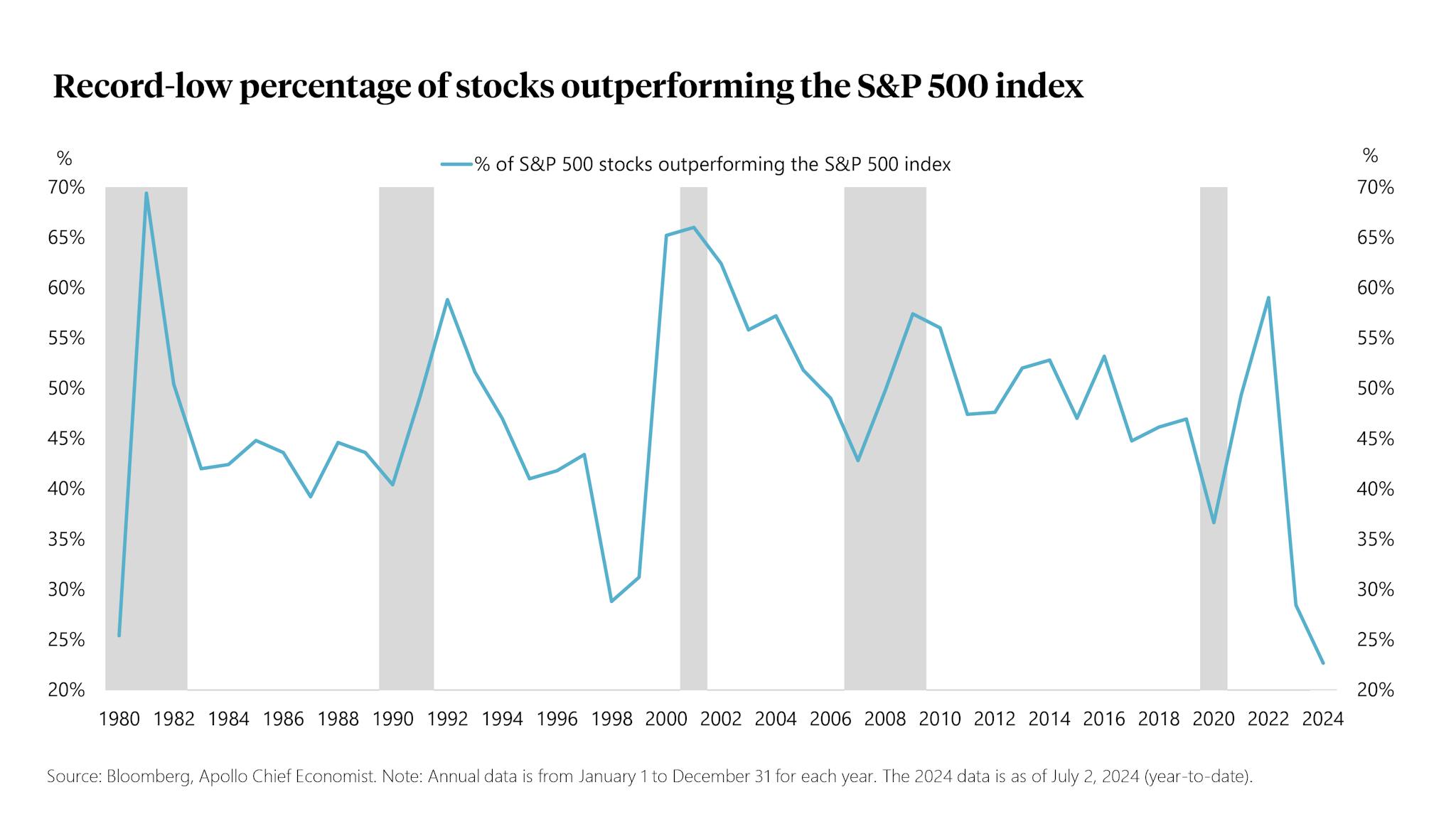

While the overall US economy appears strong, there are nuances investors should consider. A few key stocks heavily influence the S&P 500's performance. For instance, Nvidia's market valuation has surged by over $1.8 trillion since the beginning of the year, exceeding the combined market caps of Walmart, Visa, Costco, and Home Depot, totalling $1.78 trillion at the end of June. Microsoft, Apple, and Nvidia each maintained valuations above $3 trillion by the end of June, making them more valuable than the combined valuations of the bottom 400 companies in the S&P 500. At its peak, Nvidia's market capitalization was greater than the combined market cap of France, Germany, and the UK. Despite a positive quarter for developed market equities with a 2.8% return (in USD), rate-sensitive small-cap stocks and REITs struggled due to the higher-for-longer interest rate environment. At the same time, global investment-grade bonds experienced negative returns of -1.1%. Close to 80% of companies in the S&P 500 have underperformed the Index, underscoring the outsized impact of the top-performing companies.

"Close to 80% of companies in the S&P 500 have underperformed the Index, underscoring the outsized impact of the top-performing companies."

Strategic Income Pool

PERFORMANCE OVERVIEW

The Kinsted Strategic Income Pool delivered a solid performance, achieving a return of 1.6% for the quarter and 4% year-to-date (YTD). This contrasts with traditional fixed-income securities, which were down over 1% since the beginning of the year.

Several holdings stood out with notable returns. The Digitalbridge Credit Fund posted a robust return of 3.6%, highlighting the opportunity in technology-driven sectors. Churchill Middle Market Senior Loan Fund achieved an impressive return of 3.9%, benefiting from its focus on middle-market senior loans, offering high yields and significant downside protection. Additionally, the Blackstone Secured Lending Fund, a publicly traded business development corporation, recorded an exceptional return of 14.6%.

LOOKING AHEAD

Despite higher Federal Reserve interest rates and the uncertainty surrounding the upcoming US presidential election, we anticipate that private credit will continue to perform robustly through the remainder of the year. With its floating rate structures, direct lending is particularly well-positioned to offer solid returns and protection in a high-interest-rate environment. The market is experiencing higher-quality deals, with larger equity cushions and record-high yields for senior credit. Furthermore, mortgages, music royalties, and other income-oriented strategies should continue to add ballast to the pool.

Real Assets Pool

PERFORMANCE OVERVIEW

The Kinsted Real Asset Pool finished the quarter up 1.2% and has gained 3.2% YTD. While these returns are slightly below expectations, we anticipate improved performance as managers begin to consider exit strategies for some of their earlier investments.

Most of the pool's holdings delivered returns in the 0.5% to 3% range during the past quarter, with a standout performer being the Brookfield Supercore Infrastructure Partners Fund, which benefited from "inflation accelerators" built into their long-term contracts.

We continue to see significant growth in infrastructure, driven by stable, inflation-adjusted revenues and dynamic returns from energy transition assets. Data centers are experiencing substantial growth, with electricity consumption expected to triple by 2030 due to AI's power requirements. The commercial real estate sector faces challenges due to rising interest rates, but not all areas are in turmoil. Although office spaces are currently weak, industrial properties, multifamily units, data centers, and self-storage facilities are demonstrating resilience. Kinsted has minimal exposure to office space while focusing on other areas of real estate investments.

LOOKING AHEAD

Private real assets are poised for growth, supported by structural shifts in energy, technology, and market dynamics. These trends offer compelling opportunities for strategic investments in infrastructure and real estate.

Strategic Growth Pool

PERFORMANCE OVERVIEW

The Kinsted Strategic Growth Pool finished the Q2 up 3.5%, resulting in an 8.0% gain for the year's first half. Most of the pool's holdings posted positive returns, with standout performances from the Kline Hill Secondaries Fund, Benefit Street Partners Special Situation Fund, and one of our Overbay Funds, which had a robust quarter due to the write-up of SpaceX.

LOOKING AHEAD

We expect asset realizations within some holdings to further enhance portfolio performance in the mid-term, mirroring some of the positive trends we hope to see with our real asset investments. The private equity landscape is still recovering from a challenging two-year period, but we are seeing signs of gradual recovery despite higher Federal Reserve interest rates. The resilience of the US public markets is filtering into private markets, fostering positive sentiment. Although Q1 2024 deal activity has yet to reach pre-2021 levels, corporate carve-outs and add-ons are gaining traction, underscoring the ongoing interest in revitalizing undervalued assets and enhancing portfolio companies in a higher-cost debt environment.

The momentum in venture capital, driven by advancements in AI and clean tech sectors, also bodes well for private equity. Notable IPOs like Reddit and Rubrik have shown strong aftermarket performance, suggesting a healthy pipeline for future realizations. General partners anticipate continuing the trend as they seek to return capital to limited partners.

Looking forward, we anticipate that private equity will maintain its upward trajectory for the remainder of the year. The focus on corporate carve-outs and add-ons will persist, offering ample opportunities for value creation. With Europe's mid-market delivering consistent returns and the US showing signs of improving deal activity, private equity remains a vital component of a diversified portfolio and investment strategy.

Public Equities

PERFORMANCE OVERVIEW

The global equity market continues to defy its detractors with another solid quarter, with the MSCI All-Country World Index ending up 3.8% and achieving a 14.9% gain YTD. The Kinsted Canadian Equity Pool experienced a slight decline of 0.8% for the quarter but was up 7.7% YTD, contrasting with the Canadian index, down 1.4% for the quarter and up 11.0% YTD. The Kinsted Global Equity Pool saw an increase of 1.9% for the quarter and 10.1% YTD.

Given the heavy weighting of US equities within global indices, the US technology sector continues to drive returns globally. The bifurcation in US equities persisted in the second quarter, where the S&P 500 was up 4.2%, while the equal-weighted S&P 500 was down 2.7%, indicating that a small number of companies continue to drive the performance of the US equity market, impacting global equity indices.

LOOKING AHEAD

We believe the US economy will enter a recession later this year or early 2025. An anticipated rise in unemployment is likely to compel consumers to boost their precautionary savings accounts. As of April, the personal savings rate was only half of what it was in 2019. Unlike 2022, US households no longer possess substantial excess savings. Bank deposits, excluding money market funds typically held by the wealthy, have reverted to pre-pandemic levels.

Borrowing against future income receipts is also expected to become more complex. Delinquency rates on credit cards and auto loans have returned to levels last seen in 2010, when the unemployment rate averaged 9.6%. Banks have tightened lending standards and raised interest rates on consumer loans.

With limited savings and restricted access to credit, many households will have to reduce their spending. This decrease in spending will lead to reduced hiring. Higher unemployment will further limit income growth, resulting in lower spending and increased unemployment.

We expect a similar pattern to impact business investment. Despite a booming stock market, ongoing enthusiasm for reshoring, and AI investment, capital expenditure intentions remain subdued. As consumer demand weakens, businesses will likely scale back their expansion plans.

Regardless of how the US economy evolves over the next six to twelve months, the outcome of the election, or any unexpected geopolitical issues, Kinsted clients can rest assured. Our approach to managing their wealth will provide additional shock absorbers compared to a traditional balanced portfolio. While we cannot completely eliminate volatility, our strategies have been designed to offer greater resilience and stability in uncertain times.

KEY TAKEAWAYS:

- The financial markets have shown resilience despite economic uncertainties, with major indices reflecting mixed performance across different regions.

- A diversified portfolio and strategic asset allocation remain crucial for managing risk and achieving long term investment goals.

- Alternative investments, such as private credit and real assets, continue to offer opportunities for higher returns and diversification.

- Investors should be mindful of the level of risk associated with different types of assets, including stock and bond investments, to make informed investment decisions.

At Kinsted Wealth, we prioritize diversification in investment strategies, offering access to private assets alongside traditional stocks and bonds. In today’s changing investment landscape, diversification is key to resilience. Private markets provide a range of alternative assets like private equity, credit, agriculture, infrastructure, and real estate, enhancing portfolio resilience. Embracing private markets strengthens portfolios against uncertainties and fosters sustainable growth. Interested in diversifying your portfolio? Contact one of our Wealth Counsellors to craft a personalized strategy aligned with your goals and circumstances.

Kinsted Wealth is a top independent firm in the private wealth management sector in Canada, providing tailored strategies to meet the unique needs of investors seeking to invest like institutional investors. Our firm, a Calgary investment firm, is dedicated to helping you achieve financial stability and growth through a well-diversified portfolio and effective investment strategies.

Regards,

Kinsted Wealth

Regards,

Kinsted Wealth